Ripple agrees to drop cross-appeal against SEC, XRP's price remains muted

- Ripple CLO announced the company would drop its cross-appeal against the SEC.

- The SEC will keep $50 million of the original $125 million fine and ask Judge Analisa Torres to remove the injunction she placed on Ripple.

- XRP could fall to $1.96 if it declines below $2.34.

Ripple confirmed on Tuesday that it will no longer pursue its cross-appeal against the United States (US) Securities and Exchange Commission (SEC). XRP's price remained fairly muted despite the positive development.

Ripple to drop cross-appeal against SEC

Ripple has agreed to drop its cross-appeal against the SEC, bringing its case with the agency to a conclusion.

According to Ripple's chief legal officer Stuart Alderoty, the SEC will keep $50 million of the original $125 million fine from Judge Analisa Torres and return the balance to Ripple. He also highlighted that the agency will ask Judge Torres to lift the injunction she placed on Ripple last August.

Immediately after the Commission votes on it and the court processes are finalized, the more than four-year battle between Ripple and SEC will be officially over.

The new development follows Ripple CEO Brad Garlinghouse's earlier announcement last week that the SEC will drop its appeal against the company. The agency has reversed most of its actions against crypto companies since former Chair Gary Gensler resigned in January.

Judge Torres ruled at the district appellate court in July 2023 that XRP sales to retail investors do not fall under securities laws except sales to institutional investors. In August 2024, she placed a $125 million fine on Ripple — below the SEC's request of $1.9 billion — and imposed an injunction that prevented the company from selling XRP to institutions without registering the transaction as securities.

"The Ripple case was a high-stakes test of the SEC's ability to regulate crypto through enforcement, and its retreat may indicate growing recognition that clear legislation, rather than lawsuits, is the way forward," Bitget's COO Vuga Zade told FXStreet.

Despite the positive developments surrounding the case, XRP's price has remained flat on average in the past few days.

"The market reaction to Ripple's win has been muted. The case has been ongoing since 2020, and its resolution was largely priced in," said Agne Linge, Head of Growth at WeFi.

XRP risks decline to $1.96 if 50-day SMA resistance holds firm

XRP saw $4.43 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $3.44 million and $0.9 million, respectively.

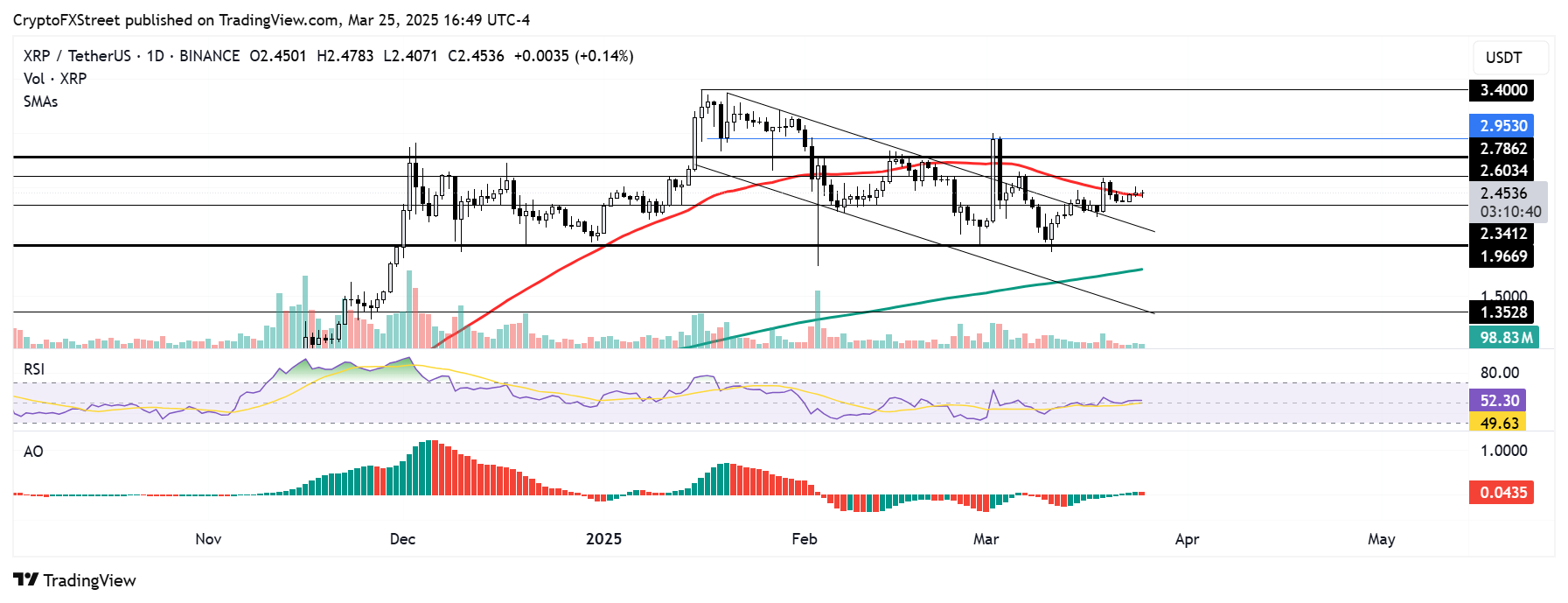

XRP has been consolidating since bouncing off the upper boundary of a descending channel last Wednesday. The remittance-based token rallied briefly upon the announcement of the SEC dropping its appeal against Ripple before seeing a rejection at $2.60. It found support at $2.34 but has struggled just below the 50-day Simple Moving Average (SMA).

XRP/USDT daily chart

XRP could fall to $1.96 if it declines below the $2.34 support and the descending channel's upper boundary. However, a firm move above the 50-day SMA and $2.78 level could see XRP tackle its seven-year high resistance of $3.40.

The Relative Strength Index (RSI) is testing its neutral level, while the Awesome Oscillator (AO) has posted a red bar above its midline, indicating weakening bullish sentiment.

A daily candlestick close below $1.96 will invalidate the thesis and potentially send XRP toward $1.35.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.