Crypto Today: BTC price plunges 4%, Litecoin X account hacked; traders position for US inflation report

- The cryptocurrency sector plunged by 5% on Monday, with over $148 billion wiped off the aggregate market capitalization.

- Bitcoin price dropped below $90,600 for the first time in 24 days, as traders anticipate the upcoming US CPI report.

- Litecoin’s X account was hacked to promote a scam “LTC” token hosted on the Solana network.

- Centralized Finance (CeFi) tokens emerged as the best-performing sector, recording the lowest daily losses at 4.2%.

Bitcoin Market Updates: BTC holds $94K as traders mount $1.04 billion support

Bitcoin (BTC) price sat precariously above the $94,600 mark at press time, having briefly plunged below $90,600 on Monday, its lowest since November 18, 2024.

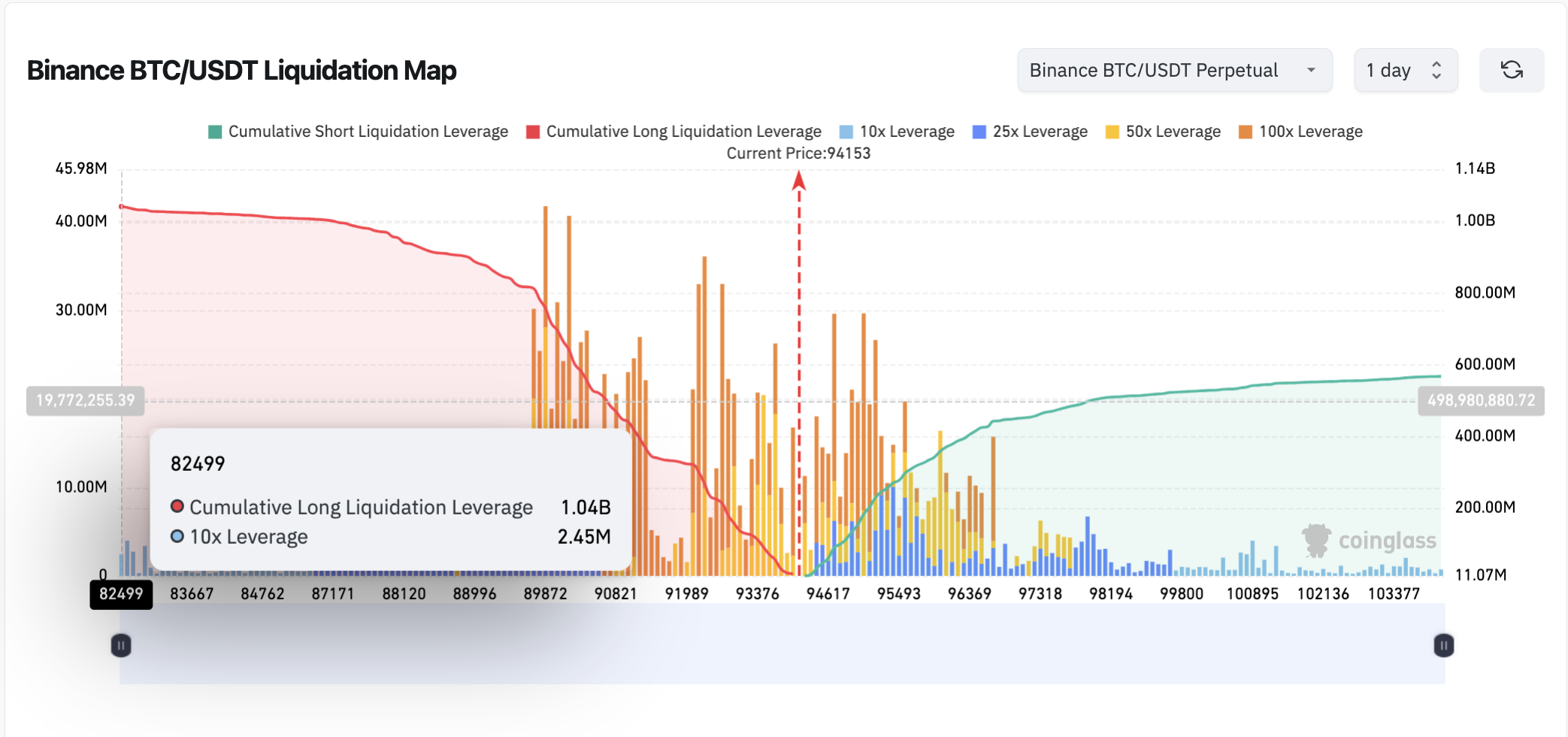

Bitcoin Liquidation Map (BTCUSDT), January 13 | Source: Coinglass

Bitcoin Liquidation Map (BTCUSDT), January 13 | Source: Coinglass

While the Bitcoin spot price trend hangs in the balance, bull traders are making frantic efforts to prevent a close below $90,000.

