Global markets feel the heat from Nvidia’s crash and Trump’s tariffs

AI giant Nvidia’s stock plunged by 8.5%, leaving Apple as the only $3 trillion company, according to data from Google Finance, which also shows that Nvidia had $273 billion erased from its market cap yesterday after reporting some pretty impressive earnings on Wednesday.

On top of that, US president Donald Trump confirmed on Thursday that his administration will move forward with tariffs on Canada and Mexico, while also threatening a 25% tax on the European Union and 10% more on China.

In a post on Truth Social yesterday, Trump said, “Drugs are still pouring into our Country from Mexico and Canada at very high and unacceptable levels. We cannot allow this scourge to continue to harm the USA, and therefore, until it stops, or is seriously limited, the proposed TARIFFS scheduled to go into effect on MARCH FOURTH will, indeed, go into effect, as scheduled. China will likewise be charged an additional 10% Tariff on that date. The April Second Reciprocal Tariff date will remain in full force and effect. Thank you for your attention to this matter. GOD BLESS AMERICA!”

Investors are watching the fallout as major indexes plunge, jobless claims rise, and Bitcoin sinks to a three-month low.

The S&P 500 fell 1.59% to 5,861.57, while the Nasdaq dropped 2.78% to 18,544.42. The Dow Jones lost 193.62 points, closing at 43,239.50, per data from Google Finance.

Nvidia stock has now lost 10% of its value so far in 2025 as investors worry about export controls, AI competition, and just overall weakening growth.

And things could get worse. Most of Nvidia’s AI chips are manufactured by TSMC in Taiwan, and Trump has already made it clear that he believes Taiwan “stole” the US chip business. The president has repeatedly mentioned tariffs on Taiwanese chips, and if that happens, Nvidia could face even deeper losses.

While stocks took a hit, jobless claims soared. The latest report from the Labor Department showed that 242,000 Americans filed for unemployment benefits last week, a surge of 22,000 from the week before and higher than the expected 225,000, which is the highest number of jobless claims since early October.

At the same time, many key indicators (like the PCE and PPI) show that the economy is weakening. Consumer confidence is slipping, retail sales have disappointed, and consumer sentiment is at its lowest level in months.

Big Tech layoffs are piling up too, as Google, Meta, and Microsoft all announced job cuts this month, though we can’t really say if that’s directly tied to tariffs.

But from an economic perspective, higher import costs could worsen corporate spending, leading to even more job cuts in the coming months.

Meanwhile, China is watching, and its offshore yuan actually rose by 0.1% yesterday, but an index of Chinese stocks in Hong Kong fell 1%. Beijing is expected to counter Trump’s tariffs during the National People’s Congress on March 5.

Bitcoin crashes as investors pull out

Bitcoin just hit a three-month low, trading at $80,500 after dropping 3.45% in a single day. That’s nearly 25% below its all-time high in mid-December, per data from CoinGecko.

The irony here is that Trump was supposed to be a pro-crypto president. I mean, this guy called himself the ‘crypto president’ during the campaign so Bitcoin surged past $100k after he won the election.

