Ripple CLO slams SEC for causing confusion in referring to crypto tokens as securities in lawsuits

- Ripple Chief Legal Officer Stuart Alderoty comments on SEC’s definition of crypto asset securities.

- SEC faces criticism for referring to crypto tokens as securities and apologizes for confusion in footnotes of Binance lawsuit.

- Alderoty points out inconsistencies in the SEC’s regulatory approach towards the crypto industry in 2017 and 2024, influencing the Ripple lawsuit.

- XRP gains over 1% on Friday, trades at $0.5695 at the time of writing.

XRP posts gains for a second consecutive day on Friday, extending Thursday’s surge, as Ripple Chief Legal Officer (CLO) Stuart Alderoty and Coinbase’s CLO Paul Grewal slammed the US Securities & Exchange Commission (SEC) stance over the usage of the term “crypto asset securities.”

The regulator clarified its use of the term “crypto asset securities” (that has no legal basis per Alderoty) and apologized for the confusion caused through an amendment to footnotes in the SEC vs. Binance lawsuit.

Daily digest market movers: Ripple, Coinbase CLO slam regulator for wrongly referring to crypto tokens as securities

- Crypto legal experts and CLOs of several exchanges and firms such as Ripple and Coinbase critiqued the SEC’s use of the term “crypto asset securities” in its lawsuits.

"The SEC regrets any confusion it may have invited" by falsely and repeatedly stating that tokens themselves are securities. This is the remarkable representation in Footnote 6 of @SECGov's Amended Complaint against Binance. I hope @s_alderoty is getting some good sleep tonight.… pic.twitter.com/PpbprvkGxh

— paulgrewal.eth (@iampaulgrewal) September 13, 2024

- Crypto market participants watch the SEC’s next steps closely as Ripple CLO previously stated that the regulator’s use of the term likely misleads judges in crypto lawsuits and “has no legal basis.” The term “crypto asset securities” implies that crypto tokens are inherently securities.

The term 'crypto asset security' is nowhere to be found in any statute—it's a fabricated term with no legal basis. The SEC needs to stop trying to deceive judges by using it. pic.twitter.com/CyNbUbeoYM

— Stuart Alderoty (@s_alderoty) September 2, 2024

- The SEC clarified its usage of the term and said it “regrets any confusion” caused by its use by amending footnotes in its lawsuit against Binance.

- The SEC’s statements in 2017 and 2024, seven years apart, are contradictory, per Stuart Alderoty. Ripple’s CLO points out in a tweet that the SEC admits that the term “crypto asset security” is not real. Alderoty believes that the regulator likely used the term to prove that “crypto asset security” is an investment contract and the SEC needed evidence of "contracts, expectations, and understandings.”

So the SEC finally admits that 1/ "crypto asset security" is a made up term and 2/ to prove a "crypto asset security" is an investment contract, the SEC needs evidence of a bundle of "contracts, expectations, and understandings"?

— Stuart Alderoty (@s_alderoty) September 13, 2024

Think it's time for @SECgov to admit it has… https://t.co/iJIYTnNvxs pic.twitter.com/E58Pft7irc

- The SEC’s definition of securities and how it applies to crypto is important to traders since it is considered when determining whether a crypto token is a “security.” XRP gained legal clarity as a non-security when Judge Torres ruled that the altcoin is not an investment contract when traded on secondary markets or exchanges.

- Another market maker likely influencing XRP price is Grayscale’s announcement on Thursday of an investment trust for the asset. Institutional capital inflow could boost the adoption and demand for XRP Ledger’s native asset, likely driving gains.

