Gold pops up whilst Greenback deepens losses again

- Gold flirts with a 1% surge on Tuesday, paring back initial losses for this week.

- Headlines on German defense spending possible deal hit the US Dollar and support Gold.

- Traders are bracing for the upcoming Fed meeting on March 19.

Gold’s price (XAU/USD) is popping back above the $2,900 round level and even trades above $2,910 at the time of writing on Tuesday. The move comes in a domino effect originated by the headline from the German Green coalition leaders, who said this morning to have given the green light to a deal on defense spending. That boosted confidence in the Euro (EUR) and triggered a new leg lower in the US Dollar Index (DXY), which opened the door for Bullion to surge.

Meanwhile, traders are still cautious after a tariff war is spiraling out of control outside the United States (US). Canada has hit several Chinese imports, which met with counter-tariffs from China on Canadian goods such as canola Oil. The demands from US President Donald Trump are being met for now as Canada and Mexico can see further easing on their own tariffication if they also impose levies on Chinese goods.

Daily digest market movers: Thai Baht flying

- US President Donald Trump’s signals that the economy could first suffer as he reshapes trade policy with tariffs stoked concerns about a potential recession. The precious metal, a traditional haven asset, can face selling pressure during sudden market selloffs, Bloomberg reports.

- Thailand’s currency, Thai Bhat (THB), has received a boost this year from a rally in Gold prices. Strategists warn though that the rally will not be enough to protect the country from tariff risks. The THB is up around 1.2% against the US Dollar this year, more than double the gain of a broad gauge of Asian currencies. A key reason is Thailand’s role as a Gold-trading hub in the region, which boosted confidence in the currency, Bloomberg reports.

- The CME Fedwatch Tool sees a 95.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. However, the chances of a rate cut at the May 7 meeting increase to 47.8%.

Technical Analysis: Opening a window

For once, it is not a headline on tariffs which is boosting the precious metal. This time, it is a domino effect where a weaker US Dollar opens the door for Gold to move higher. There are not yet aspirations for a new all-time high, but it is good to see the initial weekly loss erased and Gold returning to flat on the week.

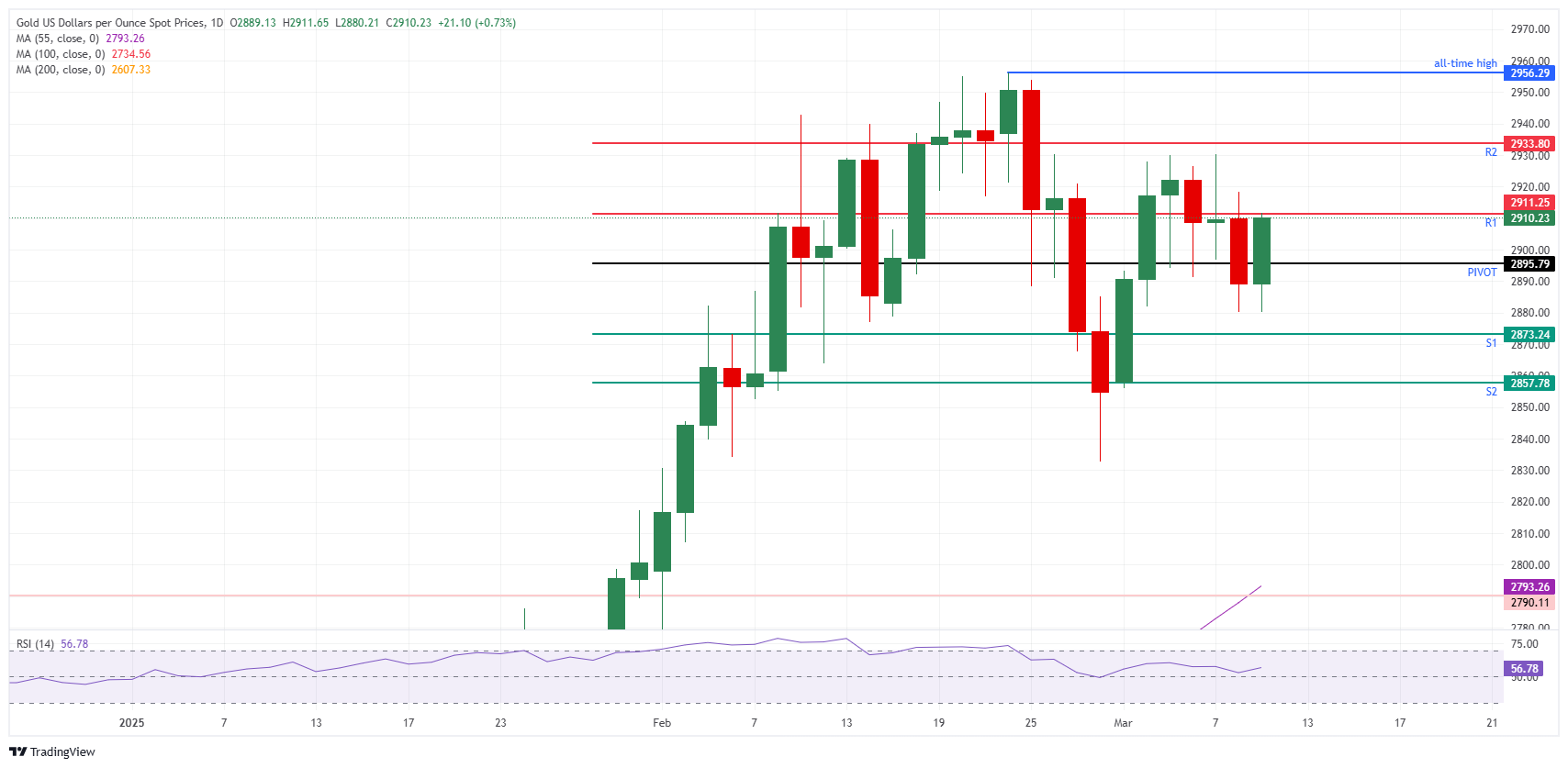

Gold is back above the $2,900 round level and, from an intraday technical perspective, it is back above the daily Pivot Point at $2,895. At the time of writing, Gold is knocking on the door of the R1 resistance near $2,910. Once through there, the intraday R2 resistance at $2,933 comes into focus on the upside, converging with last week’s highs.

On the downside, the firm support stands at $2,880, which has held Gold’s price on Monday and Tuesday. In case that level breaks, look at the S1 support around $2,873. A small leg lower could target $2,857, the convergence of the S2 support and the March 3 low.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.