The chart above shows that bulls have mounted $1.04 billion leverage on active BTC long positions against, surpassing the $568 million short positions by more than 40%.

Altcoin market updates: Litecoin plunges after hack, Cardano, and SUI emerge as top losers

The global crypto market cap shrank by 5% billion on Monday, per CoinGecko data. While BTC price held firm around $94,500, prominent altcoins endured considerable losses within the daily time frame

Key Altcoin Price Movements

- Litecoin

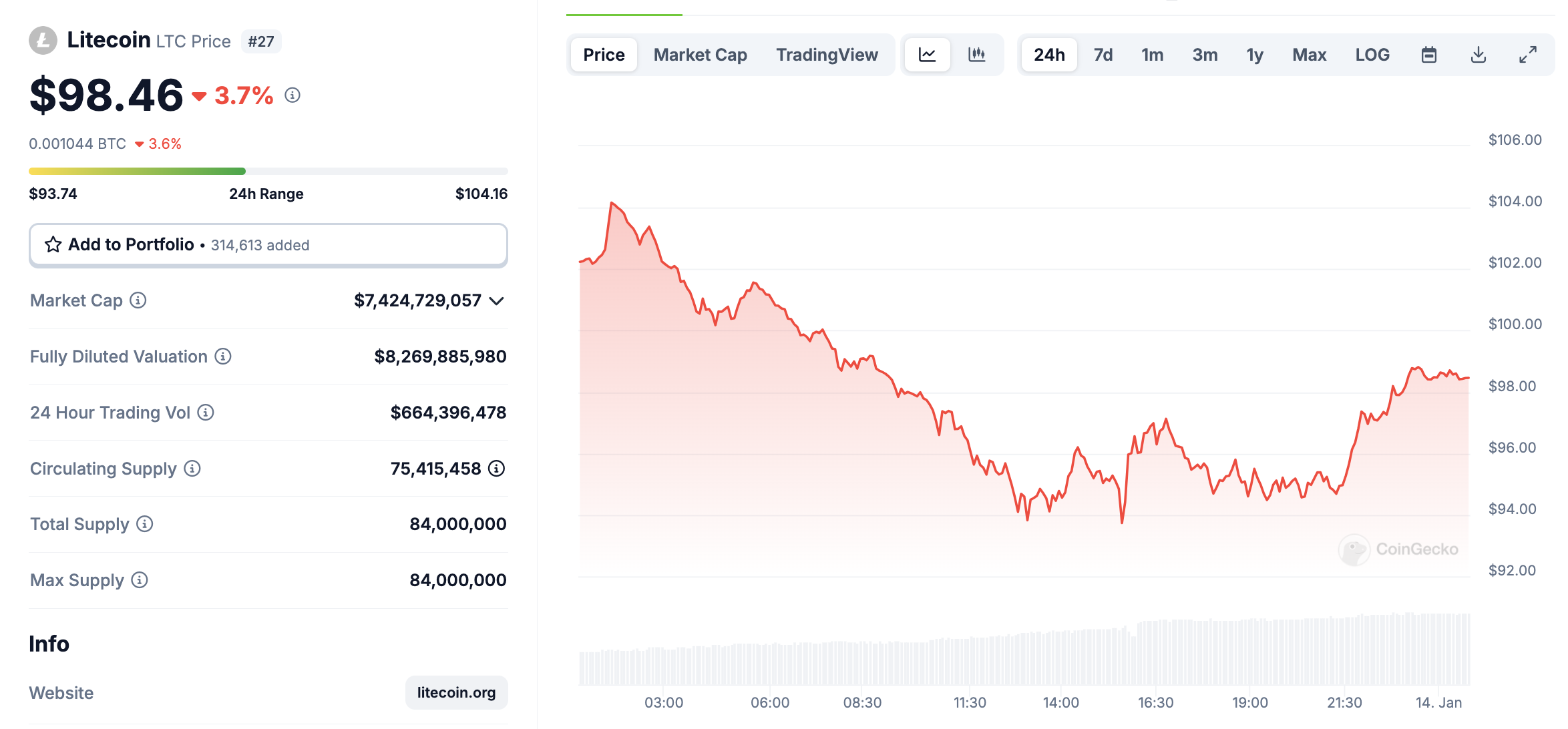

Litecoin price post another 4% loss as LTC struggles to recover from recent hack

Litecoin (LTC) price fell another 4% to hit $98, extending its weekly time frame losses to 20% after a high-profile hack eroded market confidence.

