Could Ethereum be next Nvidia based on high-growth tech narrative?

- Ethereum ETFs could flip analysts' expectations if investors buy into ETH's Nvidia-like high-growth tech play narrative.

- Ethereum is the number one blockchain network in terms of yearly revenue.

- Ethereum derivatives data reveals investors are becoming more risk averse following Mt. Gox headwind on horizon.

Ethereum (ETH) is down 3% on Wednesday following a wider market downturn with potential Mt. Gox BTC supply flooding the market. Despite the general market lull, investors may gain consolation from Bitwise prediction that Ethereum ETFs could outperform analysts' expectations if positioned as a high-growth tech play similar to Nvidia.

Daily digest market movers: Could Ethereum be the next Nvidia?

According to Bitwise CIO Matt Hougan, Ethereum ETFs could be more successful than earlier predicted if investors buy into the narrative that Ethereum is a high-growth tech play similar to Meta and Nvidia. Hougan had earlier predicted that spot ETH ETFs could attract up to $15 billion in net flows before the end of 2025.

"It's pretty easy for me to imagine investors selling a small amount of their tech exposure and adding ETH. I'd argue it's easier than imagining investors carving out an entirely separate portfolio sleeve for a new monetary asset," Hougan noted.

However, people need to buy into the idea that "Ethereum is a technology investment" for this to happen. Hougan noted that a clear understanding of how Ethereum differs from Bitcoin and the growth of applications on its network would help strengthen the “high-growth tech play” narrative.

"What might that look like? Imagine stablecoins going from $160 billion to $1.6 trillion in assets as more people embrace the speed and transparency of blockchain-enabled payments. Or consider decentralized finance applications opening up new avenues for lending and borrowing with the onset of regulatory clarity. Or imagine more firms following BlackRock's lead and building tokenized funds on the Ethereum platform," said Hougan.

The Securities & Exchange Commission (SEC) approved spot ETH ETF issuers' 19b-4 filings in May but also needs to greenlight their S-1 registration statements before the products can begin trading.

Meanwhile, Lookonchain revealed in a recent analysis that Ethereum ranks number one among blockchain networks in terms of yearly revenue. Ethereum's revenue is at $2.728 billion per year, with Bitcoin coming behind at $1.302 billion. Increased revenue often indicates high user activity in a blockchain network, which helps estimate bullish sentiment.

ETH technical analysis: Ethereum traders are skeptical with Mt. Gox headwind in sight

