Chainlink Price Forecast: How Trump’s endorsement sparked 50% LINK rally

- Chainlink's price consolidates above the $25 mark as Donald Trump's inauguration gets underway on Monday.

- With a 51% gain, LINK is the second-best performing mega-cap crypto asset of the week.

- Last month, Donald Trump-backed World Liberty Financial invested $4.7 million in LINK before officially adopting the Chainlink oracle standard.

Chainlink price steadied above the $25 territory on Monday as the crypto markets reacted to Donald Trump’s presidency. Market data shows that LINK token price was the second-best performing mega-cap crypto asset in the week leading up to the Inauguration. Is LINK on the verge of another breakout?

Chainlink price holds $25 support as Trump Inauguration kicks off

Chainlink has emerged as one of the biggest gainers in the crypto sector as activities around Donald Trump’s inauguration sparked a massive market shake-up.

As the inauguration kicked off on Monday, the likes of Bitcoin, Solana, XRP and Trump’s newly-launched Solana memecoins tagged TRUMP and MELANIA all dominated the media headlines.

However, a closer look at the recent market data shows that Chainlink has been attracting an unusually high level of capital inflows in the week leading up to the January 20 inauguration.

Chainlink Price Action | LINKUSDT (Binance)

Chainlink Price Action | LINKUSDT (Binance)

The TradingView chart above shows how Chainlink price rose 51% in the past week, rising from $17.80 on January 13 to hit a new 2025 peak of $27 on Monday.

This Chainlink is the second-best performing mega cap crypto asset behind Solana.

Trump’s endorsement driving strong demand for LINK

Crypto traders are leaning overwhelmingly toward the Solana and Chainlink markets on positive speculation for further upside potential during Trump’s presidency.

For Solana, the anticipated SOL ETF approval and the launch of the TRUMP and MELANIA memecoins serve as pivotal bullish catalysts.

Meanwhile, Chainlink's recent 51% surge has been attributed to a direct endorsement from a Trump-backed entity, solidifying its appeal among traders.

World Liberty Financial (WLFI) adopts Chainlink standard, November 14 2024.

World Liberty Financial (WLFI) adopts Chainlink standard, November 14 2024.

Following Trump’s re-election, he launched World Liberty Financial (WLFI), a crypto firm aimed at advancing DeFi investments and promoting crypto adoption.

Although the initiative faced criticism and failed to attract significant retail demand, WLFI’s on-chain investment activities have swayed crypto traders' decisions in the lead-up to Trump’s inauguration.

Notably, WLFI adopted the Chainlink standard for integrating and delivering off-chain data, a move that resonated strongly with the crypto market. This public endorsement has driven confidence in LINK, encouraging traders to place long bets on the asset.

