Bitcoin and Ethereum compete for DeFi liquidity, while Solana faces rug pulls

- Bitcoin and Ethereum aim to absorb Solana’s liquidity as the largest blockchain launches new Layer 2 solutions.

- Ethereum price hit a 12-day high this week, Solana observed a $772 million decline in liquidity.

- The meme coin frenzy faced high-profile rug pulls and controversies surrounding LIBRA and MELANIA meme tokens earlier this week.

Solana (SOL) is down over 40% from its peak of $295.83, trading to $172.98 on Thursday at the time of writing. The Ethereum competitor led Bitcoin bull market gains in 2024. However, recent developments have eclipsed the gains in the SOL ecosystem.

Ethereum hits 12-day high as Solana loses liquidity

Ethereum price hit a 12-day high of $2,849.50 this week, while Solana lost $772 million in liquidity. The two competitors have been neck and neck in terms of DEX metrics since the launch of Pump.fun, a meme coin launchpad on Solana.

This week the LIBRA and MELANIA controversy negatively impacted the meme coin category of tokens on Solana and wiped out millions in market capitalization from the chain. After months of underperforming compared to the largest cryptocurrency, Ethereum showed signs of recovery and likelihood of a rally this week, according to derivatives market data.

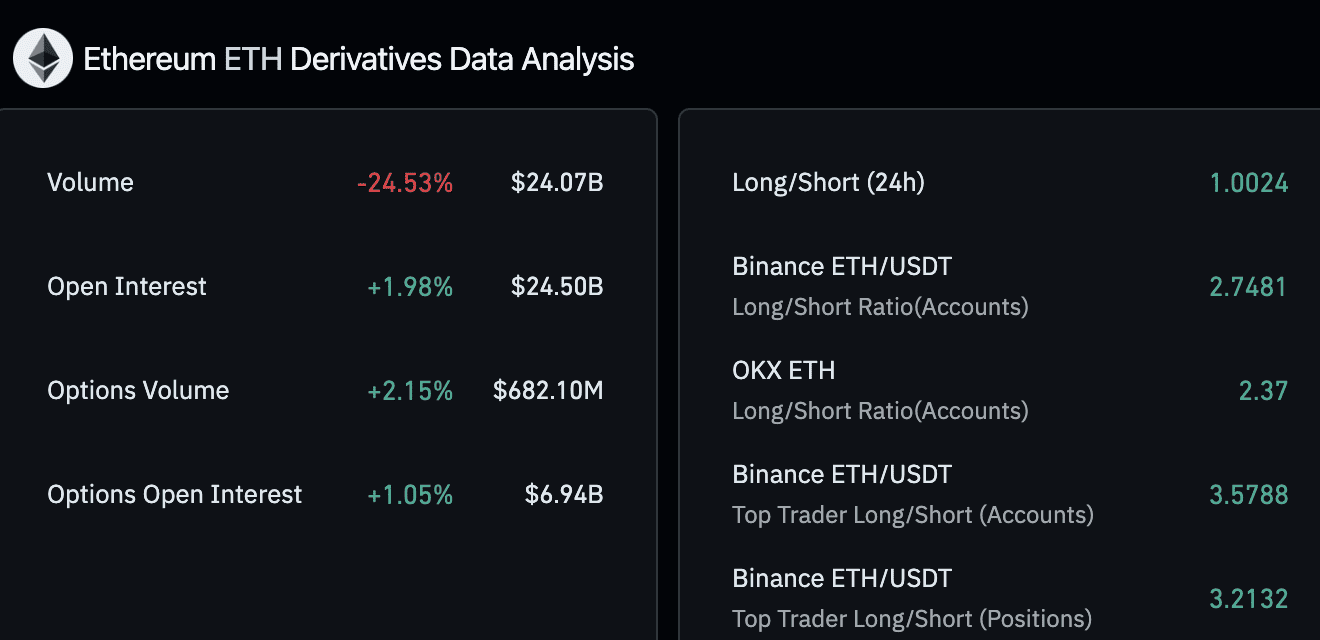

The 24-hour long/short ratio across derivatives exchanges exceeds 1, based on data from Coinglass. Derivatives traders are bullish on Ether and expect the altcoin’s price to rise on the Binance and OKX markets.

Ethereum derivatives data analysis | Source: Coinglass

While Bitcoin exchange-traded funds (ETFs) maintained their market lead, data shows that Ethereum ETFs recorded a rise in institutional adoption. In “The Institutional Crypto Newsletter” Coin Stack notes that institutional Ether ownership has increased QoQ and overall Ether ETF ownership climbed from 4.8% to 14.5%.

The latest 13F filings show that Ethereum ETFs have observed an increase in demand from institutions as well.

Institutional ownership of ETH ETFs increased QoQ, while BTC ETFs basically stayed the same:

— Juan Leon (@singularity7x) February 14, 2025

- ETH ETFs overall institutional ownership:

- Q3: 4.8%

- Q4: 14.5%

- BTC ETFs overall institutional ownership:

- Q3: 22.3%

- Q4: 21.5%

With the emergence of Layer 2 protocols on the Bitcoin blockchain, BTC has joined the race to absorb DeFi liquidity and demand. While DeFi was synonymous with Ethereum and its smart contract network for years, the emergence of Layer 2 chains that attempt to scale and tackle the low speed of transactions on the Ethereum blockchain could see the creation of a similar ecosystem on the BTC chain.

Expert commentary on meme coin developments, Bitcoin and Ethereum DeFi race

Dom Harz, co-founder of BOB ("Build on Bitcoin"), spoke about meme coins and the controversies that made headlines this week. Harz said,

“There’s no denying the broad appeal of meme coins, but after some high-profile issues, perhaps the memecoin frenzy has started to cool a bit. This week’s rug-pull accusation surrounding Argentinian President, Javier Milei’s $LIBRA token, along with earlier controversies like Donald Trump’s $TRUMP, $MELANIA and $BARRON and Hawk Tuah Girl’s $HAWK, may have done serious damage to the memecoin bullrun.

While memecoins will always be relevant for a section of the community, their dominance in mainstream media narratives and investor attention is fading. This has had a direct knock-on effect on Solana, as we see with the decrease in the chain’s liquidity.”

Ethereum’s price trend remains a cause of concern among traders expecting a better performance from the altcoin this cycle. Bitcoin’s Layer 2 chains and DeFi protocols on the chain could further intensify competition for liquidity and value captured by both chains.

Harz said:

“...Despite underwhelming performance in this bull run, Ethereum has maintained its reputation as the go-to chain for builders; because builders, like investors, follow opportunity. With the Pectra upgrade on the horizon, developers and investors may see the memecoin era winding down and refocus on Ethereum.

However, the real shift happening in crypto isn’t about Solana or Ethereum — it’s about Bitcoin. With innovations like BitVM and Bitcoin DeFi accelerating in 2025, the long-standing assumption that investors need to look beyond Bitcoin for DeFi opportunities is rapidly changing. The most exciting developments in the space are happening right now on Bitcoin, and this trend will only intensify as more builders, investors and institutions flock to crypto’s most secure and valuable asset.”