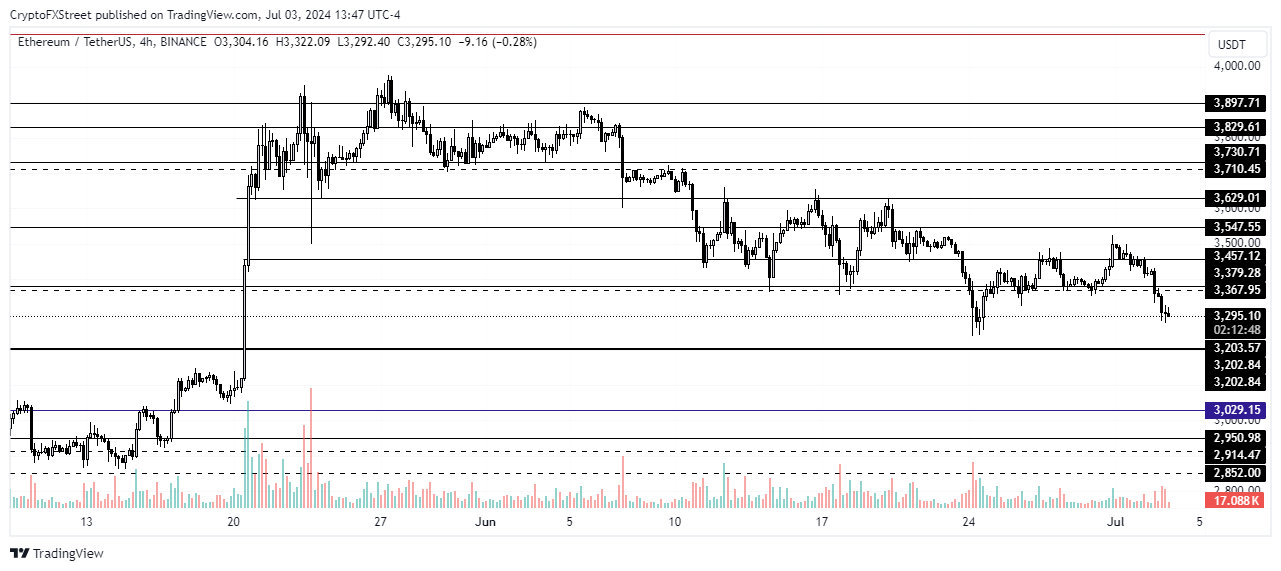

Ethereum is trading around $3,307, down about 3% in the past 24 hours. ETH breached the $3,367 support level, pouring cold water on hopes of a potential rebound. ETH liquidations reached $44.33 million, equalling that of BTC in the past 24 hours despite having a lower market cap. Long liquidations accounted for 87% of ETH's total liquidations, with shorts at 13%.

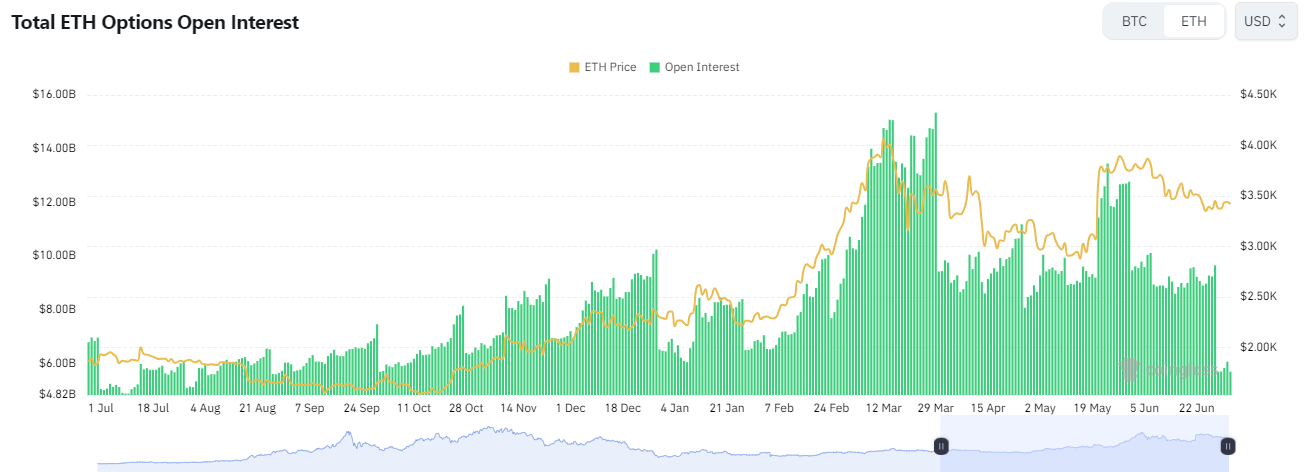

Ethereum options open interest has declined by 57% since its spike following the SEC's approval of 19b-4 filings of spot ETH ETF issuers. As of May 24, ETH options OI was at $13.44 billion. However, following the expiry of May and June options, most investors have failed to open new positions as indicated in the chart below.

ETH options OI

ETH options OI is now at $5.69 billion, its lowest level since September. The decreasing options OI accompanied by ETH's price decline suggests option traders are more risk-averse. Two possible reasons for the uncertainty among traders include:

- SEC's delay in greenlighting prospective spot ETH ETF issuers’ S-1 drafts.

- Prevailing wider market bearish sentiment from Mt. Gox BTC supply.

The ETH Long/Short ratio also provides insights into traders' sentiment in the past week. The ratio's 7-day average is at 0.946, indicating the futures market is tilted toward the downside.

As a result, ETH may sustain a horizontal movement in the coming weeks until the SEC approves issuers' S-1 drafts for spot ETH ETFs to begin trading.

ETH/USDT 4-hour chart

A breach of the $3,203 support could strengthen bearish sentiment and send ETH back to the $2,850 to $3,029 range.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.