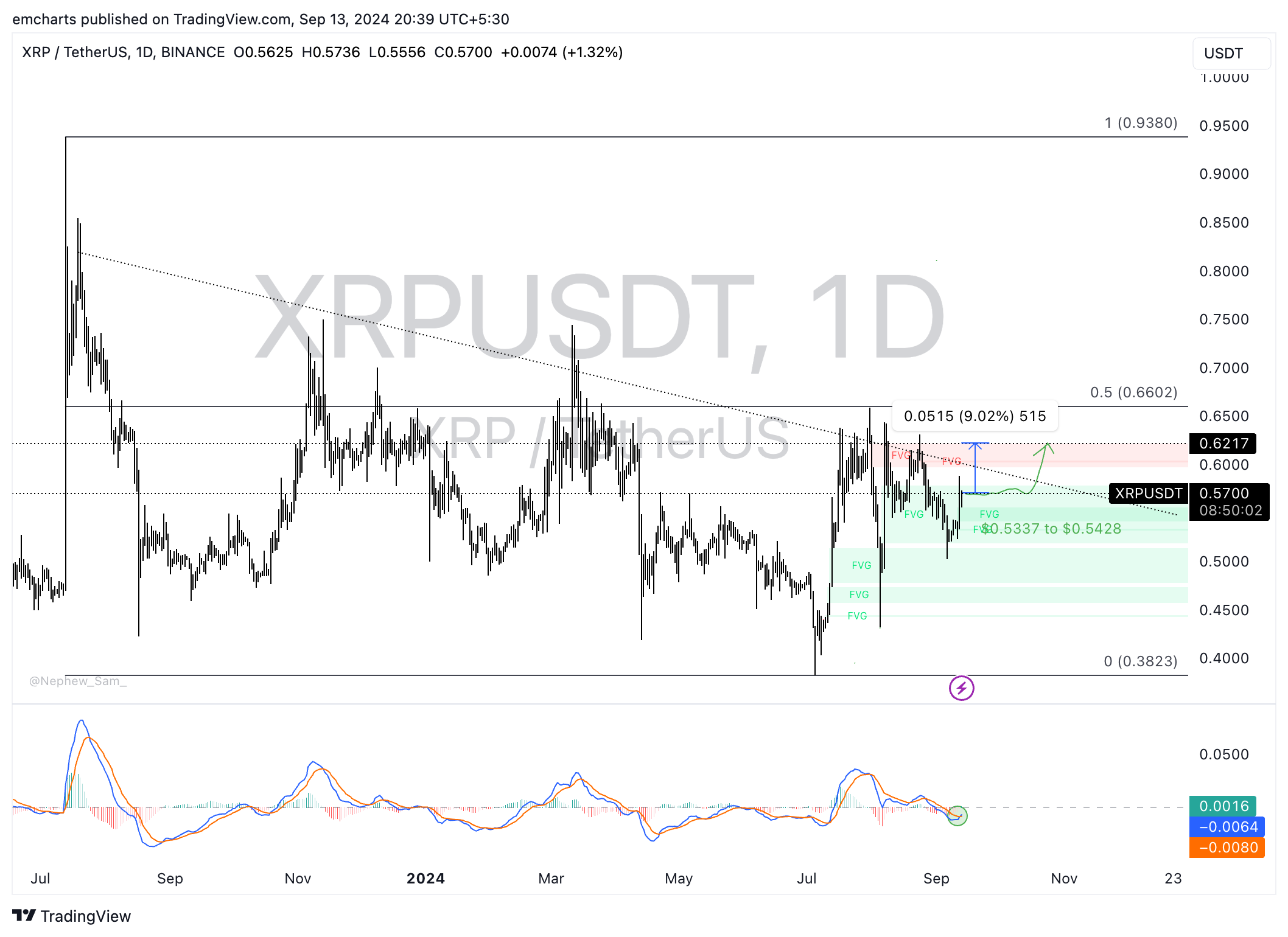

Technical analysis: XRP could rally 9% and target $0.6217

Ripple has been in a downward trend since its July 2023 top of $0.9380. Since then, the altcoin reached a low of $0.3823 in July 2024. XRP recovered somewhat afterwards, but in the last few months it has traded broadly sideways within a range between $0.6586 and $0.4319.

XRP trades at $0.5695 on Friday and could gain 9% if it reaches $0.6217, which aligns with the upper boundary of the Fair Value Gap (FVG) in the XRP/USDT daily chart.

The Moving Average Convergence Divergence (MACD) indicator shows green histogram bars above the neutral line, suggesting underlying positive momentum in XRP.

XRP/USDT daily chart

If the altcoin’s price declines, it could find support in the FVG between $0.5337 ad $0.5428. These levels have acted as support throughout August and September.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.