Ripple's XRP eyes a recovery as investors switch toward accumulation

- XRP investors have been accumulating following an uptrend in the Mean Coin Age metric.

- However, the XRP derivatives market is yet to recover from a 30% open interest decline in the past week.

- XRP eyes $2.55 but risks liquidating long positions worth over $80 million if it declines to $2.26.

Ripple's XRP is up 2% in the early Asian session on Thursday following rising accumulation among investors and a potential bottom signal in the MVRV Ratio.

XRP on-chain data indicate accumulation as derivatives trades stall

After the February 3 crypto market crash, XRP investors have largely switched towards accumulation in the past five days as buy-the-dip sentiment is becoming prevalent.

On-chain data shows that XRP has seen very minimal selling activity and more accumulation as indicated by an uptrend in Mean Coin Age metric. This metric shows the average number of days all XRP tokens remained in their current addresses. An uptrend signifies network-wide accumulation and vice versa for a downtrend.

[04.26.58, 13 Feb, 2025]-638750156741386753.png)

XRP Mean Coin Age. Source: Santiment

Also, the 30-day Market Value to Realized Value (MVRV) ratio is indicating a potential bottom after hitting -17% in the past week. The last time this metric saw such low levels, XRP rallied over 60%. If history repeats itself, XRP could see a rally in the coming days.

[04.26.43, 13 Feb, 2025]-638750157201606758.png)

XRP 30-day MVRV Ratio. Source: Santiment

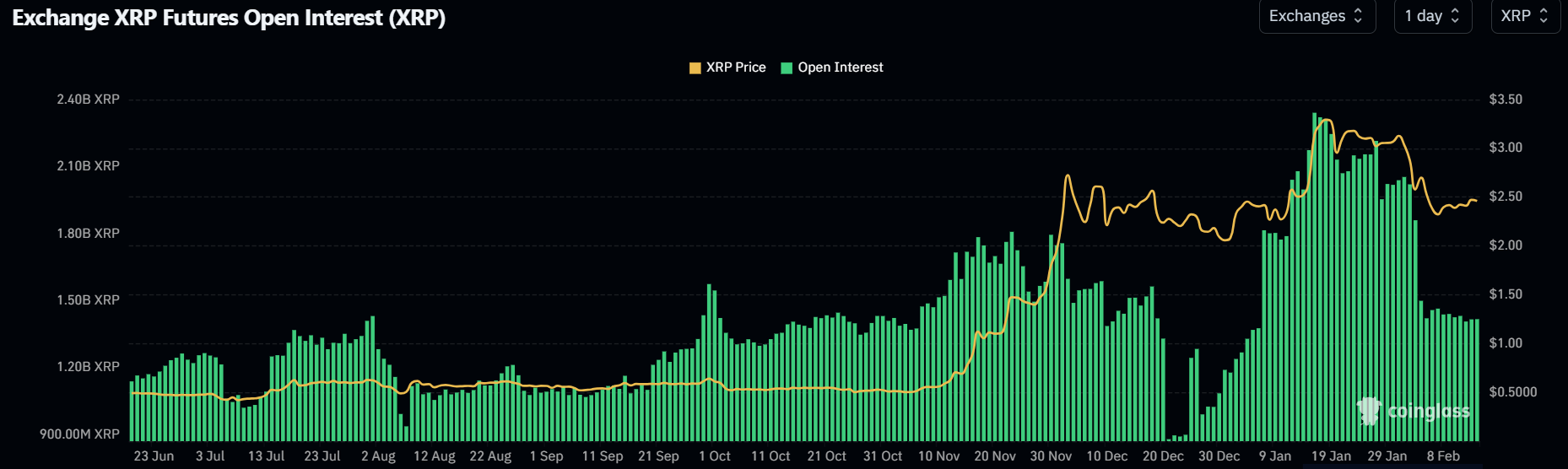

Despite signs of accumulation in the spot market, XRP's derivatives market shows traders are largely exercising caution. XRP's open interest has declined over 30% from 2.05 billion XRP to 1.42 billion XRP.

Open interest is the total amount of unsettled contracts in a derivatives market. XRP's OI needs to grow to help fuel a rally.

XRP Open Interest. Source: Coinglass

Meanwhile, the SEC acknowledged Grayscale's XRP ETF filing on Tuesday, following a 65% chance of approval placed on them by Bloomberg analysts Eric Balchunas and James Seyffart.

XRP eyes $2.55 but could spark an $80 million long squeeze if it declines toward $2.26

XRP saw $5.91 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $2.80 million and $3.11 million, respectively.

Since the February 2-3 market crash sparked by anticipation of a global trade war, XRP has been trading within a key rectangular channel marked by the $2.26 support level and the $2.55 resistance level. The current price trend signifies uncertainty among traders as the crash wiped out several long traders.

XRP/USDT 4-hour chart

However, if XRP moves above the $2.55 level and successfully overcomes the resistance near $2.72, it could incentivize a high volume of bullish bets to return to the market.

On the downside, if XRP breaches the $2.26 support, it could spark a more than $80 million long squeeze, per Coinglass data. In such a scenario, XRP could find support at $1.96.

The Relative Strength Index (RSI) and Stochastic Oscillator are above their neutral levels, indicating short-term bullish momentum.

A daily candlestick close below $1.96 will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.