Litecoin price action, January 2025 | Source: Coingecko

Litecoin price action, January 2025 | Source: Coingecko

The breach occurred when attackers compromised Litecoin’s official X account to promote a fraudulent LTC token, falsely claiming it was a Solana-hosted initiative.

While Litecoin’s network remains secure; the incident has intensified bearish sentiment across LTC spot markets.

- Cardano and SUI

Double-digit losses ADA and SUI as traders dump last week’s top performers

Cardano (ADA) and SUI have recorded double-digit losses as traders take profits from last week’s strong rallies. Such mean reversion trends highlight lingering caution among traders amidst broader bearish sentiment, as U.S. CPI data looms.

For the crypto market, these moves suggest a shift in focus away from altcoins toward defensive positioning in more established assets like Bitcoin and Ethereum. As risk appetite fades, sustained outflows from speculative tokens could pressure the broader market in the coming weeks.

- AI-Themed Memecoins: Ai16z and Fartcoin

Ai16z and Fartcoin surge as AI Agents memecoin traders remain reluctant to sell despite market dip

AI-themed memecoins are capturing the attention of younger, social media-savvy retail traders who often remain indifferent to macroeconomic policy musings. Leading the trend, Fartcoin (FART) gained 33% on Monday while Ai16z rose 2%, defying the broader crypto market’s bearish sentiment.

These tokens’ success highlights a growing narrative around AI-agent innovations and their growing appeal among retail traders. Despite a hawkish U.S. CPI outlook dampening risk sentiment across other sectors, traders in this niche remain reluctant to sell.

Chart of the day: CeFi tokens post strong performance ahead of US CPI

The crypto market extended its decline on Monday, shedding another 5%, with Bitcoin (BTC) holding steady at $94,500.

As traders reposition portfolios ahead of the U.S. Consumer Price Index (CPI) release on January 15, the broader market reflects notable sectoral divergence.

This suggests a shifting risk appetite and strategic recalibration across digital asset categories.

A closer examination of sectoral performance reveals contrasting dynamics. Layer 1 protocols led declines, shedding 6.05%, while Layer 2 projects faced sharper losses at 7.87%.

Meanwhile, the NFT and AI sectors took the brunt of the sell-off, plunging 9.21% and 11.37%, respectively.

These losses suggest speculative tokens are falling out of favor as traders opt for assets with stronger fundamentals or less volatility.

Global Crypto Market Performance, by Sector | January 13, 2025 | SosoValue

Global Crypto Market Performance, by Sector | January 13, 2025 | SosoValue

Conversely, Centralized Finance (CeFi) tokens emerged as a relative safe haven, posting the smallest sectoral loss at 4.18%.

This resilience signals heightened demand for crypto lending services and structured financial products amid volatile spot markets and low-interest-rate environments.

Stablecoin-focused sectors also demonstrated notable steadiness, edging just 0.05% lower, indicating increased capital preservation efforts.

CeFi's relative strength hints at a growing strategic shift among investors. As the market braces for the CPI report and its potential to sway risk sentiment, CeFi could attract fresh capital flows.

Crypto News Updates:

- Tether Moves Headquarters to El Salvador Following DASP License Approval

Tether, the issuer of the world’s largest stablecoin, USDT, announced the relocation of its headquarters to El Salvador after securing a Digital Asset Service Provider (DASP) license. This move underscores Tether's commitment to aligning with Bitcoin-friendly policies and leveraging the country’s progressive regulatory framework. El Salvador, which adopted Bitcoin as legal tender in 2021, has become a hub for cryptocurrency innovation, making it an ideal operational base for Tether and other crypto firms like Bitfinex Derivatives.

- Binance Faces Legal Setback as US Supreme Court Upholds Crypto Lawsuit

The US Supreme Court has rejected Binance's appeal to dismiss a lawsuit alleging the illegal sale of unregistered crypto assets, allowing the case to proceed. Filed in 2020 by investors, the lawsuit claims Binance failed to disclose risks associated with tokens like ELF, EOS, and FUN, purchased during 2017.

Plaintiffs are seeking damages for financial losses, interest, and legal fees. This decision follows an appeals court ruling that found sufficient evidence the transactions were domestic, citing server locations and investor activities in the US.

