Crypto Today: BTC traders hold $90K support as SUI, LTC, TIA see green

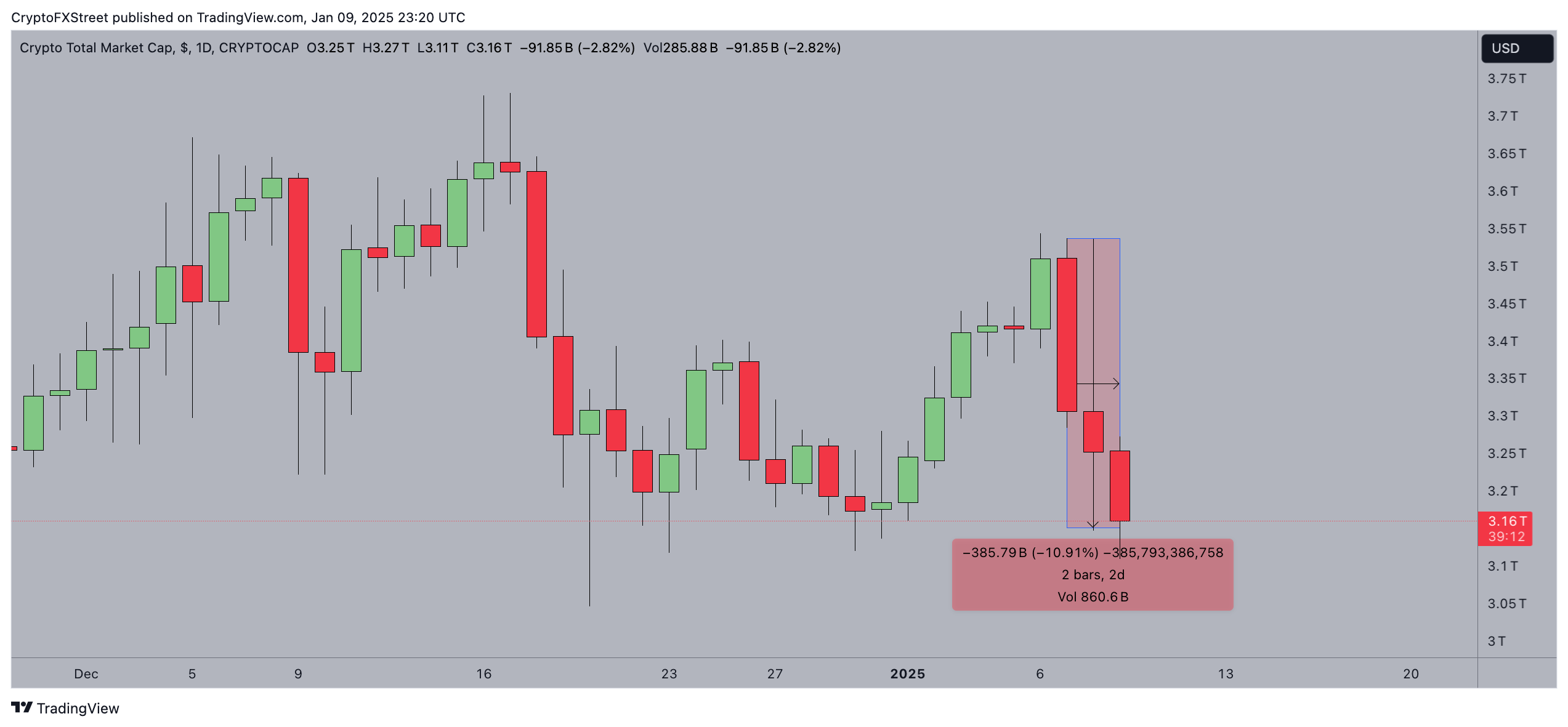

- The cryptocurrency market’s losing streak entered its third day; aggregate market cap declined 10.9% to hit $3.1 trillion.

- Bitcoin price stabilized around the $91,800 area as bulls moved to avoid further downside.

- Bitcoin ETFs bled $582.9 million on Wednesday, the largest single-day outflows since December 18.

- Altcoin markets show early recovery signals with SUI, LTC and Celestia booking mild gains on Thursday.

Bitcoin Market Updates: BTC set to hold $90K support

- Bitcoin (BTC) plunged by another 3.5% on Thursday on course to print a 3-day losing streak.

- After nearly 11% losses, Bitcoin bulls were spotted deploying $721 million leverage around the $90,000 support level.

Altcoin market updates: Celestia, LTC and SUI enter early rebound as mega cap assets struggle for momentum

On Thursday, the top three largest altcoins, Ethereum, Ripple (XRP) and Solana (SOL), recorded additional losses.

