Ripple's XRP rally fueled by growing institutional interest as SEC forms crypto task force

- XRP has maintained positive momentum following the SEC's launch of a crypto task force headed by Commissioner Hester Peirce.

- The crypto task force launch could help resolve the SEC's case against Ripple and allow the approval of XRP ETFs.

- XRP could stretch its massive uptrend to set a new all-time high above $3.55 as it develops a bullish flag pattern.

Ripple (XRP) is up 3% on Wednesday after the Securities and Exchange Commission (SEC) announced the formation of a new cryptocurrency task force. This task force is responsible for developing a more comprehensive framework for digital assets. In light of this announcement, asset managers have begun increasing their filings for an XRP exchange-traded fund (ETF).

XRP could get regulatory clarity from SEC crypto task force

With clearer crypto regulations on the way, the new SEC administration may be inclined to withdraw its case with Ripple. A notice from the SEC's website revealed that a closed-door meeting will be held with the new acting chairman of the commission on Thursday.

Among the matters to be discussed are the resolution of litigation claims and matters relating to enforcement proceedings. As a result, the case against Ripple could take center stage in the meeting.

The court battle, which lingered nearly four years under Gary Gensler's administration, could be dropped as part of the new reforms to the agency's regulatory oversight of the crypto industry.

Ripple's Chief Legal Officer (CLO) Stuart Alderoty shared his excitement about working with the SEC to create a clearer regulatory framework for crypto under acting chairman Mark Uyeda.

"Looking forward to working with the Crypto Task Force to undo the prior administration's damage," he stated in an X post on Tuesday.

Ripple executives are also trying to foster a close relationship with the Trump administration following a dinner with the President over two weeks ago.

Likewise, the crypto community highly anticipates a faster approval of spot XRP ETFs with the introduction of the crypto task force.

There are currently eleven XRP ETF filings from asset managers in the US, including ProShares, Bitwise, Canary Capital, WisdomTree, 21Shares, Rex/Osprey and Teucrium.

Meanwhile, XRP's exchange reserve across the three largest exchanges, Binance, Bithumb and Upbit, has been trending downward. Investors have withdrawn over 300 million XRP from these exchanges in the past two weeks for potential long-term holding.

-638731139878520804.png)

XRP Exchange Reserve (Upbit). Source: CryptoQuant

XRP eyes new all-time high as bullish flag develops

XRP sustained $6.91 million in futures in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions is worth $4.38 million and $2.53 million, respectively.

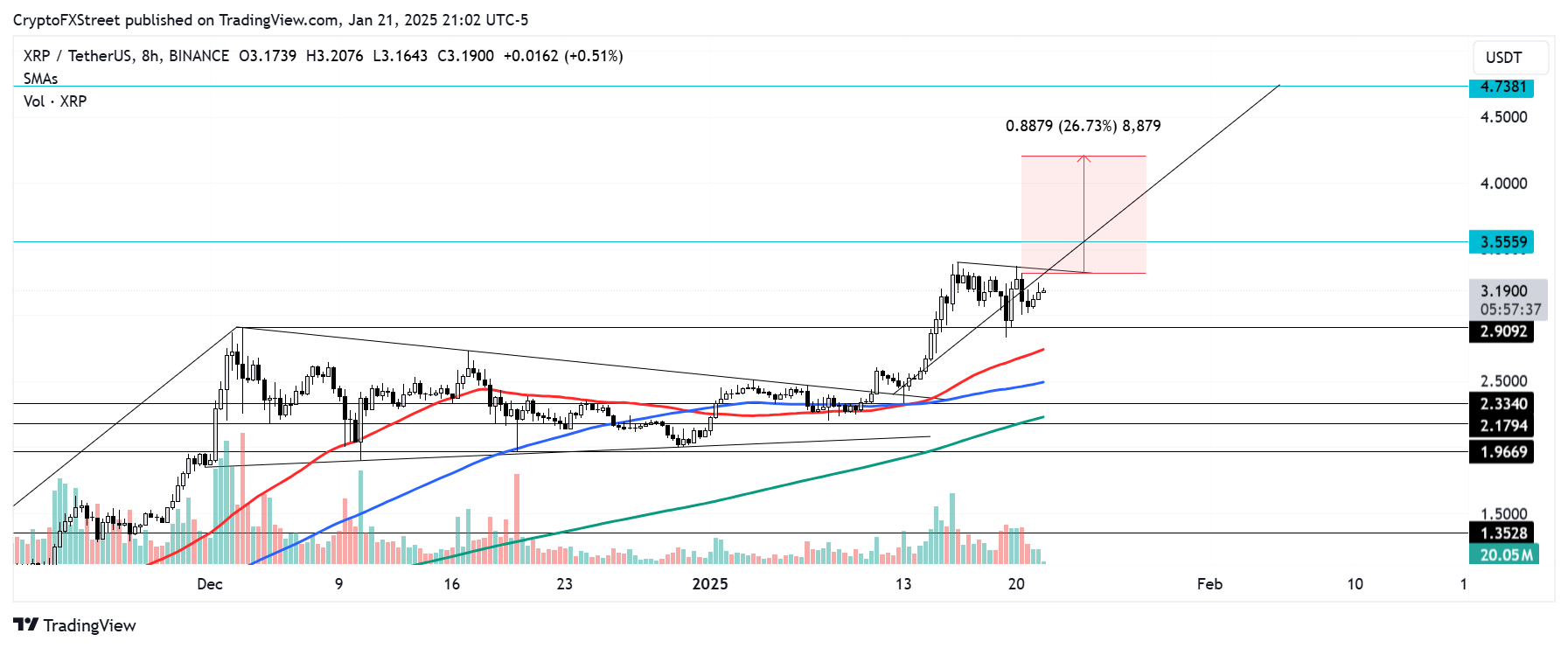

The remittance-based token is forming the flag of a potential bullish flag pattern with its consolidation between the $2.90 and $3.38 range.

Before its latest bullish flag pattern, XRP had previously validated a bullish pennant when it surged above the pennant's descending trendline resistance on January 11.

XRP/USDT 8-hour chart

Hence, if XRP clears the upper boundary resistance of the new developing flag with a high-volume move, it will signal the continuation of a massive uptrend that dates back to November. Such a move could help XRP establish a new all-time high above $3.55.

On the downside, XRP could find support at $2.90 if it sees a rejection at the flag's upper boundary resistance.

A daily candlestick close below $2.33 will invalidate the bullish thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.