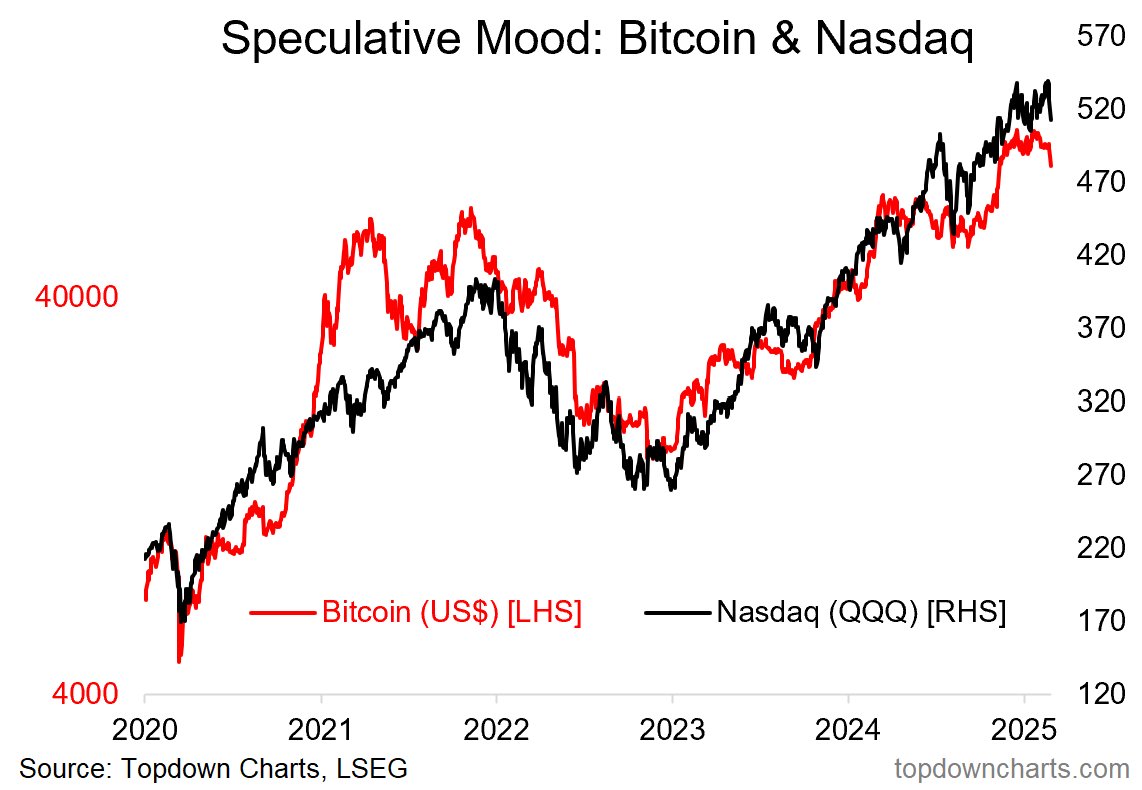

The total crypto market cap has dropped from $3.7 trillion to $2.8 trillion in the last five weeks. The reason is that Bitcoin is trading like a tech stock now, not a hedge against uncertainty, according to data from the LSEG.

Since 2023, Bitcoin’s correlation with the Nasdaq 100 has been nearly perfect, meaning when stocks crash, so does crypto.

The February crypto flash crash wiped out $760 billion in just 60 hours, showing how fragile the market is when liquidity dries up. And right now, capital is leaving crypto fast.

The US dollar is getting stronger, which means investors are treating it as the safest risky asset—not Bitcoin.

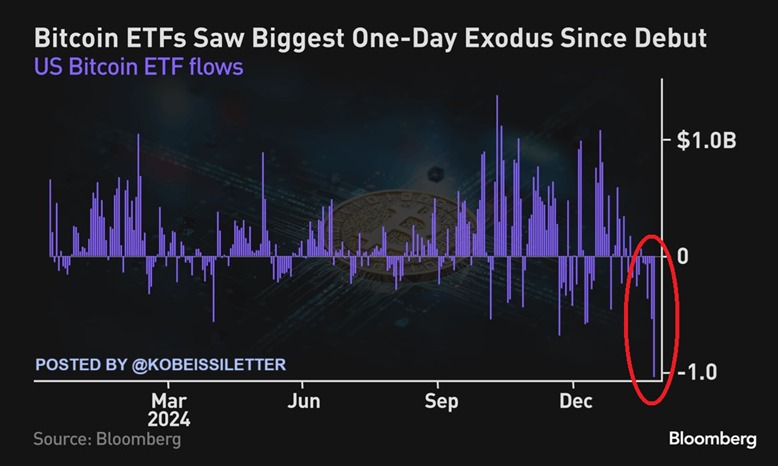

Bitcoin ETFs are getting hammered too as $2.1 billion has been pulled from them in the past six days, with a record-breaking $1 billion outflow on Thursday alone, which is the largest one-day withdrawal in Bitcoin ETF history according to Farside’s data.

Back in November, retail traders flooded into crypto after Trump’s victory, pumping billions into these ETFs day in and day out. Even Trump’s memecoin ($TRUMP) brought in millions of new investors, even if it ended up being a semi-scam.

But that optimism has clearly faded fast, as trade war fears are driving massive daily outflows, and when crypto traders panic, they all run for the exits at the same time. They’re sensitive and dramatic like that.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More