Crypto Today: SUI and Trump token in profit, BTC price fails $95K test amid rumours of lower China tariff

- Cryptocurrency market retraces below $3 trillion on Thursday, down 3.5% in 24 hours.

- Trump's softening stance on China tariffs has seen investors skim crypto profits to reinvest in recovering US stocks.

- SUI and the Official Trump token are the only top 50-ranked altcoins posting 24-hour gains, according to Coingecko data.

The cryptocurrency market capitalization dips below $3 trillion on Thursday, retreating 3.5% from the 50-day peak of $3.2 trillion recorded earlier this week. Macro news insights suggest that investors are rotating capital back towards United States (US) stocks as President Donald Trump softens his stance on China’s tariffs.

Bitcoin market update:

Bitcoin price continues to consolidate around the $93,000, having topped out at $94,300 on Thursday. The strong BTC price performance can be linked to unusual buying pressure from Bitcoin ETFs.

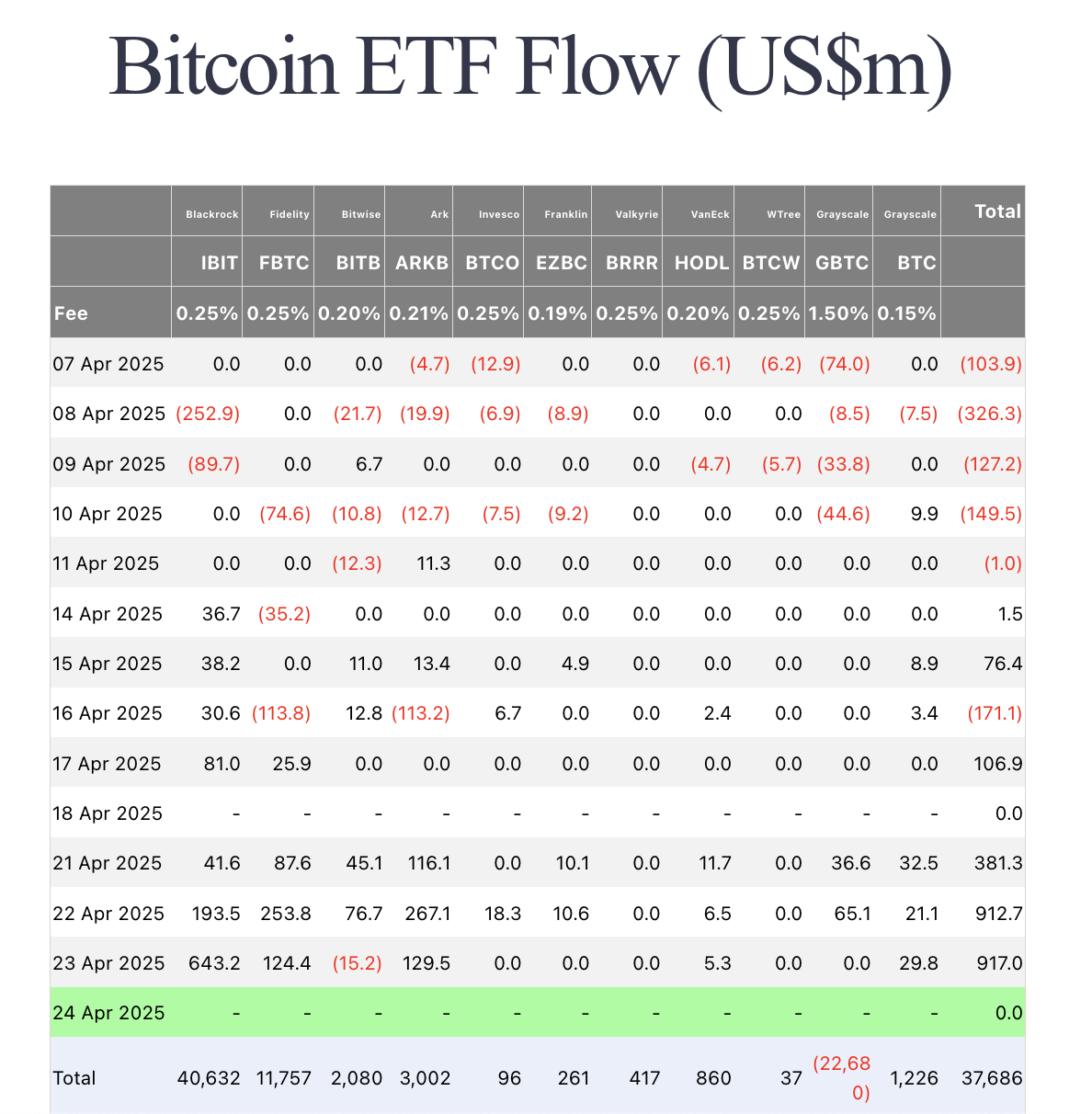

Chart of the day: Bitcoin ETFs set another single-day inflow record with $917M deposits

US spot Bitcoin ETFs recorded $917 million in net inflows on Wednesday, according to Farside, pushing the three-day total above $1.4 billion.

Notably, the $917 million inflows on Wednesday marginally exceeded the previous record of $912 million recorded just 24 hours earlier.

Bitcoin ETF flows as of April 23, 2025 | Farside

But with Trump now softening his stance on trade tariffs, official sources suggest the US and China are nearing a deal to slash current tariffs by up to 50%.

With market confidence returning to the US stock market, demand for BTC among the US-based corporate holders of Bitcoin ETFs could drop off from the current unusual peaks.

If this scenario plays out, Bitcoin price could struggle to break above the $95,000 mark, without an additional bullish market catalyst.

Altcoin market updates: Only SUI and Trump token retain profits as market sentiment shifts

