Top 3 meme coins Dogecoin, Shiba Inu, Pepe: Three reasons behind a possible rally

- Meme coins have added 7% to their market capitalization, which is above $136 billion on Thursday.

- Dogecoin and Shiba Inu prices advanced slightly on the day while Pepe corrected.

- Bitcoin reclaimed $100,000 on Wednesday and meme coins rallied alongside the largest cryptocurrency.

- Over-leveraged derivatives traders’ positions were flushed out in the correction and open interest recovers on Thursday.

Bitcoin (BTC) is back above $100,000 after its brief correction on Tuesday. Meme coins crashed in response to BTC’s decline at the start of the week and started their recovery on Wednesday. In the past 24 hours, the top 3 meme coins have started their recovery, and on-chain indicators support a thesis for further gains in the tokens.

On Thursday, Dogecoin (DOGE) andShiba Inu (SHIB) posted slight gains, while Pepe (PEPE) corrected at the time of writing.

Meme coin market capitalization climbs above $136 billion

The market capitalization of the meme coin sector climbed 7% in the past 24 hours, as top meme tokens added to their value and recovered from setbacks earlier this week. The market cap has crossed $136 billion according to CoinGecko data.

Dogecoin (DOGE)advanced slightly on Thursday and is trading around the $0.41500 level, nearly 14% below its 2024 peak of $0.48434.

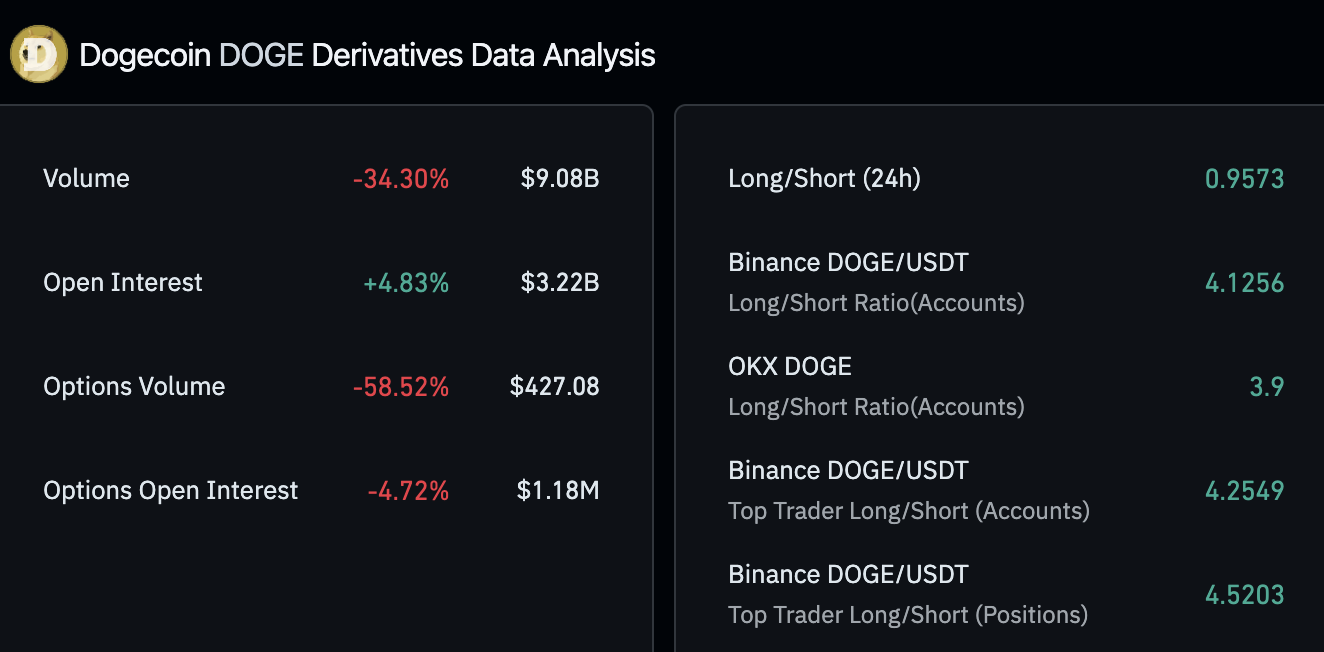

One of the key drivers of Dogecoin’s recovery this week has been the liquidation of over-leveraged trades across derivatives exchanges. Coinglass data shows derivatives trade volume declined by 34% in the past 24 hours. In the same period, Open Interest (OI), or the value of open derivatives contracts across exchanges, climbed nearly 5%.

The Long-to-short ratio, a metric that measures the balance of long (buy) and short (sell) positions, reads over 4 across derivatives exchanges like Binance and OKX. The ratio is well above 1, meaning most traders are in long positions as the market sentiment is positive.

The average Long-to-short ratio is 0.9573, however, across exchanges derivatives traders are bullish on DOGE.

Dogecoin derivatives data. Source: Coinglass

Shiba Inu (SHIB) and Pepe also recorded a spike in open interest on Thursday. SHIB open interest climbed slightly, by less than 0.5% and 1000PEPE (a financial derivative derived from PEPE/USD x 1000 Index price) recorded a 3.22% increase in OI.

Bitcoin traders take profits, likely rotating capital to meme coins

On-chain data from Santiment shows positive spikes in the network realized profit/loss metric for Bitcoin. Large spikes in NPL indicate profit-taking activities of traders. In previous cycles, traders have typically rotated capital from Bitcoin to altcoins after taking profits. This is called “capital rotation.”

[17.21.09, 12 Dec, 2024]-638696151634870438.png)

Network realized profit/loss and Bitcoin price. Source: Santiment

If the pattern repeats, Bitcoin traders could rotate the profits to meme coins, fueling demand and supporting the bullish thesis for DOGE, SHIB and PEPE.

Moreover, the transaction volume across Dogecoin, Shiba Inu and PEPE recorded large spikes between November 6 and December 10. Since the spikes coincided with a price increase, it is interpreted as a positive sign.

Rising transaction volume, coupled with price increases in the same timeframe, is typically indicative of higher relevance and demand among traders, and can be a result of higher inflow to exchange platforms.

[17.35.06, 12 Dec, 2024]-638696152035183640.png)

Transaction volume (DOGE, SHIB and PEPE). Source: Santiment

At the time of writing, Bitcoin held steady above $100,000, trading at $101,505 on Thursday.