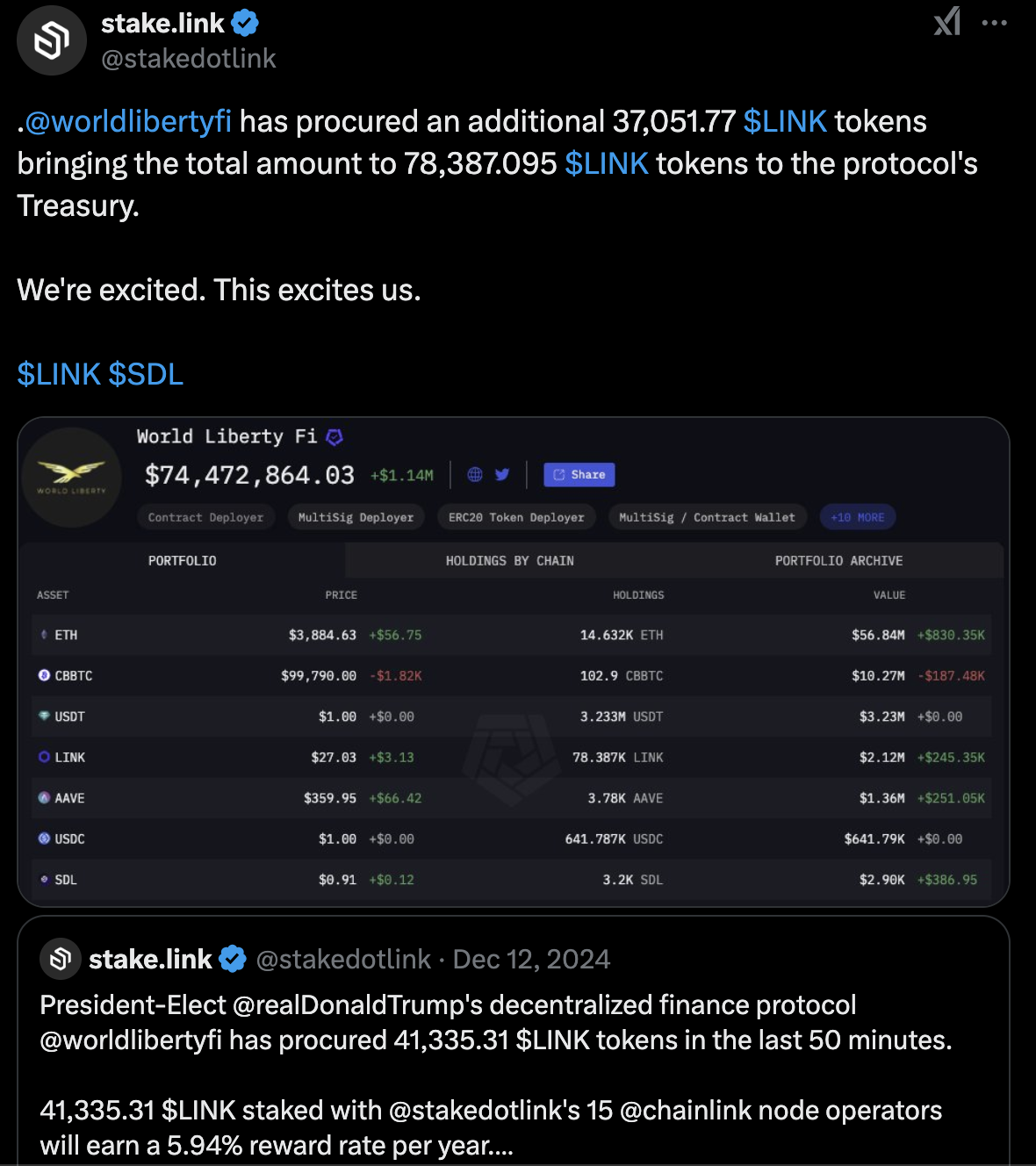

WLFI Invests $4.7 million in Chainlink (LINK), December 2024 | Source: X.com/StakedotLink

WLFI Invests $4.7 million in Chainlink (LINK), December 2024 | Source: X.com/StakedotLink

In mid-December, WLFI reinforced its support for Chainlink by purchasing $4.7 million worth of LINK tokens in multiple transaction tranches and still holds them at press time on Monday.

These developments could signal long-term bullish momentum for Chainlink.

With WLFI’s continued backing and Trump’s exposure to the asset, LINK could benefit from sustained institutional interest and increased utility in the evolving DeFi landscape, potentially driving its price higher in the coming months.

Chainlink Price Forecast: Another breakout ahead if $25 support holds

Chainlink price is consolidating at $25.80 after a stellar 51% rally over seven days, as highlighted in the TradingView chart below.

The price surge coincides with growing optimism fueled by the adoption of Chainlink by Trump-affiliated entities, boosting investor confidence.

Key technical indicators on the LINKUSD daily chart further emphasize the bullish outlook that LINK could extend its rally toward the $30 level if the $25 support holds.

Chainlink price forecast | LINKUSD

Chainlink price forecast | LINKUSD

The Bollinger Bands indicate a narrowing price range near the upper band, reflecting heightened volatility during the recent rally.

LINK closed above the midline ($22.21), suggesting bullish momentum.

The Parabolic SAR reinforces this view, with its blue dots positioned below the candles, confirming the upward trend. The BBP (Bull-Bear Power) at 4.37 signals strong bullish strength, hinting at continued upward pressure.

In a bullish scenario, LINK could target resistance near $27.50 if buy volumes remain elevated, potentially setting the stage for $30.

Conversely, if bears reclaim control and $25 support fails, LINK might dip to retest the midline of the Bollinger Bands at $22.21.

Traders should monitor volume spikes and the Parabolic SAR for signs of trend exhaustion.

With LINK benefiting from institutional adoption narratives, the technical backdrop remains favorable for another breakout, provided the $25 support holds steady.