Ripple asks for stay of $125 million settlement in final lawsuit ruling, XRP slips to $0.54

- Ripple filed a letter requesting stay of monetary portion of the court’s judgment in the SEC vs. Ripple lawsuit and received SEC approval.

- The two parties consent on the request for temporary postponement of the $125 million fine.

- XRP slips to $0.54 as the altcoin faces a correction in the aftermath of the recent correction in crypto prices earlier this week.

Ripple (XRP) dipped to $0.54, erasing 1.81% of its value on the day. The payment remittance firm had submitted a letter requesting a stay on the monetary portion, the $125 million settlement in its recent lawsuit, on August 7. The Securities & Exchange Commission (SEC) consented to the request.

Daily digest market movers: Ripple and SEC agree to postpone the monetary fines imposed in lawsuit

- The final ruling in the SEC vs. Ripple lawsuit was considered a partial victory for both parties. The ruling judge, Analisa Torres, upheld the ruling that XRP is not a security in

- secondary market transactions on crypto exchange platforms.

- A fine of $125 million was imposed on Ripple for securities law violation and the firm requested a stay on this monetary portion of the ruling on August 7.

- The letter requesting this temporary postponement of the fine received the SEC’s consent as well, per September 4 filing in the court.

#XRPCommunity #SECGov v. #Ripple #XRP Ripple has filed a letter requesting a stay of the monetary portion of the Court’s Judgment entered on August 7, 2024. The SEC has consented to the request for a stay. pic.twitter.com/zo68dq6D8j

— James K. Filan (@FilanLaw) September 4, 2024

- XRP traders are waiting to see whether the regulator will appeal the final ruling in the lawsuit.

- If there is an appeal, it could negatively impact XRP’s legal clarity.

Technical analysis: XRP could extend losses by nearly 5%

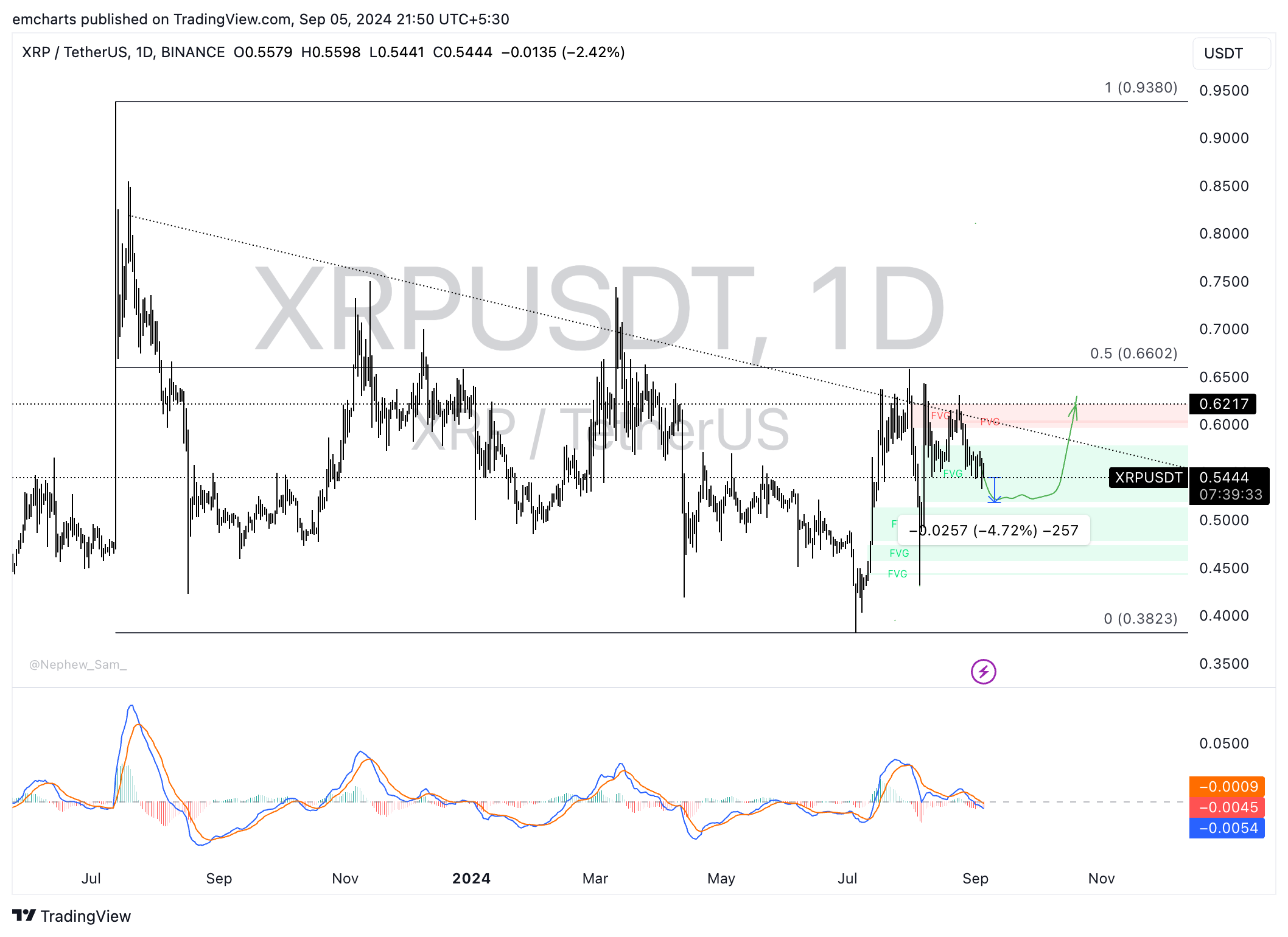

XRP has been in a multi-month downward trend that started on July 13, when the altcoin was at $0.9380. XRP is likely to extend losses by 4.72% and sweep liquidity at $0.5188. This marks a key support level for the altcoin as it is the lower boundary of a Fair Value Gap (FVG).

The Moving Average Convergence Divergence (MACD) shows red histogram bars under the neutral line, which signifies that there is underlying negative momentum in the XRP price trend.

XRP/USDT daily chart

A daily candlestick close above $0.5785 could invalidate the bearish thesis. XRP could target the psychologically important $0.60 level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.