In the memecoins sector, Shiba Inu (SHIB) and Dogecoin (DOGE) also suffered considerable corrections within the daily timeframe.

However, a closer look at the broader altcoin market reveals early rebound signals.

Aggregate Crypto market capitalization

BNB and BGB gained traction as exchange-linked assets benefited from a surge in user activity on Binance and Bitget platforms. Meanwhile, XRP found support at $2.3, fueled by optimism surrounding Ripple’s new collaboration with Chainlink, aimed at integrating oracles for improved DeFi adoption.

Key Altcoin Price Movements

Sui (SUI)

Sui has demonstrated notable resilience, with its price currently at $4.74, reflecting a slight increase of 2.84% over the past 24 hours.

Following this mild surge, Sui's market capitalization has surpassed that of Toncoin, positioning it at the 12th spot among cryptocurrencies, per CoinGecko data.

Litecoin (LTC)

Litecoin is currently trading at $103.29, marking a 1.85% increase over the previous close. The intraday movement saw a high of $105.61 and a low of $100.35.

Celestia (TIA)

Celestia's price stands at $4.57, showing a 2.01% increase from the previous close, with intraday fluctuations between $4.41 and $4.71.

With traders seeking entry opportunities in undervalued assets, SUI and Litecoin, TIA's growth performances on Thursday could spark renewed investor interest across the altcoin market in the coming trading sessions.

Chart of the day: Bitcoin ETFs bled $582M as US Govt moves to offload BTC worth $6.5B

The U.S. Department of Justice (DOJ) has received approval to sell $6.5 billion worth of Bitcoin seized from the infamous Silk Road marketplace.

The move comes ahead of Donald Trump's anticipated inauguration, adding uncertainty to Bitcoin's near-term price trajectory.

Analysts caution that the DOJ’s sale could flood the market with significant supply, exerting downward pressure on Bitcoin's price in the weeks leading up to the event.

Historically, large-scale government sales of seized assets have disrupted market momentum, sparking concerns of increased bearish activity.

Bitcoin ETFs Trading data as of January 8 2025, Source: SosoValue

In reaction, Bitcoin ETFs experienced their most significant daily outflows in 20 days on Wednesday, shedding $582.9 million.

The mirrored broader global market turbulence, as investors fled major crypto assets in the backdrop of market uncertainty and hawkish shifts in macroeconomic landscape.

Following the latest sell-off, Bitcoin ETFs total net asset levels dipping to $106.82 billion.

This marked the sharpest decline in total assets since December 18. Trading volumes in these ETFs reflected heightened activity, indicative of panic-driven redemptions.

Meanwhile, Bitcoin's price remained relatively stable at $93,980, at the time of publication underscoring strong buy-side support despite the rising ETF outflows.

Crypto news updates:

- Polymarket faces backlash for California Wildfire betting markets

Prediction markets platform, Polymarket is under fire for hosting controversial betting markets tied to the ongoing California wildfires, sparking ethical concerns over profiting from natural disasters.

The decentralized prediction platform has seen nearly $100,000 in bets placed on scenarios such as wildfire containment timelines and potential political fallout.

Critics argue that monetizing such events trivializes human suffering and may even incentivize reckless behavior to influence outcomes.

The backlash has intensified on social media, where users and advocacy groups have denounced Polymarket for exploiting a sensitive crisis.

While the platform defends its markets as tools for aggregating public sentiment and forecasting probabilities, opponents warn of the dangerous precedent it sets.

- Ripple targets RLUSD expansion with major exchange Listings

Ripple is ramping up efforts to expand its US dollar-pegged stablecoin, RLUSD, by targeting listings on major exchanges, including Coinbase.

Launched on Ethereum and XRP Ledger, RLUSD is part of Ripple's broader push to integrate stablecoins across multiple networks.

Senior Vice President Jack McDonald acknowledged the technical and strategic challenges of securing partnerships with platforms like Coinbase, especially given the exclusive ties some exchanges maintain with other stablecoins.

Despite these hurdles, Ripple remains optimistic about RLUSD’s future, emphasizing its potential for cross-network utility.

- Standard Chartered debuts Crypto custody service in Luxembourg

Standard Chartered has launched a crypto custody service in Luxembourg, marking its entry into the European Union's digital asset market under the newly implemented MiCA regulation.

This move aligns with the bank's global digital asset strategy and follows its recent expansion into the UAE.

The Luxembourg entity, led by CEO Laurent Marochini, will offer custody services for cryptocurrencies and digital assets, targeting institutional clients seeking compliance in a stable regulatory environment.

