Memecoins to watch as Trump replaces Gensler; DOGE, BONK, PEPE price forecast

- The memecoin sector grew 1.7% in the last 24 hours, signaling that the majority of traders are reluctant to cash in early on their weekly time frame profits.

- The newly-launched TRUMP and MELANIA tokens remain the top trending memes despite recent pullback.

- Technical indicators suggest DOGE, BONK, FLOKI could regain momentum in the weeks ahead.

Memecoin’s aggregate valuation crossed the $117 billion mark on Tuesday as President Donald Trump officially replaced Gary Gensler as head of the Securities & Exchange Commission (SEC), marking a paradigm shift for cryptocurrency regulations in the US. Analyzing key market events and technical analysis signals, some prominent meme tokens are showing bullish prospects for the coming weeks.

Memecoin sector approaches $120 billion valuation as Trump fuels fresh capital inflows

Memecoin traders continued to rake in profits on Tuesday as Trump's latest moves ignited global interest in the sector.

While legacy tokens like PEPE and SHIB have struggled, recent inflows from traders entering the memecoin market with TRUMP and MELANIA tokens have pushed the sector’s valuation to record highs.

Notably, charts show that TRUMP and MELANIA dominated media chatter leading up to Inauguration Day.

However, investors are now strategically reinvesting profits into more established mega-cap memecoins.

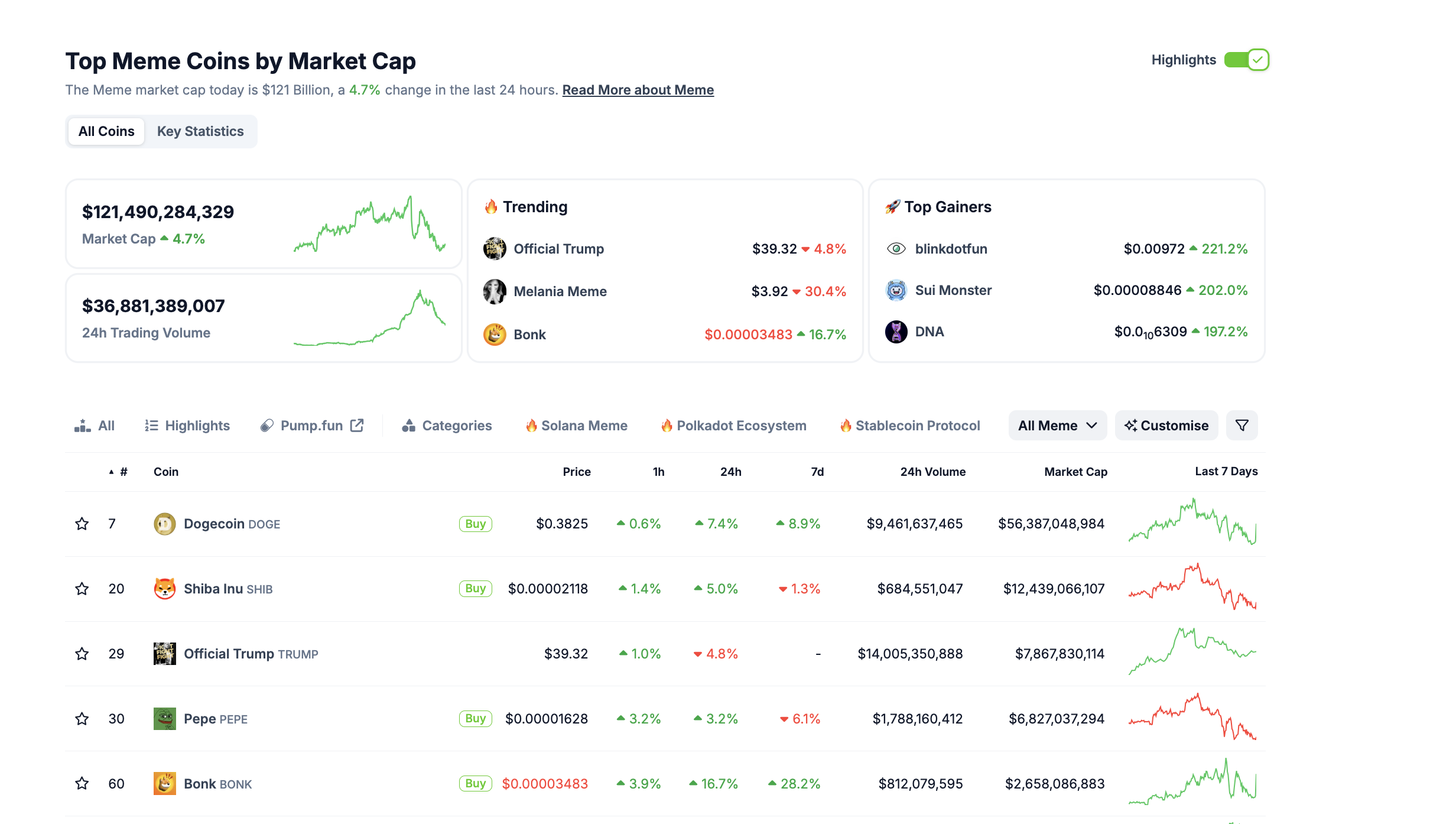

Memecoin Sector Performance, January, 21 2025 | Source: Coingecko

Memecoin Sector Performance, January, 21 2025 | Source: Coingecko

According to CoinGecko’s latest data, the memecoin sector’s valuation surpassed $118 billion on Tuesday, marking a 1.7% increase in 24 hours.

