Crypto markets could gain $1 trillion as Gold price reaches $3,000: Tokenized-Gold expert explains

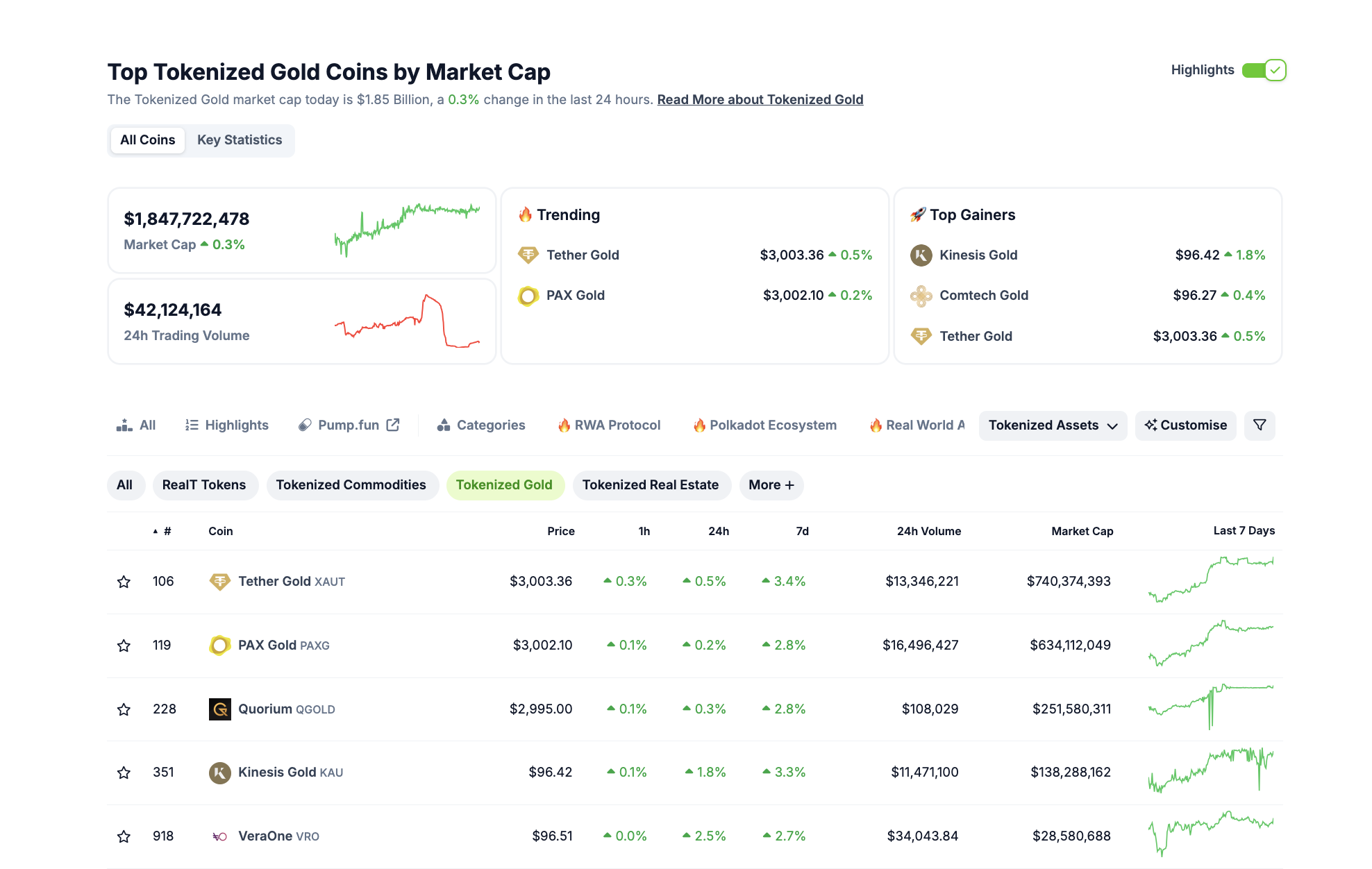

- Tokenized-Gold assets hit a $1.8 billion market cap on Monday after Gold (XAU) price reached new all-time highs above $3,000.