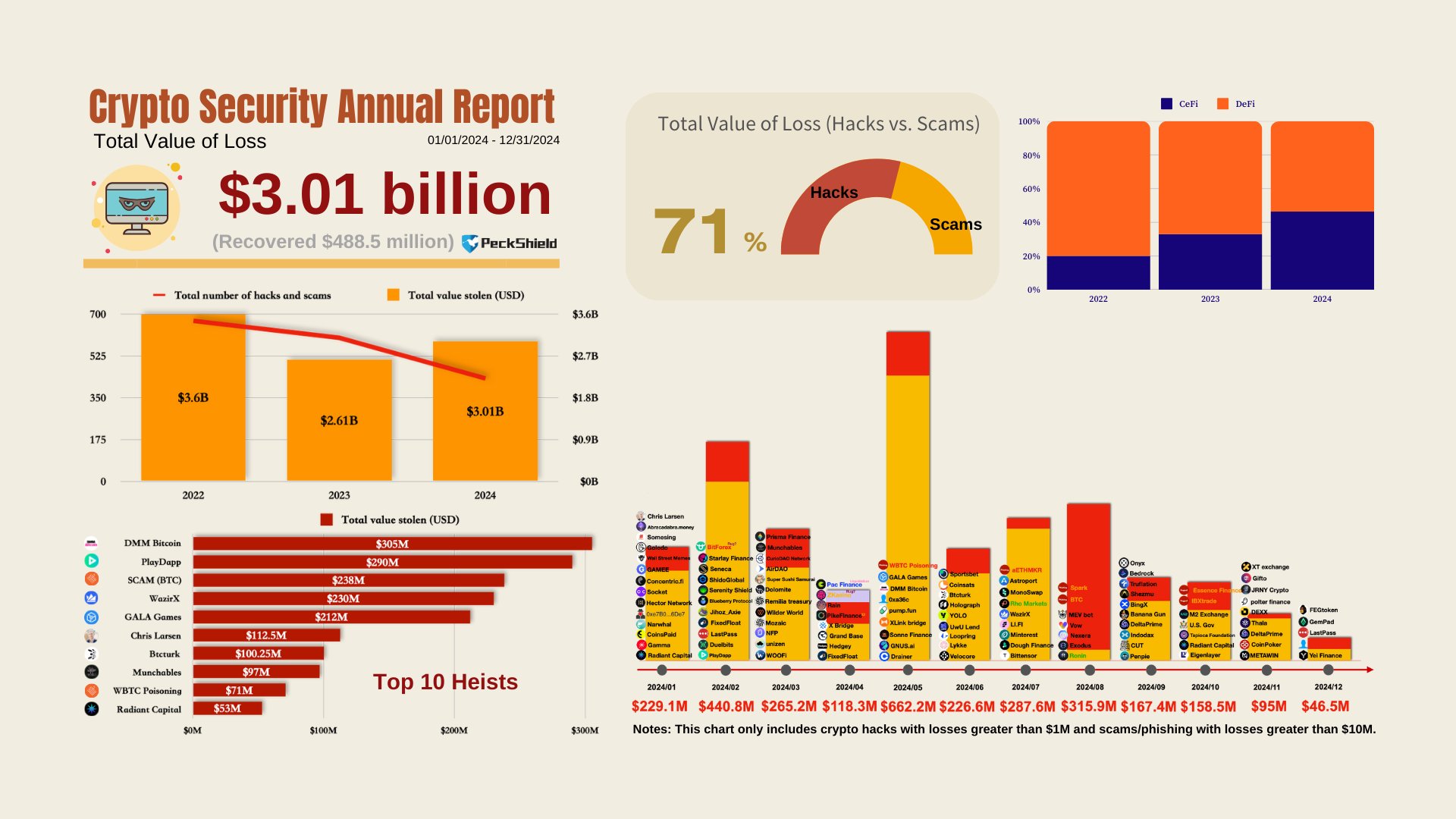

- Crypto hacks surge in 2024, Losses exceed $3 billion

Crypto-related hacking activities experienced a sharp resurgence in 2024, with total losses surpassing $3.01 billion, according to PeckShield.

This marks a 15% increase compared to the $2.61 billion lost in 2023, highlighting growing vulnerabilities in the digital asset ecosystem.

Of the total, $2.15 billion was stolen through hacks, while scams accounted for $834.5 million.

Crypto Security Annual Report 2025 | Source: Peckshield

Crypto Security Annual Report 2025 | Source: Peckshield

Despite these alarming figures, recovery efforts have yielded some progress, with approximately $488.5 million worth of stolen assets retrieved.

The rise in cybercrime underscores the urgent need for enhanced security measures and regulatory oversight in the cryptocurrency space as the sector grapples with growing sophistication in hacking techniques.