Forest Bai, co-founder of cryptocurrency investment firm Foresight Ventures, also emphasized Trump’s influence on the current market trend.

"I’m very optimistic about the crypto market following Trump’s inauguration.

I had expected he might use a range of measures—like lowering interest rates, establishing national reserves, encouraging businesses to buy crypto, or introducing crypto-friendly policies.

But in the end, Trump chose the most direct approach: launching a memecoin, which immediately brought in millions of new users"

- Forest Bai, Co-Founder/CTO Foresight Ventures.

Meanwhile, the top three trending tokens — TRUMP, MELANIA and Dogelon Mars — saw double-digit losses within the same period.

These rare market dynamics suggest traders are taking profits from low-cap tokens and reallocating funds into high-cap memecoins.

This is evidenced by notable gains in Dogecoin, BONK, and PEPE as investors reshuffle their portfolios following Trump’s inauguration events.

DOGE recorded significant price increases, BONK saw strong upward momentum, and PEPE also booked notable gains.

When an asset’s top-searched status coincides with double-digit losses, it often indicates that holders are actively monitoring prices, potentially triggering panic selling.

If TRUMP and MELANIA tokens continue to decline from their current overbought conditions, analysts suggest DOGE, BONK and PEPE could attract significantly higher inflows, building on their current upward momentum.

Dogecoin Price Forecast: The $0.40 resistance level is at risk

Dogecoin price surged 8.48% on Tuesday, reaching $0.3846 as traders capitalized on strong bullish momentum.

The chart illustrates DOGE reclaiming the middle Donchian Channel (DC) boundary at $0.3718, signaling growing optimism.

The upper DC resistance near $0.4340 is the immediate test for bulls.

Volume spikes suggest a renewed interest in DOGE, further supported by the Accumulation/Distribution Line (ADL), which continues its steady ascent, indicating robust buying pressure.

Dogecoin Price Forecast | DOGEUSDT

Dogecoin Price Forecast | DOGEUSDT

In a bullish scenario, the breakout above $0.4000 could attract new capital inflows, propelling DOGE toward $0.4500, aligning with December highs.

Sustained volume near 4.24 billion bolsters this outlook, while a decisive push past $0.4340 may ignite speculative momentum.

Conversely, a failure to clear $0.4000 resistance could expose DOGE to bearish risks.

A decline below the middle DC line at $0.3718 would shift sentiment, potentially dragging prices toward the lower boundary at $0.3096.

Such a move, compounded by waning ADL momentum, might encourage profit-taking among traders.

Current conditions favor the bulls, but $0.40 remains a critical inflection point.

BONK Price Forecast: $0.00004 breakout in sight

Bonk rallied on Tuesday as the top-ranked memecoin on the Solana network.

If market liquidity declines following Trump inauguration euphoria, BONK could maintain resilience.

As the leading meme token on Solana, BONK's unique positioning may attract sustained investor interest.

This narrative places BONK in the spotlight with a potential breakout to $0.00004000 within reach in the weeks ahead.

Bonk climbed 16.91% on Monday, reaching $0.00003484 as it surged alongside broader market enthusiasm.

The chart indicates DOGE's breakout above the Volume-Weighted Average Price (VWAP) at $0.00003287, suggesting a strengthening bullish trend.

Keltner Channel bands highlight potential resistance at $0.00004048, marking a key target for further upside.

The MACD indicator shows a bullish crossover with rising histogram bars, confirming upward momentum.

BONK Price Forecast | BONKUSDT

BONK Price Forecast | BONKUSDT

In the bullish scenario, sustained buying volume could propel BONK toward the upper Keltner Channel at $0.00004048.

A breakout above this level would likely energize bulls, with $0.00004500 as the next key resistance.

Robust support at $0.00003287 (VWAP) underpins this outlook, reinforcing confidence among traders.

Conversely, if BONK fails to sustain its rally, a pullback below the mid-Keltner Channel level at $0.00003119 could trigger bearish pressure.

This move might expose DOGE to a retest of the lower band at $0.00002190, shifting sentiment.

PEPE Price Forecast: More gains ahead after reclaiming $2 billion market cap

PEPE has shown resilience after reclaiming the $2 billion market cap, rebounding off recent lows.

On the daily chart, PEPE is currently trading near $0.00001610, marginally above its VWAP ($0.00001573), signaling an upward bias.

The Bollinger Bands (BB) have tightened, indicating decreasing volatility and a potential breakout in either direction.

In a bullish scenario, PEPE's successful defense of support at $0.00001573 and a sustained move toward the BB midline of $0.00001705 could invite further upside momentum.

If buyers reclaim the $0.00001849 resistance, PEPE could test the upper BB boundary at $0.00002199, supported by improving sentiment.

PEPE Price Forecast | PEPEUSDT

PEPE Price Forecast | PEPEUSDT

The Relative Strength Index (RSI) at 41.49 remains subdued but is trending upward, suggesting the possibility of strengthening momentum.

Conversely, failure to hold $0.00001573 as support may result in a retest of the lower BB boundary at $0.00001499.

A close below this level could dampen bullish enthusiasm, opening the door for further downside.

For now, PEPE remains positioned for a potential rebound, supported by stabilizing indicators.