Bitcoin Weekly Forecast: BTC holdings of large investors surges as Trump takes the Oval Office

- Bitcoin price trades in the green on Friday after hitting a new all-time high of $109,588 earlier in the week.

- CryptoQuant’s weekly report highlights that large investors’ demand for BTC surges as President Trump takes the Oval Office.

- Trump signed an executive order this week that includes working toward developing a national digital asset stockpile.

Bitcoin (BTC) trades in the green and hovers above $105,000 on Friday after hitting a new all-time high of $109,588 on Monday. CryptoQuant’s weekly report highlights that the demand for BTC from large investors surges as US President Donald Trump takes the Oval Office. Moreover, on Thursday, Trump signed an executive order that includes working toward developing a national digital asset stockpile. However, traders should remain cautious, as the upcoming Trump executive orders could bring volatility to the crypto space.

Bitcoin price hits new all-time high of $109,588 as Trump takes the Oval Office

Bitcoin price continues to trade in the green, rallying almost 4% this week and hovering above $105,000 on Friday after hitting a new all-time high (ATH) of $109,588 on Monday.

This week’s rally was mostly fueled by US President Donald Trump’s inauguration on Monday, which caused BTC to reach a fresh ATH hours before the event. However, BTC quickly slipped 6.68% from its top and closed at $102,260 that day.

Santiment’s data shows that social media has reached major greed and Fear Of Missing Out (FOMO) among Bitcoin traders. The chart below shows mentions on X, Reddit, Telegram, 4Chan, and Farcaster. Historically, prices move in the opposite direction of the crowd’s expectation, particularly in the short term.

In BTC’s case, the crowd's mention of higher prices on Monday suggested a selling signal. A similar move occurred in mid-December when the crowd's mention of higher prices led to a short-term fall in Bitcoin prices.

Bitcoin Social Volume chart. Source: Santiment

On Tuesday, BTC resumed its rally after bouncing off the $100,000 support level and rose 3.8%. This rally continuation was fueled by Michael Saylor’s post on X, which highlighted that MicroStrategy (MSTR) had acquired 11,000 BTC worth $1.1 billion at an average price of $101,191 per Bitcoin, and the firm currently holds 461,000 BTC for $29.3 billion, at an average price of $63,610 per BTC.

MicroStrategy has acquired 11,000 BTC for ~$1.1 billion at ~$101,191 per bitcoin and has achieved BTC Yield of 1.69% YTD 2025. As of 1/20/2025, we hodl 461,000 $BTC acquired for ~$29.3 billion at ~$63,610 per bitcoin. $MSTR https://t.co/SOgvMscghy

— Michael Saylor⚡️ (@saylor) January 21, 2025

During the same time, US President Donald Trump announced on Truth Social that he had unconditionally pardoned Ross Ulbricht, the founder of the dark web marketplace Silk Road. This news gave confidence to the crypto community as Trump followed through on his promise to the crypto industry as US president.

However, BTC failed to sustain the upward momentum and declined slightly on Wednesday, falling 2.3%, as the US Dollar (USD) strengthened after President Trump threatened 25% tariff hikes on Canada and Mexico and 10% on China, which will come into effect on February 1. He also plans to impose tariffs on Europe after stating that the European Union would have to “pay a big price” for not buying enough American exports during his electoral campaign. Additionally, Trump threatened to impose “high levels” of sanctions on Russia and tariffs on imports from there if President Vladimir Putin did not reach a settlement to end its war against Ukraine, per CNBC.

On Thursday, BTC hovered around $103,900 as the US weekly Initial Jobless Claims data came in at 223K for the week ending January 17, a little higher than the forecasted value of 220K. This data could allow the US Federal Reserve (Fed) to keep rates lower or around the same levels for longer, weakening the US Dollar (USD) and supporting risky assets such as stocks and Bitcoin.

Late Thursday, President Donald Trump signed an executive order to promote the advancement of cryptocurrencies in the US and to work toward potentially developing a national digital asset stockpile.

“The digital asset industry plays a crucial role in innovation and economic development in the United States, as well as our Nation’s international leadership.” states the order.

Trump's active participation and support for cryptocurrencies from the US government could create a bullish outlook for Bitcoin prices in the future.

