EUR/USD gains ground, but recovery remains limited

- EUR/USD bounced back toward the 1.0600 handle on Wednesday.

- Markets have stepped away from broad Greenback bidding pressure.

- Volumes and trading flows set to be crimped through the rest of the week.

EUR/USD caught a broad-market bid on Wednesday, taking a new run at the 1.0600 handle during the midweek market session. Fiber’s bullish rebound was due mostly to investors broadly taking a step out of recent Greenback buying pressure, rather than any instrinsic strength within the Euro itself.

Wednesday’s data docket was entirely one-sided, delivering a wide chunk of US economic figures before US markets shutter exchanges for the Thanksgiving holiday on Thursday, to be followed by shortened trading hours on Friday. Annualized US Gross Domestic Product (GDP) grew by the expected 2.8% through the third quarter, to no one's surprise and barely moving the needle on investor pulses. Core Personal Consumption Expenditure Price Index (PCEPI) accelerated to 2.8% for the year ended in October, also meeting expectations. While upticks in inflation metrics generally bode poorly for market expectations of future rate cuts, the move upward was widely expected, and a hold in monthly figures at 0.3% MoM helped to frame the bump in the data as being in the rear-view mirror.

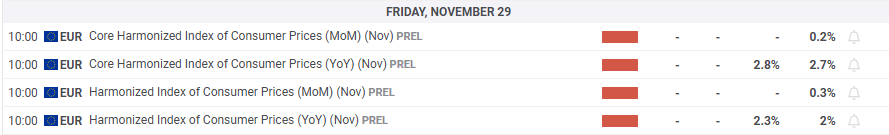

Fiber traders will be looking toward Friday’s preliminary pan-EU Harmonized Index of Consumer Prices (HICP) inflation data, with equal parts hope and despair. Pan-EU inflation is broadly forecast to tick higher in the near term, which will further cripple the European Central Bank (ECB) even further as ECB policymakers struggle to find the words to bolster investor confidence in the lopsided European economy.

EUR/USD price forecast

The Euro’s much-needed bullish reprieve on Wednesday gave Fiber bulls a chance to put more distance between themselves and the pair’s latest swing low below the 1.0400, but not by much. EUR/USD is poised for a battle with the 1.0600 handle, and even a victory on the key technical level still sees further topside momentum running aground of a quickly-descending 50-day Exponential Moving Average (EMA) falling through 1.0750.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.