Ripple's XRP futures show increased bearish trends despite long-term holders seeing strong gains

- XRP open interest and funding rates have remained largely negative in recent weeks.

- Investors remained calm despite the high bearish sentiment in the futures market, likely due to their large profits.

- XRP could flip to a bullish momentum if it holds firm the upper boundary of a descending channel.

Ripple's XRP declined by 1% on Tuesday, as on-chain and futures data reveal the impact of the recent market downturn on its investors.

XRP's high-profit ratio has helped dilute its price decline

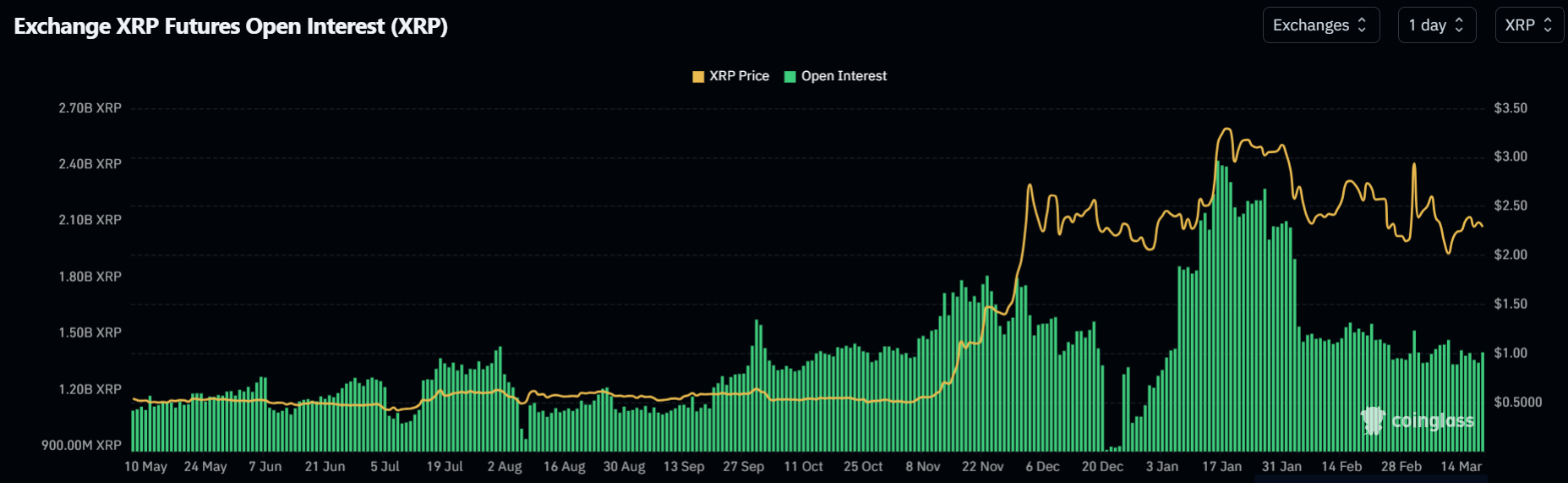

XRP futures open interest (OI) has remained largely flat since the market crash in early February. The remittance-based token has shed 33% of its OI between February 1 and March 18, per Coinglass data.

Open interest is the total amount of outstanding contracts in a derivatives market. A decline in OI signifies dominant risk-off sentiment among traders.

XRP open interest. Source: Coinglass

Also, XRP funding rates have mostly been negative in recent weeks, indicating that most traders are opening short positions following the wider crypto market's consolidation.

Funding rates are periodic payments between traders holding long and short positions to keep the price of perpetual futures contracts on par with the underlying asset they track.

Despite XRP's derivatives market indicating heightened bearish sentiment, its price decline has been low compared to most top crypto assets. While Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) are down on the weekly timeframe, XRP managed to pull a 3% gain.

A potential reason for the low price decline is that XRP investors — especially long-term holders (LTH) — are still up on their investments by an average of 233%, per Santiment data.

The Dormant Circulation metric, which measures the movement of previously idle tokens, shows that most of XRP's recent distribution comes from coins that are 1 year old and lesser.

[03.57.14, 19 Mar, 2025]-638779498505437550.png)

XRP dormant circulation. Source: Santiment

Meanwhile, the conclusion of SEC vs Ripple's legal battle could be the catalyst to switch XRP toward a bullish momentum following reports of both parties nearing an agreement.

XRP battles to hold key support level

XRP sustained $7.40 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $5.15 million and $2.25 million, respectively.

The remittance-based token is struggling to hold the upper boundary of a descending channel since breaking above it over the weekend. It is retesting the channel's upper boundary support for a third consecutive day.

XRP/USDT daily chart

If XRP holds the descending channel's upper boundary, the next key resistance is $2.72. A move above $2.72 could send XRP to tackle its seven-year high.

The Relative Strength Index (RSI), Stochastic Oscillator (Stoch) and Moving Average Convergence Divergence (MACD) are testing their neutral levels. A firm crossover above their neutral levels will indicate a switch toward dominant bullish momentum and potentially boost XRP's price.

A daily candlestick close below the support near the $2.00 psychological level will invalidate the thesis and send XRP toward $1.35.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.