Crypto market lost $440 million in market cap despite regulation and BTC reserve clarity

- The overall crypto market capitalization lost over $440 million last week.

- The reaction to Trump’s announcement of the Strategic Bitcoin Reserve wasn’t what many expected.

- Donald Trump acknowledged that the economy could see short-term pain from his policies.

The overall crypto market capitalization lost over $440 million last week; on Monday, it reads $2.66 trillion. The reaction to Trump’s announcement of the Strategic Bitcoin Reserve wasn’t what many expected as the market continued to correct. Moreover, in a Fox News appearance on Sunday, Donald Trump acknowledged that the economy could see short-term pain from his policies.

Total crypto market capitalization dipped to $2.61 trillion

Last week, the crypto market continued its downtrend and crashed from Monday’s open at $3.11 trillion to Sunday’s close at $2.61 trillion, losing $440 million in market cap.

Total crypto market capitalization chart

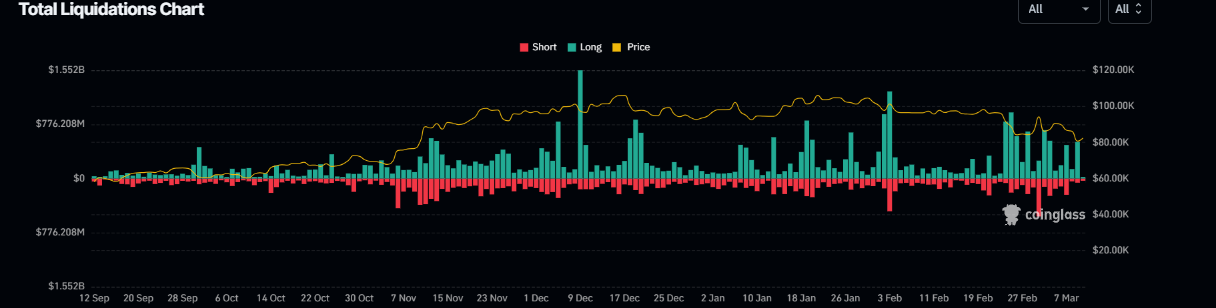

This downturn triggered a wave of liquidation, wiping out $3.64 billion in total liquidation, according to Coinglass data.

Total liquidation chart. Source: Coinglass

Multiple events fueled this market crash as major coins like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Solana (SOL) faced a double-digit decline last week.

President Donald Trump’s heated Oval Office exchange with Ukrainian President Zelenskyy and the potential for new US tariffs added even more uncertainty. The White House crypto summit and the announcement of a US Bitcoin reserve sparked a reaction that defied widespread expectations.

In an exclusive interview, Ian Balina, founder and CEO of Token Metrics, told FXstreet, “The announcement about the Strategic Bitcoin Reserve is not what the market was hoping for. Many expected the Reserve to buy new Bitcoin, but instead, they stated they would not sell any of their existing Bitcoin or confiscated Bitcoin. While this is a positive move, it caused a sharp decline in Bitcoin’s price. Moreover, our market indicator for Bitcoin remains firmly bearish and has not shifted to a bullish stance despite this latest news.”

In a Fox News appearance on Sunday, Donald Trump acknowledged that the economy could see short-term pain from his policies.

“If you look at China, they have a 100-year perspective … we go by quarters,” Trump continued. “What we’re doing is building a foundation for the future.”