Early Friday, US President Trump said in an interview that he “would rather not have to use tariffs on China” but called tariffs a "tremendous power," after he spoke to China's President Xi Jinping. BTC trades slightly above $105,000 at the time of writing.

Bitcoin’s large investors supported its price rise

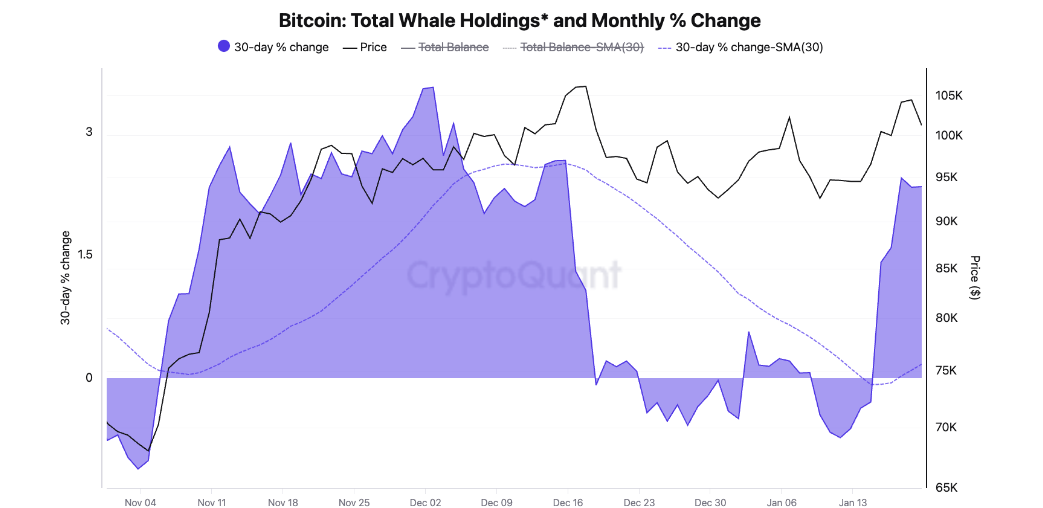

The CryptoQuant weekly report highlights that the demand for BTC from large investors surged as President Trump took the Oval Office.

According to the report, large investors have accumulated Bitcoin again ahead of President Trump’s inauguration. As shown in the graph below, the monthly percentage growth of the BTC holdings of large investors accelerated from -0.25% on January 14 to +2% on January 17, the highest monthly rate since mid-December.

“Large Bitcoin holders are a key driver of Bitcoin demand and price,” says a CryptoQuant analyst.

Bitcoin total whale holdings and monthly % change chart. Source: CryptoQuant

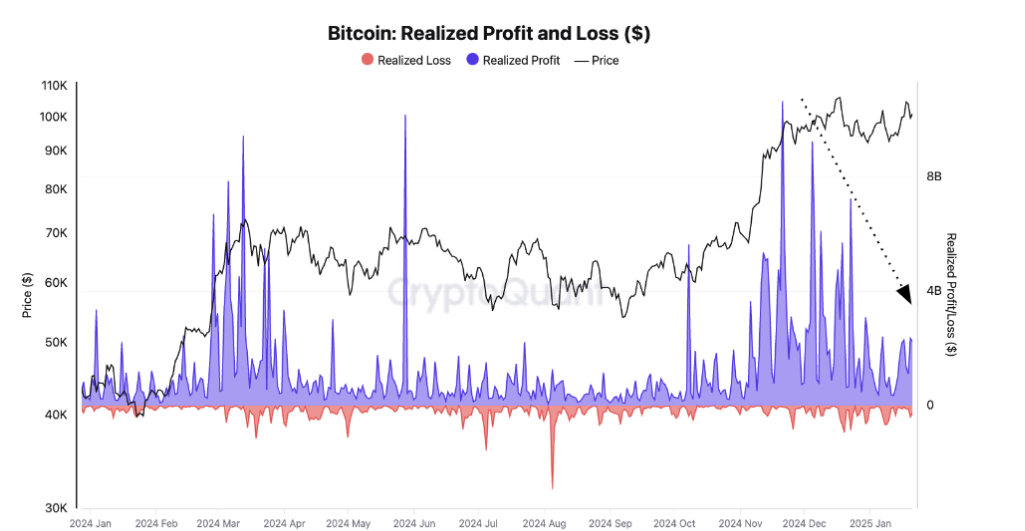

The report continued that BTC’s sell pressure may have declined sharply after holders realized profits in December. The Bitcoin realized profit and loss indicators show that holders realized daily profits as high as $10 billion as BTC approached $100K in December. However, daily realized profits fell to $2–$3 billion in January, indicating that market participants may have mostly finished selling Bitcoin.