- Crypto markets have declined 28% since Trump’s inauguration, while Gold prices rose 11%, signalling investors’ sensitivity to geopolitical and macroeconomic risks.

- In an exclusive interview, RAAC CEO Kevin Rusher explains how the tokenized-Gold sector could impact the next crypto market recovery phase.

Tokenized-Gold assets hit a $1.8 billion market cap on Monday after the Gold (XAU) price marked new all-time highs above $3,000 per troy ounce. In an exclusive interview with FXStreet, RAAC CEO Kevin Rusher explains how tokenized Gold assets could impact the next crypto market recovery phase.

Gold rallies to $3,000 as Trump’s policies unsettle crypto markets

Since President Donald Trump's inauguration on January 20, the global cryptocurrency market has experienced a significant downturn with its total capitalization declining by 30%.

Bitcoin (BTC) saw its value drop by 31% from its record high on inauguration day, currently trading around $83,325.

In contrast, Gold prices have hit record highs. On Monday, Gold traded at an all-time high of $3,005 per troy ounce, reflecting investor anxiety over economic growth due to trade policies and a testy geopolitical landscape.

-638778333529952223.png)

Gold (XAU) price action vs. Bitcoin (BTC), March 2025 | Source: TradingView

With the US Fed rate decision slated for Wednesday forming an active bearish overhang, investors are rotating assets to navigate the market lull.

The crypto market is stagnating amid uncertainties surrounding multiple regulatory changes and active policy proposals.

Trump’s multifaceted tariffs are drawing the ire of financial markets as some observers predict they will lead to a recession or reduced growth.

As Gold’s rally to all-time highs above $3,000 draws investor mind share, skews capital allocation, it could impact the global markets’ momentum in the near-term.

RAAC CEO sets $1 trillion target as XAU rally propels tokenized-Gold sector to $1.8 billion

Cryptocurrencies markets remain on edge as Q1 2025 grinds to a close.

Having shed over $1 trillion of market cap since Bitcoin price hit an all-time high of $109,000 ahead of Trump’s inauguration on January 20, a majority of investors are anticipating more outflows ahead of the upcoming US Fed rate decision slated for Wednesday.

In late February, Analysts at Goldman Sachs adjusted their forecasts and predicting that Gold prices may surpass $3,100 per ounce in 2025, driven by a variety of economic and geopolitical factors. UBS raised their Gold price target on Monday to $3,200.

Tokenized Gold Assets performance, March 17 2025 | Source: Coingecko

Tokenized Gold Assets performance, March 17 2025 | Source: Coingecko

However, the Real World Asset (RWA) lending and borrowing ecosystem offers innovative options to keep crypto market liquidity on-chain during volatile periods of geopolitical upheaval or hawkish macro economic policy swings.

According to Coingecko data, the aggregate tokenization sector hit $1.8 billion as Gold prices crossed the $3,000 mark on Monday.

In an exclusive FXStreet interview, ahead of its latest testnet launch that could see $235 million in Gold-backed deposits tokenized from one of the largest Gold reserves in North America, RAAC CEO Kevin Rusher offers experts how crypto traders could benefit from the current Gold rally:

- Question 1 (Q1): The U.S. Crypto Strategic Reserve effective pits Bitcoin's against other commodities and traditional treasury assets like Gold. How could this impact sovereign and institutional appetite for Gold in the coming years?

Kevin Rusher: “Central banks and sovereign wealth funds will likely continue holding physical Gold for its historical security and legal clarity, tokenized Gold could offer a more liquid, cost-effective alternative that appeals to institutions seeking faster transactions or diversification into digital assets.

“Over time, this may shift some portion of institutional liquidity toward tokenized Gold, particularly for trading or yield-generating opportunities, though physical Gold is likely to remain a cornerstone of sovereign reserves.”

- Q2 : Proof of reserves is a major issue for Gold-backed tokens. What standards should investors demand to ensure transparency and prevent fractionalization?

