Crypto Today: BTC, Solana, XRP set new $3.7T record on Trump inauguration

- The global crypto market capitalization grew by 2.4% on Monday, reaching a new all-time high of $3.7 trillion.

- Cumulative crypto market trading volume crossed the $640 billion mark for the first time since November.

- Bitcoin, Solana and XRP reached new all-time highs during the market frenzy fueled by Trump’s inauguration.

- TRUMP and MELANIA tokens hit unicorn status within hours post-launch, pulling capital away from legacy memecoins like DOGE, PEPE and SHIB.

Bitcoin Market Updates: Trump inauguration drives Bitcoin price to all time high

Bitcoin price reached a new all-time high above $109,000 on Monday, amid euphoric speculative trading surrounding Donald Trump’s Presidency.

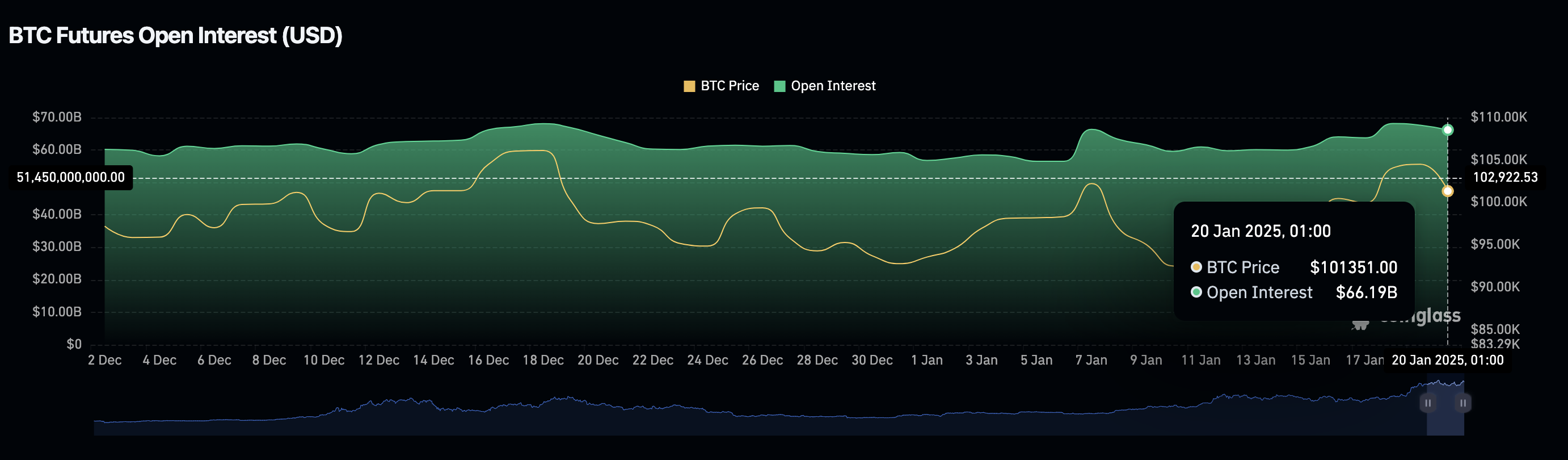

Bitcoin Open Interest vs. BTC Price | Source: Coinglass

Bitcoin Open Interest vs. BTC Price | Source: Coinglass

Bitcoin open interest declined by $2 billion, despite price climbing to all time highs, signalling that traders are reluctant to enter new positions around the current prices.

This could be an early signal of an imminent correction phase for BTC price.

Altcoin market updates: Vitalik announcement triggers Ethereum rebound as SOL and LINK emerge as top gainers

While Bitcoin prices hit record peaks on Monday, the altcoin markets endured intense volatility.

Amid fears of tariff announcements at the inauguration speech, many traders opted to lean towards Bitcoin, XRP, Solana and Chainlink, and newly-launched meme tokens TRUMP and MELANIA with close ties to Trump’s presidency.

TOTAL3 (Cryptocurrency market cap excluding BTC and ETH) | Source: TradingView

TOTAL3 (Cryptocurrency market cap excluding BTC and ETH) | Source: TradingView

TradingView’s TOTAL3 represents the global cryptocurrency market cap growth, excluding Bitcoin and Ethereum.

The chart above shows the altcoin market cap declined by 6% to hit $1.09 trillion on Monday, while top ranked assets BTC, XRP and SOL booked considerable gains over the last 24 hours.

This emphasizes that the majority of crypto investors leaned towards top-ranked layer 1 assets in a bid to hedge against the risk of adverse sell-offs in the aftermath of the Inauguration.

With the inauguration now concluded, early market signals suggest major downside risks ahead, with rising trading volumes over the past week hinting at oversupplied altcoin markets.

Key altcoin price movements today

- Ethereum price retakes $3,250 resistance

Ethereum (ETH) price saw a sharp rebound on Monday, climbing above the $3,250 level after co-founder Vitalik Buterin weighed in on community requests to halt further ETH sales to fund the Ethereum foundations operations. The mild ETH price rebound comes amid a period of declining demand and heightened market volatility, which had previously pushed Ethereum to a weekly low.

