Bitcoin Price Forecast: BTC expects volatility around White House Crypto summit

- Bitcoin price hovers around $87,600 on Wednesday after finding support around $85,000 the previous day.

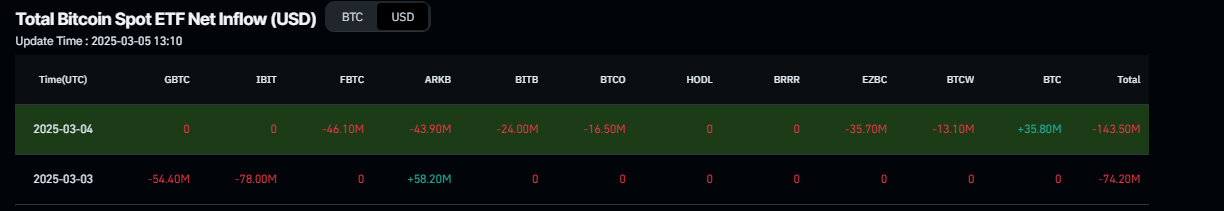

- US Bitcoin spot ETFs continued their outflows this week, totaling $217.7 million until Tuesday.

- The upcoming White House Crypto Summit on Friday could bring volatility to BTC.

Bitcoin (BTC) price hovers around $87,600 on Wednesday after finding support around $85,000 the previous day. US spot Exchange Traded Funds (ETFs) continued their outflows this week, totaling $217.7 million until Tuesday and signaling institutional demand weakness. Traders should be cautious as the upcoming first-ever White House Crypto Summit on Friday could bring volatility to BTC.

Bitcoin investors await first-ever ‘White House Crypto’ summit

Bitcoin price hovers around $87,600 on Wednesday after erasing its weekend gains at the start of the week. Bitcoin gained almost 12% during the weekend as US President Donald Trump announced the ‘Crypto Strategic Reserve’ on his Truth Social platform. However, the brief crypto rally following Trump’s announcement was swiftly erased as it has become nothing more than a short-term “buy the rumor, sell the news” event.

Apart from this pump-and-dump scenario, Bitcoin investors await the first-ever White House Crypto Summit on Friday, which aims to discuss regulation and innovation in the cryptocurrency sector. This summit indicates a significant milestone in US digital asset policy, highlighting the government’s supportive crypto approach and commitment to establishing clear regulations, which President Trump promised during his campaign.

The event will unite key industry leaders — founders, CEOs, investors, and the US President’s Working Group on Digital Assets — to explore how regulation and innovation can shape the cryptocurrency market’s future.

The summit will be chaired by White House AI and Crypto Czar David Sacks and administrated by Working Group’s Executive Director Bo Hines. The summit’s goals remain unconfirmed, as do its potential impacts on the crypto market. With high speculation, traders should exercise caution, as such events often trigger volatility and potential liquidations.