Bitcoin realized profit and loss chart. Source: CryptoQuant

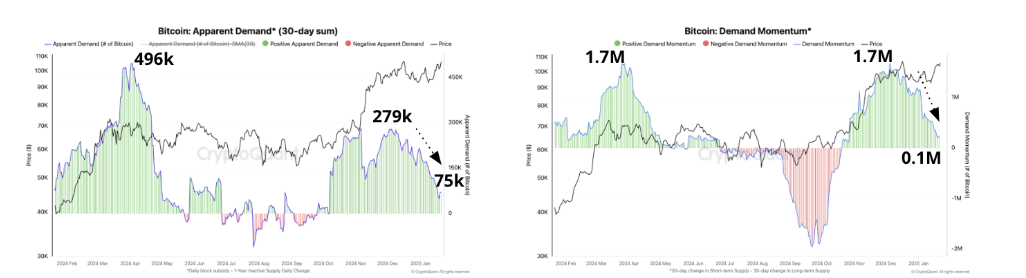

The report concluded that overall Bitcoin spot demand growth has slowed, and it’s yet to come back for prices to rally again. Bitcoin’s apparent demand has continued in expansion territory. However, the expansion rate has declined from 279K Bitcoin in early December 2024 to 75K this week. BTC’s demand growth must accelerate again for prices to rally significantly.

Bitcoin Apparent Demand (30-day sum) and demand momentum chart. Source: CryptoQuant

Bitcoin institutional demand holds strong

Institutional demand remained strong this week and supported Bitcoin’s rally. According to Coinglass, Bitcoin spot Exchange Traded Fund (ETF) data recorded a total net inflow of $1.24 billion until Thursday, after a $1.86 billion inflow last week. For Bitcoin’s price to continue its rally, the magnitude of the ETF inflow must intensify.

Bitcoin spot ETF net inflow chart. Source: Coinglass

In an exclusive interview with FXStreet, Ruslan Lienkha, chief of markets at YouHodler, said, “If Trump delivers on executive orders allowing banks to trade and hold crypto, banks would have the potential to become direct competitors to ETFs.”

Lienkha continued that if banks enter the market, they could offer safe and straightforward alternatives to ETFs, providing an equally simple mechanism for investing in crypto assets.

“While this development is positive for the broader cryptocurrency market, as it could drive additional capital inflows, it poses challenges for ETFs. With banks offering alternative investment options, retail investors would have more choices beyond ETFs for gaining crypto exposure, potentially impacting the demand for ETF products,” said Lienkha.

Bitcoin technical outlook: BTC bulls aim for $125K mark

Bitcoin price reached a new all-time high (ATH) of $109,588 at the start of this week on Monday but quickly slipped 6.68% and closed at $102,260. However, the next day, it found support around its key $100,000 level and rose 3.8%. On Wednesday, it could not sustain its rise and fell 2.3%, closing below $104,000. At the time of writing on Friday, it trades slightly higher, around $105,000.

If the $100,000 support level holds and BTC breaks above its all-time-high, it could extend the rally above the $125K mark, calculated by the 141.40% Fibonacci extension level (drawn from the November 4 low of $66,835 to Monday’s ATH of $109,588) at $127,287.

The Relative Strength Index (RSI) indicator on the daily chart reads 61, above its neutral level of 50, and points upwards, indicating bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator flipped a bullish crossover on January 15, giving a buy signal and suggesting a continuation of an uptrend.

BTC/USDT daily chart

However, if BTC faces a pullback and closes below $100,000, it could extend the decline to retest its next support level at $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.