- TRUMP & MELANIA Token Performances

President Donald Trump launched the $TRUMP meme coin, which quickly garnered significant attention. Initially sold at $3 per coin, $TRUMP surged to an intraday high of $76.94, achieving a market capitalization of approximately $15 billion.

However, the subsequent release of First Lady Melania Trump's $MELANIA token, which peaked at $9.30, led to a sharp decline in $TRUMP's value.

This dynamic shift suggests that traders rapidly transitioned from $TRUMP to $MELANIA, resulting in both tokens retracing over 40% from their daily peaks.

Investors express concerns that the potential introduction of additional tokens could further dilute interest and impact valuations.

- XRP Surpasses $3, Reaching Seven-Year High

XRP's price surged past the $3 mark, reaching an intraday high of $3.34, a 16% increase over the past 24 hours.

This rally is attributed to declining U.S. core inflation, increasing expectations for Federal Reserve interest rate cuts, and anticipation of new spot exchange-traded funds (ETFs) that would directly own cryptocurrencies.

Additionally, positive developments in the SEC's legal case against Ripple have further boosted investor confidence in XRP.

- Solana Price Hits All-Time High as Trump Tokens Spark Residual Demand Frenzy

Solana (SOL) surged to a new all-time high, reaching $275 as the blockchain played host to the highly-publicized Trump-themed tokens, $TRUMP and $MELANIA.

The launch of these tokens sparked a wave of speculative demand, not only for the tokens themselves but also for the native SOL token.

While the network battled another outage, investors continued to flock towards SOL, as trading volumes on TRUMP and MELANIA tokens exceeded 20 billion combined over the last 24 hours.

This remarkable performance highlights SOL as a key asset to watch as Trump’s Presidency unfolds.

Chart of the day: Privacy Coins (PayFi) lead Crypto market performance as US Tiktok ban heightened surveillance fears

Privacy coins have emerged as the best-performing cryptocurrency sector in the crypto market amid rising concerns over digital surveillance.

Reports of a potential US TikTok ban, and potential tariff announcements sparked fears of heightened government surveillance, leading a surge in demand for privacy-preserving cryptocurrencies on the US Presidential Inauguration day.