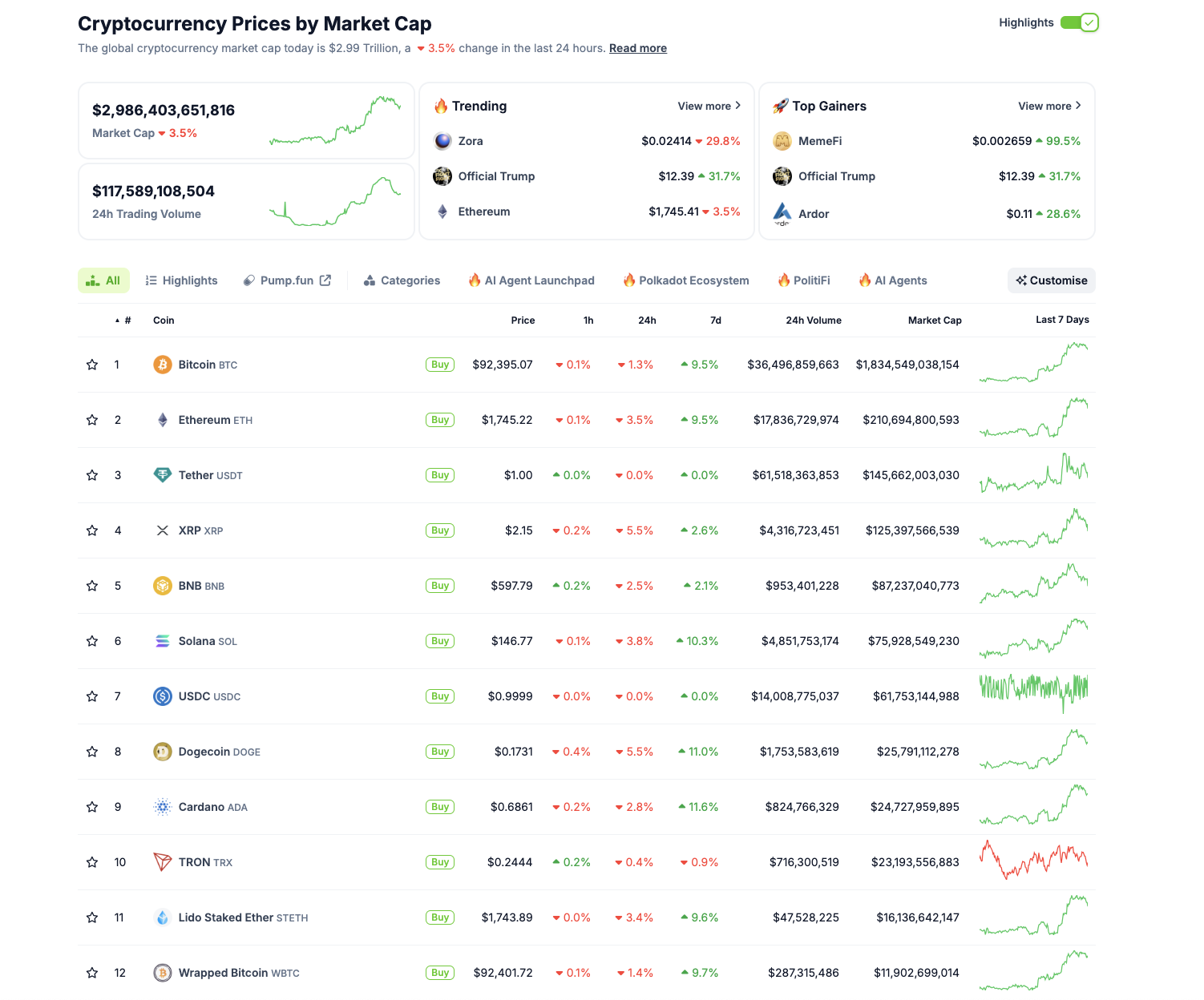

The global cryptocurrency market cap dropped by 3.5% over the past 24 hours to $2.99 trillion, signaling a sentiment reversal after a multi-week rally.

Crypto market performance | Source: Coingecko

Among the few altcoins defying the market correction, the Official Trump token posted a staggering 31.7% gain in 24 hours, trading at $12.39. Meanwhile, SUI remains in positive territory with 3% gains on the day.

While Bitcoin ($92,395, -1.3%) and Ethereum ($1,745, -3.5%) remain dominant in market cap, directional flows show capital rotation into stable assets.

As seen on CoinGecko, USDT and USDC have held steady at $1.00 and $0.9999, respectively, with rising trading volumes reflecting a flight to safety as traders digest shifting macro narratives.

Crypto news updates:

FBI: Seniors lost $2.8B to crypto fraud as total hits $9.3B in 2024

Crypto-related fraud in the US surged to over $9.3 billion in 2024, a 66% increase from 2023, according to the FBI’s Internet Crime Complaint Center.

The report reveals that seniors aged 60 and older bore the brunt of these losses, accounting for $2.8 billion—nearly 30% of the total—despite representing only 17% of the population.

The FBI attributed the disproportionate impact on older Americans to crypto ATM schemes and investment scams. Victims in this age group reported average losses of $83,000, more than four times the average for other online crimes.

RockawayX raises $125M fund to back Solana startups amid VC slowdown

RockawayX has closed a $125 million fund to invest in early-stage startups building on the Solana blockchain. The fund was finalized in Q1 2025 and marks the firm's second early-stage vehicle, following a successful 2021 fund that delivered over 2x returns to investors.

Despite a steep decline in crypto venture capital in recent years, RockawayX continues to bet on Solana’s long-term ecosystem growth.

The firm plans to deploy the new capital across seed investments and liquid strategies, while also launching a Solana-focused accelerator in Dubai. RockawayX manages around $2 billion in assets and operates from offices in Prague, Dubai, and London.

ZKsync recovers $5M in stolen tokens after hacker accepts 10% bounty

ZK Nation has recovered around $5 million in stolen tokens linked to the ZKsync protocol following a 10% bounty arrangement.

The hacker returned the funds after accepting the Security Council’s offer, ending the dispute without further incident.

The recovered assets, now valued at approximately $5.66 million, remain in custody pending governance decisions.

ZKsync confirmed that user funds were never at risk during the incident and that there is no ongoing threat to the protocol’s security.