Gold falls on Trump creating more confusion about tariffs

- A mixed Nvidia outlook and an unclear tariffs schedule delivered by US President Trump are cause for concern.

- Gold faces strong selling pressure and trades down over 1% on Thursday.

- Although US yields are dropping off further, the precious metal has lost support for now.

Gold’s price (XAU/USD) faces strong selling pressure and extends this week’s correction to hit a ten-day low near $2,880 at the time of writing on Thursday. The leg lower comes after United States (US) President Donald Trump cast doubts and confusion during a cabinet meeting on Wednesday about what levies will be applied, when and to which countries.

President Trump said “tariffs will go on, not all, but a lot of them” and added that levies on Canada and Mexico imports will go into effect on April 2. Reciprocal tariffs should be installed on April 2 too. The US President confirmed a 25% tariff would be imposed on Europe as well on autos and other things but he did not provide further details.

Daily digest market movers: March is just around the corner

- Overnight markets braced for Nvidia’s (NVDA) earnings. Nvidia's quarterly sales will be about $43 billion, slightly above analysts' estimates, but gross profit margins will be tighter than expected due to the rollout of a new chip design called Blackwell. The mixed outlook came in with bad timing as concerns about slowing spending on AI and the potential impacts of US tariffs could mean more headwinds for the company.

- The CME Fedwatch Tool projects a 33.0% chance that the interest rates will remain at the current range in June, with the rest showing a possible rate cut.

- On the US data front, the second reading of the US Gross Domestic Product (GDP) for the fourth quarter is due at 13:30 GMT. Projections are that the GDP annualized will remain stable at 2.3%. The quarterly headline preliminary Personal Consumption Expenditures (PCE), which precedes the monthly PCE on Friday, is expected to continue stable at 2.3% as well. The core PCE number should come in at 2.5%, also unchanged.

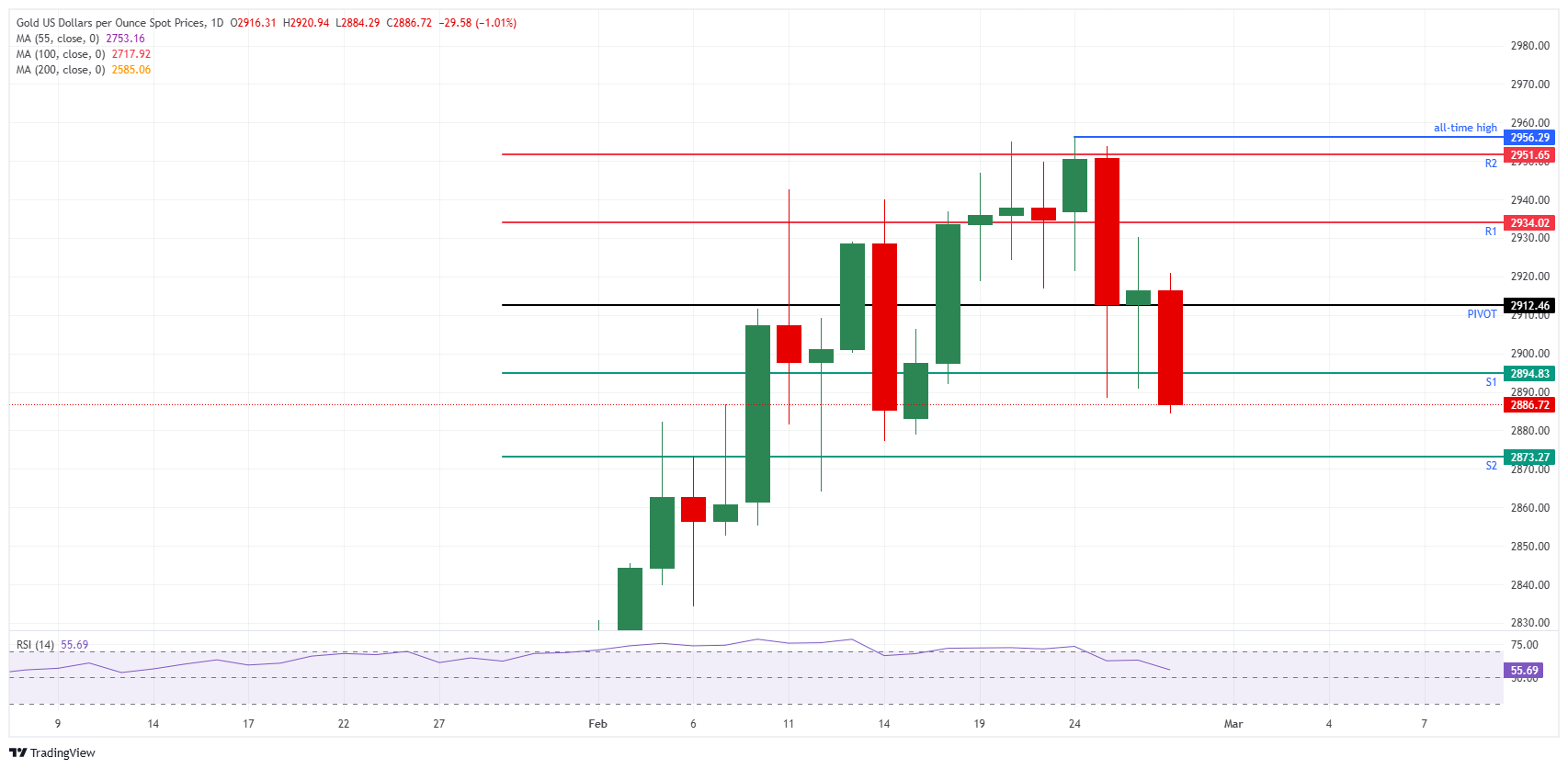

Technical Analysis: Look for the stops

On Wednesday, a few analysts warned that greedy price action was taking place in Gold, with traders willing to buy at any given price to remain part of the rally. With the current correction, several traders will be facing a squeeze and might soon see their stop losses exercised. This idiosyncratic action will result in more selling pressure and might even see a firm drop lower in Bullion to possibly even $2,860 on the day.

The main element to trigger a turnaround comes at the daily Pivot Point of $2,912. Should Gold fully recover back above that level, it would confirm that traders are buying the current dip. Once through there, $2,934 and $2,951 are levels on the upside to look out for in the form of the intraday R1 and R2 resistances.

On the flip side, Tuesday’s low at $2,890 is starting to give way. Further down, watch out for $2,873 (the S2 support), which could open the door for a test to $2,860.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.