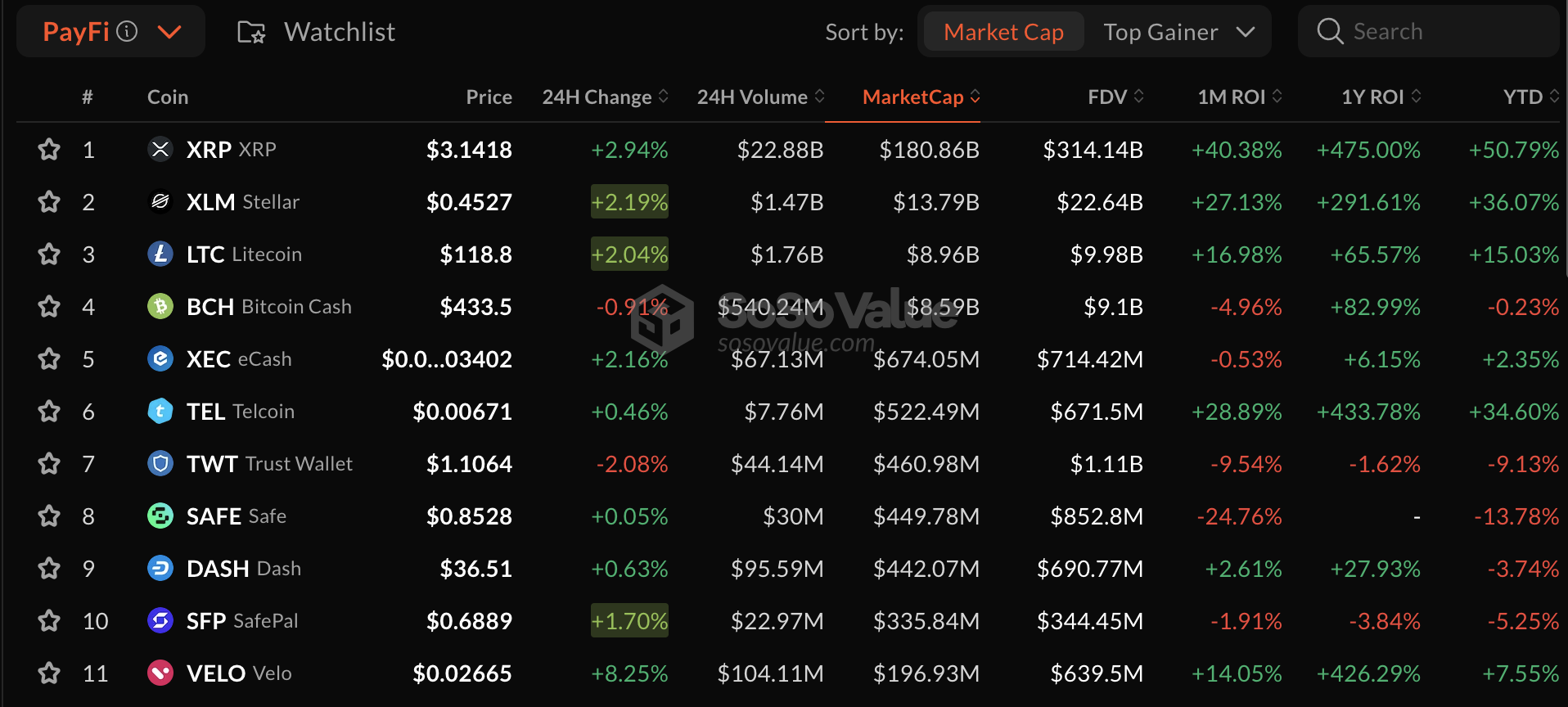

Privacy Coins (PayFi) Sector performance | Source: SosoValue

Privacy Coins (PayFi) Sector performance | Source: SosoValue

XRP and Stellar (XLM) demonstrated a synchronized price movement this week, trading higher due to their shared historical ties.

With XRP trading at $3.14, up 2.94% in 24 hours, and XLM rising 2.19% to $0.45, both tokens have benefited from overlapping investor interest.

This connection stems from the founding history of Stellar, created by a former Ripple executive, Jed McCaleb, which has often resulted in parallel trading patterns during market rallies.

The looming U.S. TikTok ban and speculation over new tariffs targeting China have stoked fears of rising surveillance and financial oversight.

As investors took on hedged positions ahead of Trump’s inauguration speech, the Privacy Coin sector increased by 5% to become the best-performing altcoin market sub-sector on

Monday. Prominent privacy coins Litecoin (LTC), Bitcoin Cash (BCH), Dash (DASH), and eCash (XEC), have historically witnessed heightened demand during periods of geopolitical scuffle and surveillance concerns.

Leading the charge this week, Litecoin (LTC) rose 2.04% in the last 24 hours to hit $118, further emphasizing its historical reputation as “digital silver”.

Similarly, Bitcoin Cash (BCH), often seen as a faster and more privacy-focused alternative to Bitcoin, traded at $433.50 despite a minor pullback.

Dash (DASH) and eCash (XEC) also exemplify the growing demand for privacy-preserving features. Dash gained 0.63% to $36.51, while XEC rose 2.16% to $0.00003402, capitalizing on their ability to offer anonymous and efficient transactions.

With the looming U.S. TikTok ban and speculation over new tariffs targeting China still hanging in the balance, these tokens could potentially sustain the increased market demand in the coming days.

Crypto News Updates: Mark Cuban Unveils Trump-Inspired Meme Coin to Reduce U.S. Debt

- Billionaire entrepreneur Mark Cuban has announced plans to launch a meme coin aimed at tackling the U.S. national debt.

Inspired by the $TRUMP token, Cuban's project will direct all revenue from coin sales to the U.S. Treasury.

Outlining the proposal on X, he pledged a 20% float and a release schedule identical to $TRUMP.

“If meme coins are the way, maybe I’ll issue one. Same terms as $TRUMP… one difference: All the revenue from the sale of the coins goes to the U.S. Treasury,”

Mark Cuban, January 20 2025.

While acknowledging the speculative nature of meme coins, Cuban framed the initiative as a transparent gamble to help reduce debt.

The proposal has sparked debate among crypto enthusiasts, with some raising concerns over investor risks and distribution challenges

- Caroline Pham Named Acting Chair of CFTC by Trump

President Donald Trump has appointed CFTC Commissioner Caroline Pham as the acting chair of the U.S. Commodity Futures Trading Commission (CFTC).

The agency members confirmed Pham’s appointment, citing her leadership in advancing digital asset regulations.

Pham previously spearheaded initiatives like the creation of a Digital Asset Markets subcommittee and proposed a regulatory framework to oversee the cryptocurrency sector.

- Gensler exits as Trump appoints Mark Uyeda as acting SEC chair

President Donald Trump has named Mark Uyeda, a Republican SEC commissioner, as acting chair of the Securities and Exchange Commission (SEC).

Uyeda replaces Gary Gensler, who served during the Biden administration.

Trump also announced plans to nominate former SEC Commissioner Paul Atkins as permanent chair, signaling a potential shift in the SEC's approach to digital assets.

Uyeda, alongside Commissioner Hester Peirce, has been an advocate for clearer crypto regulations and criticized Gensler’s enforcement-heavy strategy.

Uyeda and Peirce are reportedly preparing to introduce significant reforms to crypto policies, including revisiting contested issues like last year’s crypto accounting guidance that drew congressional criticism.

However, major policy changes may face challenges due to the SEC's current structure, with only three commissioners—Uyeda, Peirce, and Democrat Caroline Crenshaw. Under quorum rules, unanimous approval is required for new rulemaking, giving Crenshaw effective veto power over proposed reforms.