Gold steadies at fresh highs on uncertainty ahead of US presidential election

- Gold hits fresh record highs on increasing demand for safe havens amid the US political uncertainty.

- US Treasury yields’ reversal from mid-term highs has increased bullish pressure on the precious metal.

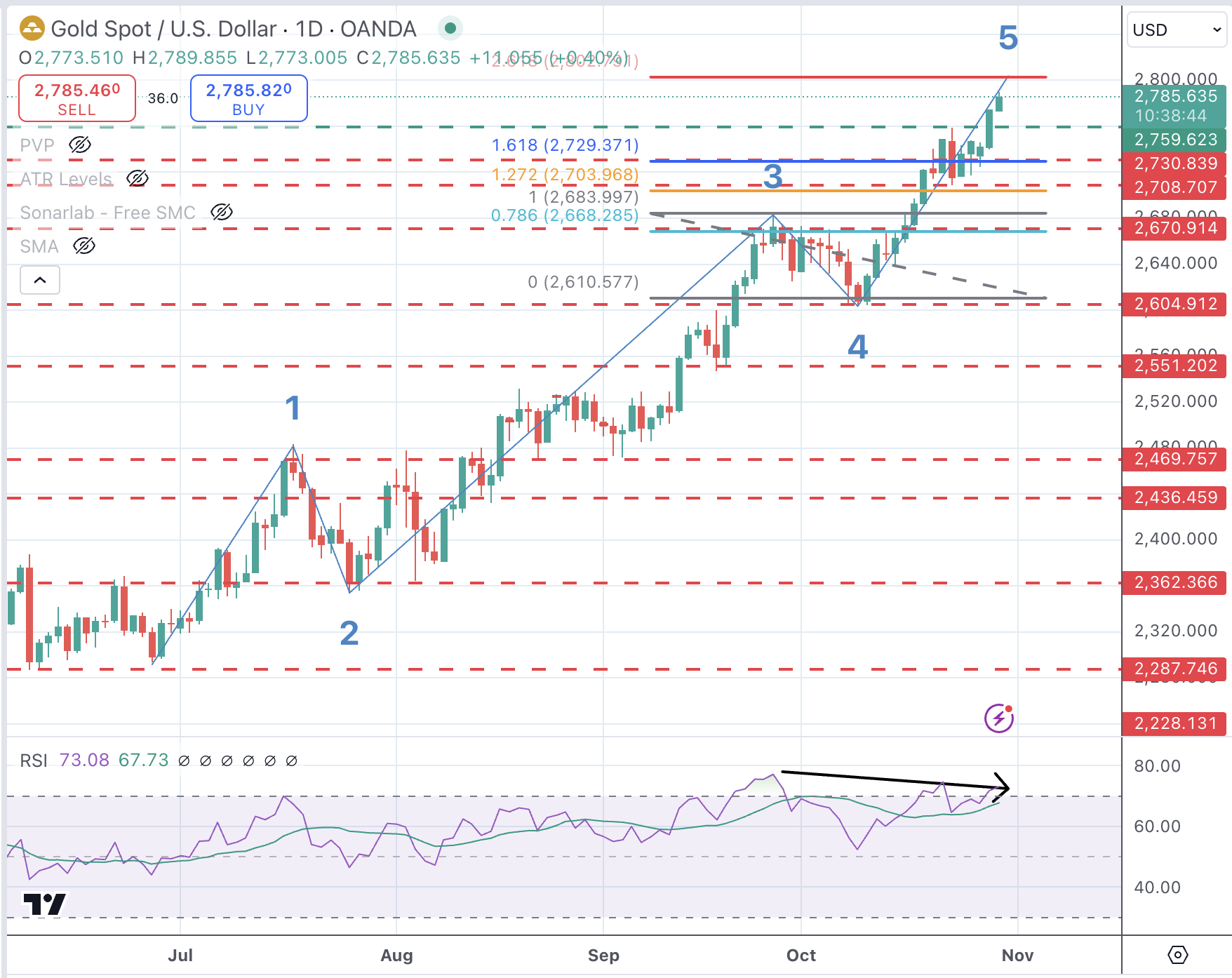

- XAU/USD rally looks overextended, with the RSI showing a bearish divergence.

Gold price (XAU/USD) has stretched to fresh record highs on Wednesday, favored by a combination of higher demand for safe-haven assets amid the US political uncertainty and retreating US Treasury yields.

Investors are looking for safety with the US presidential election around the corner and recent polls showing a close race between the two candidates Vice President Kamala Harris and former President Donald Trump.

Beyond that, US Treasury yields pulled back after JOLTS Job Openings data declined by more than expected in September. The Federal Reserve (Fed) has set the labor market as the main focus of its monetary policy, and these figures have practically confirmed a 25 bps rate cut next week.

Daily digest market movers: Gold consolidates gains with investors pricing two more Fed rate cuts in 2024

- US JOLTS Job openings declined to 7.44 million in September, and August’s reading was revised down to 7.86 million from the previously estimated 8.04 million. These figures have scratched the picture of a solid labour market ahead of Friday’s Nonfarm Payrolls (NFP) report.

- On the other hand, the Conference Board’s Consumer Confidence Index improved to 108.7 in October from 98.7 in September, beating expectations of a 99.5 reading.

- The CME Group’s Fed Watch tool shows a 99.6% chance of a quarter-point rate cut by the Fed next week, up from 92% on Tuesday. The chances of another 25 bps cut in December have increased to 76.6% from 72%.

- US 10-year Treasury yields retreated from three-month highs at 4.33% to 4.23% on Wednesday, which has provided an additional impulse to the precious metal.

- The main focus on Wednesday is the advanced US Gross Domestic Product (GDP) report, which is expected to show a healthy 3% annualized growth in Q3. The ADP Employment Change, however, is seen declining to 115K from 143K, which might increase doubts about Friday’s Nonfarm Payrolls (NFP) report.

Technical analysis: XAU/USD’s rally looks overstretched near $2,800

Gold is on a bullish trend amid a supportive fundamental backdrop, but the technical picture is showing signs of a potential correction. The RSI is at overbought levels in most time frames, with the 4-hour chart showing a bearish divergence, which often anticipates a corrective reaction.

Immediate resistance is the intra-day high at $2,780, ahead of the $2,800 level. Support levels are the previous top at $2,760 and $2,730.

The daily chart shows the pair likely to be at the end of a 5-wave (Elliot Wave) impulse, with the 261.8% retracement of the 4th wave, in the $2,800 area, as a potential pivot point.

XAU/USD Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.