Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

- Bitcoin price consolidates around $94,000 on Friday after rallying over 10% this week.

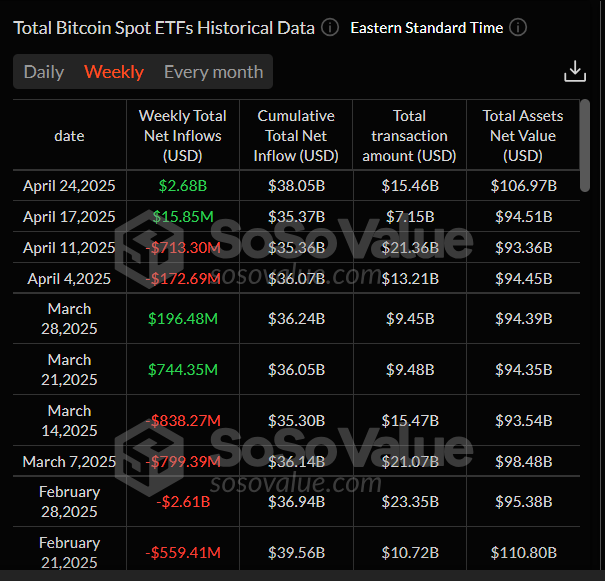

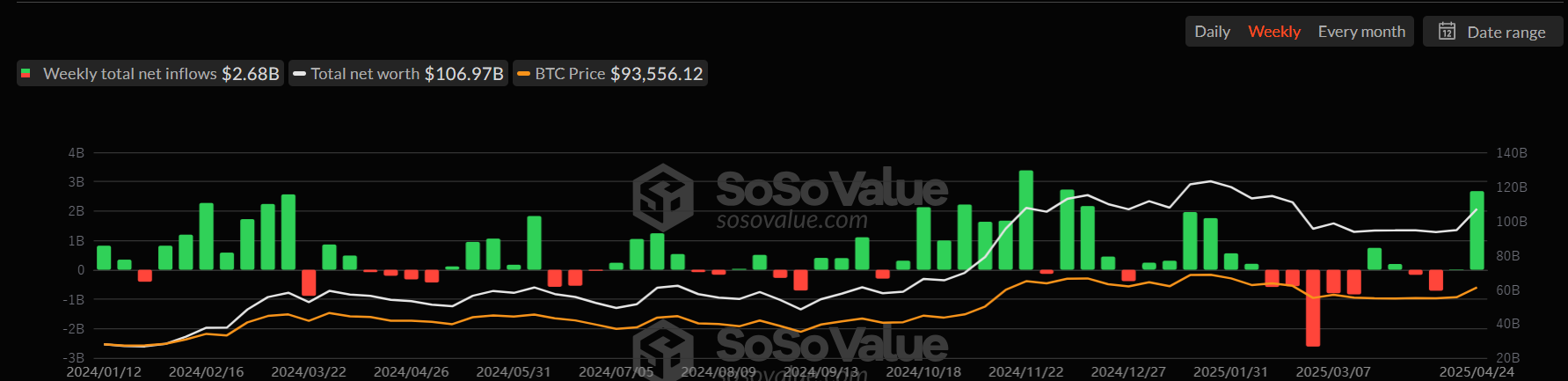

- US Bitcoin spot ETFs recorded a total inflow of $2.68 billion until Thursday, the highest weekly inflow since mid-December.

- Risk-on sentiment prevails as pro-crypto Paul Atkins swears in as head of the US SEC and Trump eases rhetoric on the Fed and China.

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $2.68 billion until Thursday. Moreover, the risk-on sentiment prevails in the market as pro-crypto Paul Atkins has been sworn in as the new head of the US Securities and Exchange Commission (SEC),and US President Donald Trump’s administration appears to be softening its tone on the US Federal Reserve (Fed) and trade tensions with China.

Institutional inflows to Bitcoin ETFs hit four-month highs

Bitcoin institutional demand supported its price rally this week. According to SoSoValue data, the US spot Bitcoin ETF had recorded a total inflow of $2.68 billion as of Thursday, the highest inflow level since mid-December, when Bitcoin broke above the $100,000 mark for the first time. If these inflows continue and intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

Moreover, demand from public companies also remained strong this week. MicroStrategy announced on Monday that it has acquired 6,556 BTC for $555.8 million. During the same period, Japanese investment firm Metaplanet (MTPLF) also acquired an additional 330 BTC for $28.2 million. Then, on Thursday, the firm purchased an additional 145 BTC, bringing the total holdings to 5,000 BTC.

Investment firms’ buying activity is generally bullish for Bitcoin’s price, driven by increased demand, reduced circulation, and positive market sentiment. If this trend continues, Bitcoin is likely to experience more stable price growth over the long term; however, short-term fluctuations are expected to persist as the market adjusts to this new wave of institutional involvement.

Pro-crypto Paul Atkins swears in as new SEC Chairman

Paul Atkins was sworn in as the 34th Chairman of the US Securities and Exchange Commission (SEC) on Monday after Gary Gensler’s departure on January 20. Atkins previously served as an SEC Commissioner under President George W. Bush.

Atkins has proactively supported the digital asset industry, serving as co-chair of the Token Alliance at the Digital Chamber of Commerce since 2017. Atkins has been a strong advocate for clarity in regulation, and he is considered pro-crypto due to his track record of advocating for innovation-friendly policies or his direct involvement in the industry.

The crypto community has broadly welcomed his appointment, as he could bring a less punitive regulatory framework for digital assets. His predecessor, Gary Gensler, opted for a regulation-by-enforcement approach that kept prices of most crypto tokens at subdued levels.

Trump backs down on Fed, US-China trade war

According to a report in The Wall Street Journal this week, global markets have rallied after President Trump stated that he is not planning to fire Federal Reserve (Fed) Chair Jerome Powell. The president also said 145% tariffs on China are “very high.” “It won’t be that high,” Trump said. “It will come down substantially.”

The softening stance on the Federal Reserve and trade tensions with China have boosted investor confidence and supported the risk-on sentiment for riskier assets.

Bitcoin has been one of the best-performing assets in the past couple of weeks, decoupling its correlation with the stock markets since Liberation Day tariffs were announced. “Potential deals on trade between the US and its major trading partners or a dovish pivot from the Federal Reserve could be the catalyst for its next bull run,” said Yohay Elam, senior financial analyst at FXStreet, on Friday’s edition of Orange Juice newsletter.

Bitcoin could fall toward $90,000 before recovering to $97,000

Bitcoin price broke above its 200-day Exponential Moving Average (EMA) at $85,000 on Monday, rising 10.45% to close above $93,000 on Thursday. However, BTC failed to close above its March high of $95,000. At the time of writing on Friday, it is consolidating at around $93,500.

Bitcoin’s current price action appears indecisive, with two possible outcomes emerging.

Holders are booking profits, and BTC faces a mild correction. If this scenario plays out, BTC could extend the decline to find support around the $90,000 psychological importance level.

The Relative Strength Index (RSI) on the daily chart reads 66 after being rejected around its overbought level of 70 on Thursday. This indicates bullish momentum is slightly fading and supports this correction thesis.

BTC/USDT daily chart

Another possibility is that BTC continues its upward momentum and closes above $95,000, potentially extending the rally to retest its next daily resistance at $97,000. In this case, the RSI may move toward its overbought level of 70 and remain above it.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.