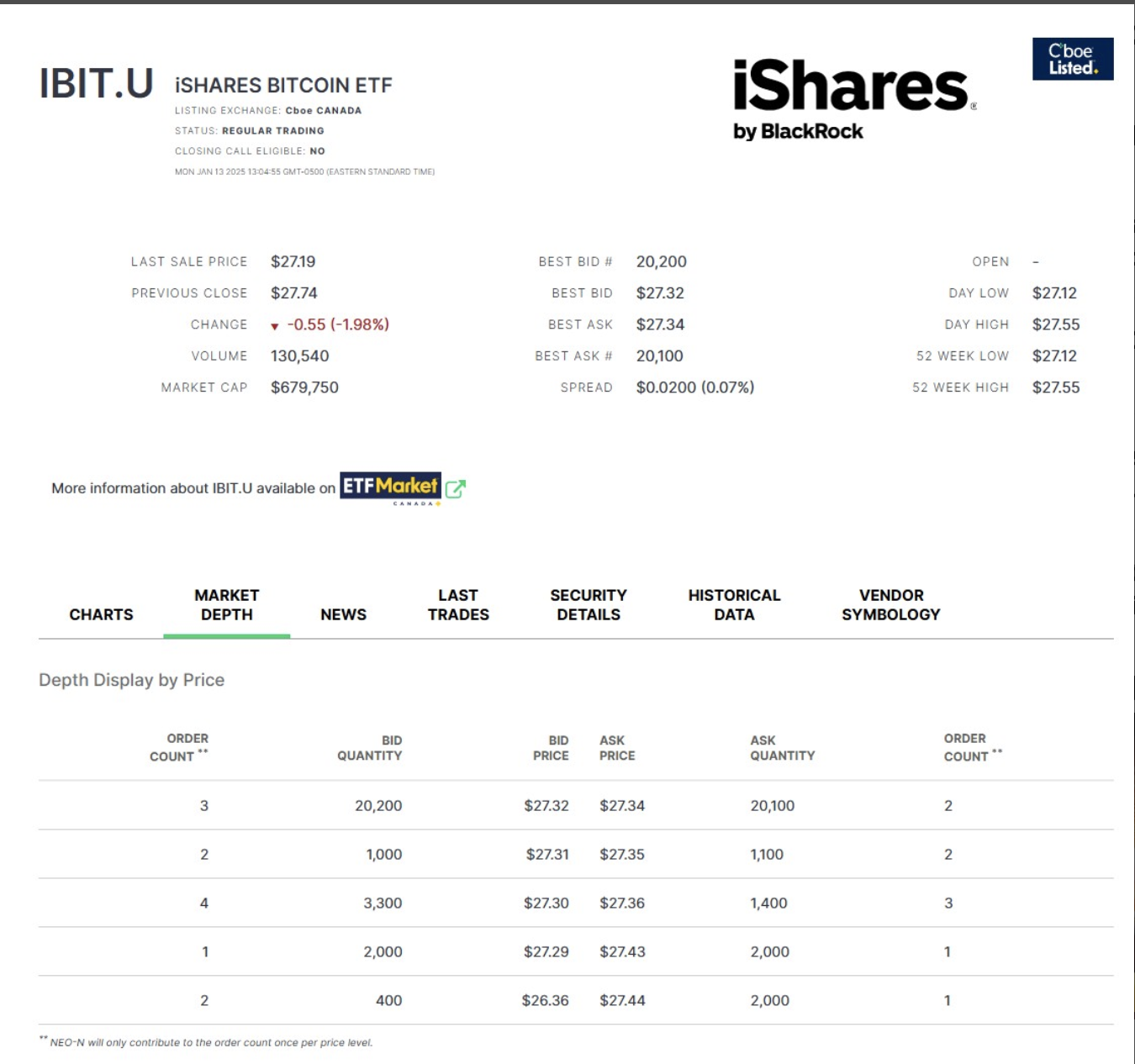

- BlackRock Launches Bitcoin ETF on Cboe Canada, Expanding Global Reach

Global asset management giant BlackRock has introduced a new Bitcoin exchange-traded fund (ETF) on Cboe Canada, aiming to provide Canadian investors with streamlined access to Bitcoin exposure. The iShares Bitcoin ETF, trading under the ticker IBIT, mirrors BlackRock’s US-based flagship Bitcoin fund, the iShares Bitcoin Trust.

IBIT.U is listed in Canada. Source: Cboe Canada

IBIT.U is listed in Canada. Source: Cboe Canada

The ETF eliminates the need for direct Bitcoin custody, offering a simplified investment solution. BlackRock’s head of iShares Canada, Helen Hayes, highlighted the product’s role in removing operational complexities for investors.

The fund’s launch reinforces Canada’s position as a key hub for Bitcoin ETFs, with over a dozen similar products already available on Canadian exchanges. Steno Research analysts project that Bitcoin ETFs could attract $48 billion in net inflows during 2025.