Bitcoin rallies with crypto market on steeper Fed rate cut speculation and Q4 positivity

- Bitcoin and the crypto market rallied in the past few hours as investors anticipate Wednesday’s FOMC meeting.

- CME FedWatch Tool reveals a higher probability of a 50-basis-point rate cut, which has a historical correlation with crypto bull runs.

- Bitcoin has historically performed better in Q4 compared to other quarters.

Bitcoin (BTC) and the crypto market saw a brief rally on Tuesday following speculations that the Federal Open Market Committee (FOMC) may opt for a 50-basis-point rate cut during its meeting on Wednesday.

Bitcoin and Fed rate cuts correlation amid Q4 positivity

Cryptocurrency investors are becoming active again amid increasing anticipation that the Federal Open Market Committee (FOMC) might decide on a substantial 50-basis-point interest rate cut on Wednesday.

The CME FedWatch Tool, an instrument that measures the Federal Reserve's fund target rate, provides insight into how market participants are positioning themselves ahead of the meeting.

"According to the CME FedWatch Tool, markets are pricing in a 38.0% chance of a 25-basis-points Federal Reserve interest rate cut at the September meeting, while the probability of a 50-basis-point cut has surged to 62.0%, up from 50.0% just a day earlier," wrote FXStreet analyst Akhtar Faruqui.

A 25-basis-point cut by the Federal Reserve would represent the most significant surprise since 2008 by a considerable margin. Conversely, a 50-basis-point reduction would be the largest unexpected move since 2009, noted Kobeissi Letter’s analyst.

As a result, the upcoming Wednesday's FOMC meeting is largely influencing the price of Bitcoin and the general crypto market. Bitcoin is up 4% in the past 24 hours, climbing above $60K

Several altcoins also saw a rise alongside Bitcoin, with Ethereum, BNB, Solana and XRP rising 4%, 3%, 1.5% and 1%, respectively. The brief market rally has led to liquidations reaching $125 million in the past 24 hours. Bitcoin's 24-hour liquidations reached $45.66 million, while Ethereum's liquidations hit $26.80 million.

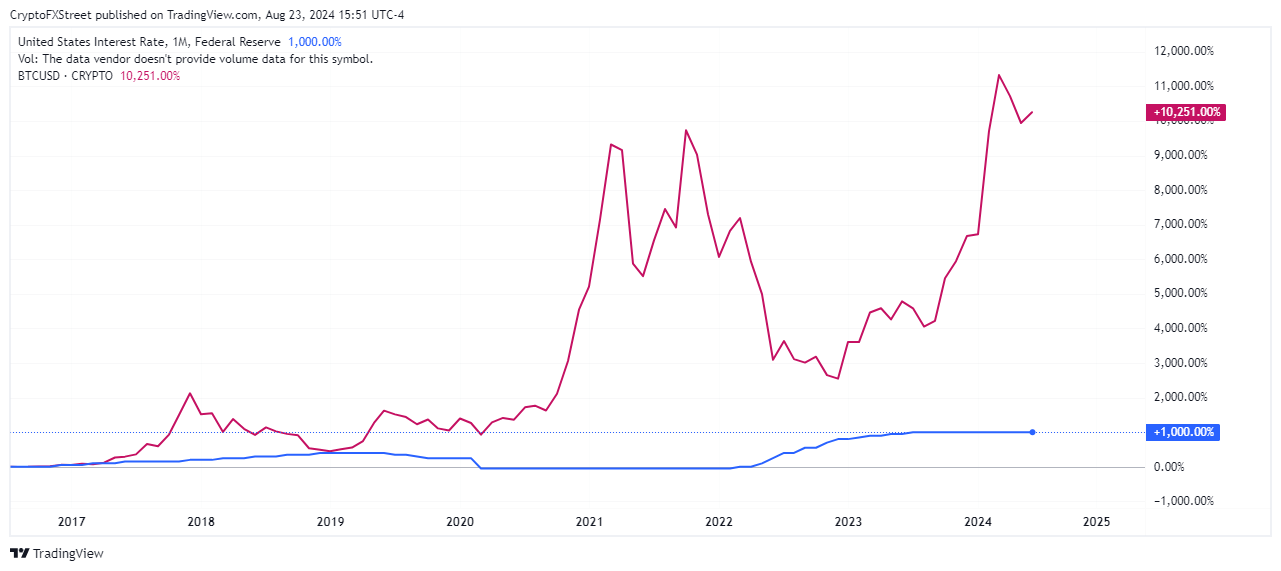

Historically, Bitcoin and the broader crypto market have experienced price increases during periods of low interest rates. This trend was particularly evident during the 2017 crypto market bull run and the initial coin offering (ICO) boom when rates hovered around 0.75% - 1% and 1% - 1.25%.

USINTR/BTCUSD Weekly chart

Another notable trend is visible in the market rally from late 2020 to 2021. Following the Federal Reserve's decision to reduce interest rates to a range of 0% to 0.25% in response to the pandemic, Bitcoin embarked on a remarkable rally, surging over 1,000% within a year.

However, the market saw a pullback as the central bank began to increase rates again in 2022. The recent outlier is the brief surge in Q1'24, which was caused by the Bitcoin ETF approval.

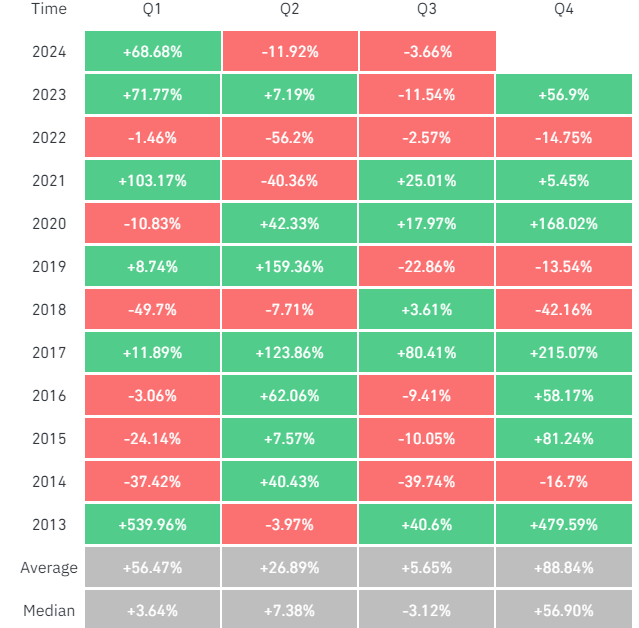

Meanwhile, crypto investors are anticipating a recovery from the Q3 market lull as Q4 approaches. Historically, Q4 has proven to be the best period for Bitcoin, rising an average of 88.84%.

BTC Quarterly Returns

Hence, the positivity surrounding Q4 and the possibility of a 50-basis-point rate cut may stir a significant bull run among crypto assets.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.