Kevin Rusher: “Investors should insist on verifiable proof of reserves for tokenized Gold that includes frequent third-party audits by reputable firms, along with transparent reporting and on-chain verification mechanisms.

Importantly, these audits need to confirm a 1:1 ratio between the Gold reserves and the issued tokens - this will prevent any hidden fractionalization.”

- Q3: Gold provenance is increasingly important due to supply chain ethics and sustainability concerns. How does the RAAC team and the Gold tokenization sector address these issues? Any Internal governance, Industry SOPs or Decentralized solution?

Kevin Rusher: “Through RAAC’s partnership with the Pretio DAO Treasury, mining operations and suppliers adhere to strict ethical and sustainability standards.

These sources are documented via standardized audits, and blockchain-based tracking maintains a verifiable record of all Gold extracted, refined and securely stored.

This approach ensures full visibility into the supply chain, allowing stakeholders to confirm that the Gold is responsibly sourced and meets agreed-upon ESG criteria”.

- Q4: Gold markets have long faced price manipulation through paper contracts. Could blockchain-based reserves bring more transparency to global Gold pricing?

Kevin Rusher: "Unlike paper markets, anything put on-chain is immutable and cannot be tampered with.

Tokenized Gold offers the opportunity for real-time monitoring and verifiable proof of physical Gold backing each token.

With tokenized Gold, traders can also eliminate broker fees, storage, and other third-party costs, without exposure to additional handling costs or custody risk."

- Q5: Traditional Gold traders are used to dealing with spot XAU and ETF markets. What aspects of tokenized Gold would be most compelling to them?

Kevin Rusher: "Tokenized Gold offers several benefits over traditional markets. These include faster settlement, immediate access, and real-time price discovery. Having Gold on-chain gives traders much more flexibility to earn yield, without affecting the inherent security and reliability of the asset."

- Q6: Meme coins and AI have dominated crypto narratives in 2025. Can Gold-backed investments tap into these trends for wider adoption?

Kevin Rusher: "As the current price of Gold shows, Gold-backed investments remain the go-to stable asset for most investors. As such, we would not rule out the possibility of integrating AI and meme culture into the tokenized Gold ecosystem.

Our team believes passionately in increasing access to the world’s most stable assets in one of the world’s most volatile sectors. We don't just want to bring the next billion users into decentralized finance, but the next $100 billion."

- Q7. When Gold reached $3,000, the market capitalization of tokenized Gold assets hit $1.8 billion, representing less than 1% of the total crypto market dominance.

Kevin Rusher: "Looking ahead, what do you project the Gold Real World Asset (RWA) sector will be worth in terms of its aggregate valuation and market share within the crypto space over the next five years?

Currently, RAAC reserves are valued at approximately $400 million — 20% of a discounted spot price of $2,000 per troy ounce. Over a 10 to 15-year production cycle, the tokenized asset’s total estimated value could reach up to $3 billion, depending on market conditions and future Gold prices.

If the tokenized Gold market follows the trajectory of gold ETFs, achieving tokenization of even 5% of Gold’s $15 trillion total market cap would effectively increase the crypto sector valuation by more than $1 trillion."

In summary:

Since Trump’s inauguration, crypto market's 28% slump coinciding with Gold price rallying11% to $3,000 all time highs, hints that investors increasingly pulling liquidity out of crypto sector as economic uncertainty signals mount.

As the next US Fed’s rate decision nears under hakwish pressure from Trump’s recent trade tarrif policies, RAAC CEO Kevin Rusher sees innovations around tokenized Gold asset as a potential $1 trillion catalyst for recovery and bridging liquidity gaps between traditional marktets and the crytptocurrency sector.

By combining Gold's price stability with blockchain’s efficiency with transparency and 24/7 trading liquidity, the RWA sector may attract new institutional investors and traditional Gold day traders towards the crypto-based products.

Beyond that, by rotating into tokenized Gold tokens, crypto-native traders can retain more capital on-chain during during periods of geopolitcal upheaval or contractionary monetary policy cycles.