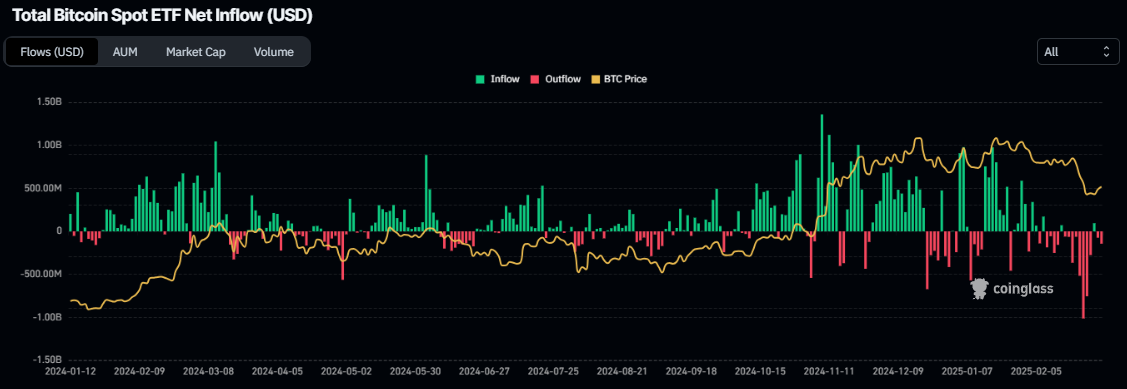

Bitcoin institutional demand continues to weaken

Bitcoin’s institutional demand continues to weaken as the week begins. According to Coinglass, Bitcoin spot Exchange Traded Funds (ETF) recorded a second day of outflows this week, totaling $217.7 million until Tuesday, after net outflows of $2.39 billion the previous week. If the magnitude of the outflow continues and intensifies, the Bitcoin price could see further corrections.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

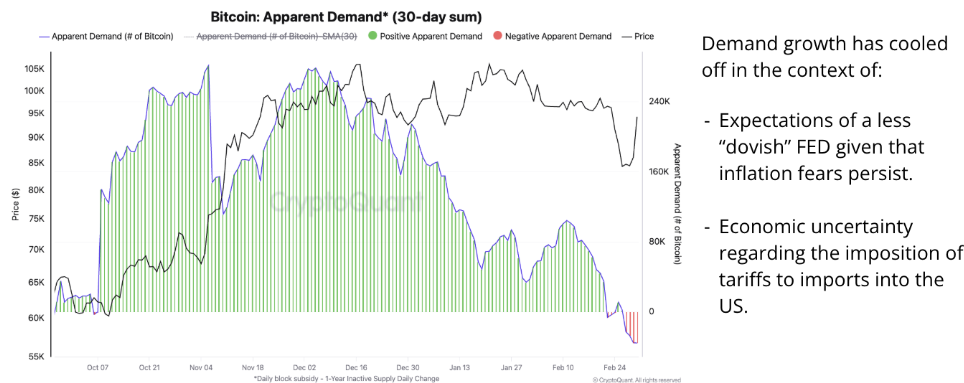

CryptoQuant’s weekly report also shows that Bitcoin’s apparent demand growth has declined after a period of acceleration in November–December 2024 — spurred by the US presidential election results — and is now in contraction territory for the first time since September 2024. Unless Bitcoin demand recovers, sustaining a rally in crypto prices will be difficult.

Bitcoin Apparent Demand (30-day sum) chart. Source: CryptoQuant

Some signs of optimism

Bitcoin shows some optimism as Japanese investment firm Metaplanet announced on Wednesday that it had bought another 497 BTC worth $44 million, which led to an 18% rally in its stock price. The company holds 2,888 BTC worth $251.18 million, with an average buying price of $84,325, according to Lookonchain data.

Moreover, El Salvador President Nayib Bukele dismissed terms laid out by the IMF to secure a $1.4 billion loan agreement and wrote on his social media platform, X.

“This all stops in April.” “This all stops in June.” “This all stops in December.” No, it’s not stopping.”

Bukele continued, “If it didn’t stop when the world ostracized us and most ‘bitcoiners’ abandoned us, it won’t stop now, and it won’t stop in the future.”

Bitcoin Price Forecast: BTC could recover if the $85,000 support level holds

Bitcoin price faced rejection around the $95,000 level on Sunday and declined 8.54% the next day. However, on Tuesday, BTC dipped below the daily support level at $85,000 but bounced and closed above it. This daily level roughly coincides with the 200-day Exponential Moving Average (EMA) at $85,760, making it a key support zone. At the time of writing on Wednesday, BTC trades slightly above at around $87,600.

If the $85,000 level holds as support, BTC could extend the recovery to retest its Sunday high of $95,000.

The Relative Strength Index (RSI) reads 41 and points upwards toward its neutral level of 50, indicating fading bearish momentum. The RSI must move above its neutral level to initiate a bullish momentum. Such a development would add a tailwind to the recovery rally.

BTC/USDT daily chart

However, if BTC breaks and closes below $85,000, it could extend the decline to retest its next support level at $73,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.