Canadian Dollar struggles on Tuesday, tests 55-month low

- The Canadian Dollar took a plunge on Crude Oil weakness on Tuesday.

- Canada is almost entirely absent from the economic calendar this week.

- Geopolitical headlines about Israel-Hezbollah ceasefire stabilize energy markets.

The Canadian Dollar (CAD) got knocked lower on Tuesday, declining to a fresh four-plus-year low point against the Greenback. The economic calendar was a thin affair on Tuesday, with markets broadly focused on geopolitical events and renewed tariff threats from incoming US President Donald Trump.

Canada is almost entirely absent from the economic calendar this week, with Loonie traders forced to wait until Friday for Canadian quarterly growth figures. The CAD has been left exposed to broad market flows in the meantime, keeping USD/CAD bid into the attic.

Daily digest market movers: Loonie buckles after tariff threats and Israel ceasefire

- The Loonie found a fresh 55-month low on Tuesday, sending USD/CAD to 1.4178 in intraday trading.

- President-elect Donald Trump reiterated his campaign threats to impose sweeping tariffs on all goods imported into the US, verbally targeting Canada with an across-the-board 25% import fee when he takes office in January.

- Markets broadly shrugged off the economically devasting threat as investors continue to believe former President Trump will be dissuaded from revisiting the Smoot-Hawley era of US history that devastated the US economy during the Great Depression.

- Israel has inked a ceasefire deal with Lebanon, sending Crude Oil markets lower and dragging the Canadian Dollar lower in a knock-on effect as the Loonie remains exposed to Crude Oil prices.

Canadian Dollar price forecast

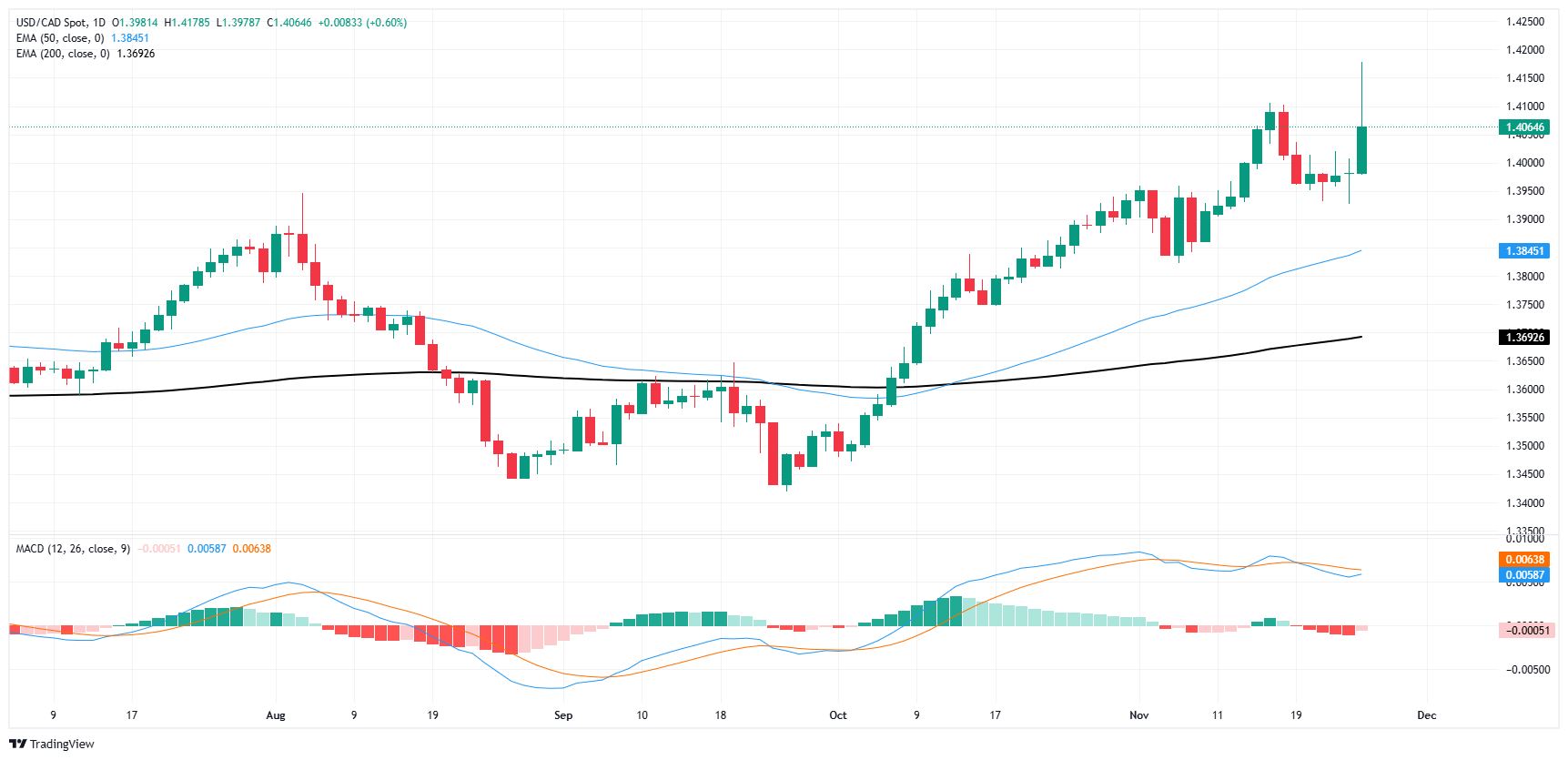

After briefly visiting a new four-and-a-half year low on Tuesday, the Canadian Dollar has pulled back somewhat, moderating slightly and keeping USD/CAD bids below 1.4100 for the time being. The pair is knocking on the high end of a long-term technical congestion pattern that has plagued price action since 2016 when the Loonie backslid to its lowest prices against the Greenback since early 2003.

Momentum traders could be looking for a downside break in USD/CAD bids to drag the pair back to a medium-term inflection point near the 1.3000 handle, a price that long-term trends have cycled for nearly a decade, but in the interim, broad-market Greenback strength continues to keep USD/CAD bid into the high end.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.