Ripple Price Prediction: Is a breakout to $3 possible as XRP soars over 10% in a week?

- XRP bulls put effort into defending the $2.00 support as the crypto market recovers from tariff-triggered drawdowns.

- Whales embark on a fresh risk-on mode, scooping more XRP tokens ahead of a possible climb to $3.00.

- A MACD buy signal and an uptrending RSI reinforce the bullish momentum on Monday.

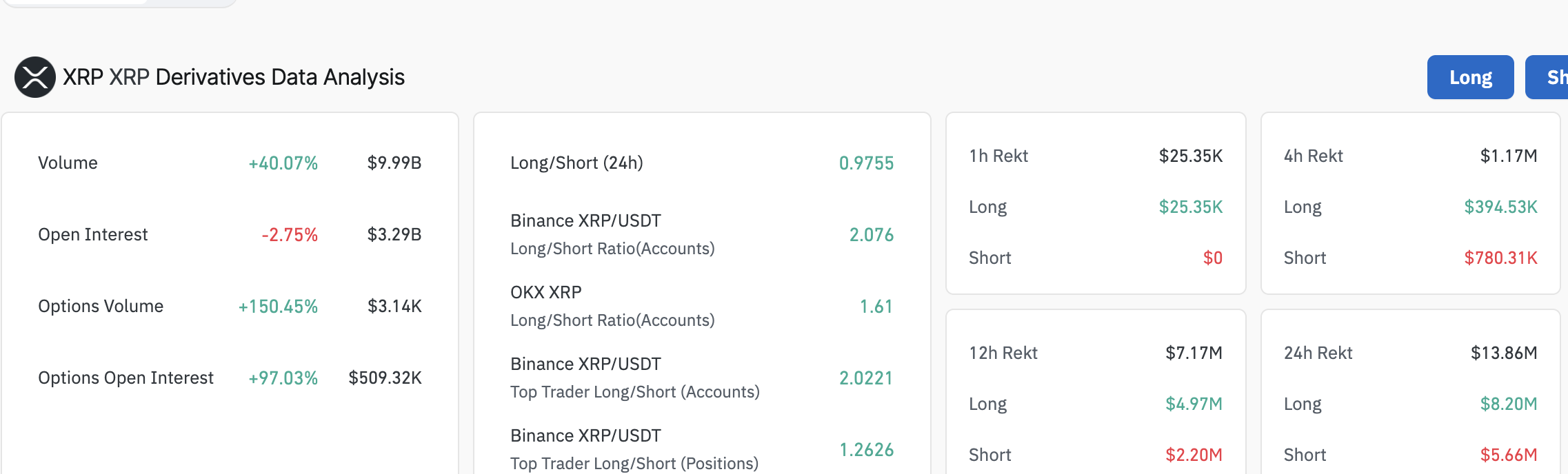

- A 2.75% drop in the derivatives' open interest calls for caution among traders and suggests potential downside risks.

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend after reclaiming support above $2.00 on Friday. Based on the current fundamentals and technical structure, XRP showcases immense potential to keep the uptrend intact, targeting key resistance levels at $2.75 and $3.00, respectively.

XRP whales go on a buying spree as risk-off sentiment fades

Global markets, including crypto, have suffered under heightened liquidity and sustained drawdowns since April 2, when United States (US) President Donald Trump announced reciprocal tariffs. Digital assets like Bitcoin (BTC), Ethereum (ETH), and XRP started recovering mid-last week, as President Trump changed his tune on tariffs, suspending the new policy for 90 days.

However, the President turned the tariff war a notch higher on China, levying the Asian economic giant a 145% duty on goods exported to the US. China, not relenting, retaliated with a 125% duty on United States goods, adding that it would fight to the end.

President Trump made another surprise move on Friday, exempting certain goods, including smartphones, computers, and devices like semiconductors, from his reciprocal tariffs, according to a CNBC article.

The cryptocurrency market continued to trade positively over the weekend despite President Trump clarifying that exemptions are not permanent. Moreover, he said goods will still attract the existing 20% fentanyl tariffs.

XRP whales responded positively to the tariff news from the middle of last week, increasing their holdings. Per Santiment's data, wallets with between 1 million and 10 million XRP have grown to hold 9.27% of the total supply. Similarly, addresses between 10 million and 100 million accounted for 11.61% of the total supply. These wallets' gradual but steady growth hints at rising risk appetite among the whales. If the uptake of XRP continues, bullish momentum could soar, lifting XRP price towards the $3.00 level.

XRP price on the cusp of a breakout

XRP holds between two key levels highlighted by the 200-day Exponential Moving Average (EMA) at $1.95 as support and the short-term confluence resistance showcased by the 50-day EMA and the 100-day EMA at $2.25.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator further affirms the bullish outlook. As the MACD recovers toward the mean line and histograms flip green, the path of the least resistance clears, targeting previously tested resistance levels at $2.75 and $3.00.

The Relative Strength Index (RSI) indicator, holding neutral at 49.95 while trending higher, upholds the bullish outlook. Traders could seek more exposure as the RSI steadies into the upper neutral half. Note that breaching the descending trendline resistance in the RSI indicator would further reinforce the bullish grip.

XRP/USD daily chart

On the other hand, traders must be cautious not to overexpose their capital, considering the drop in the derivatives’ Open Interest (OI) by 2.75% in the last 24 hours to $3.29 billion. A 40% drop in volume to $9.99 billion in the same timeframe could mean that existing positions are closed significantly, dampening bullish momentum.

XRP derivatives data | Source: Coinglass

Liquidations hit $13.86 million in the last 24 hours, with long positions being the hardest hit at $8.2 million amid $5.66 million in short positions. As the price increases, long position holders may choose to take profit, reducing their exposure. Moreover, a decline in OI suggests that traders lack the conviction to open new positions.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.