Crypto Today: BTC drops 3% despite $52M ETF inflows as Chainlink launches Ripple’s RLUSD

- The cryptocurrency market lost $320 billion in the last 24 hours, with the aggregate market capitalization dropping 10% to $3.2 trillion on Wednesday.

- BTC price has declined by 3%, plunging as low as $94,200 despite $52 million Bitcoin ETF inflows.

- Ripple and Chanilink have partnered to launch multi-chain access for the RLUSD stablecoin

Bitcoin Market Updates: BTC plunges by another 3% despite strong ETF demand

- Bitcoin (BTC) plunged by another 3% on Wednesday, with prices sliding towards $93,700 at the time of publication.

- Bitcoin ETFs defy bearish sentiment as they recorded $52 million inflows on Tuesday, bringing the weekly intake to $1.04 billion.

Altcoin market updates: Exchange tokens BNB and BGB show strength as XRP holds $2.3 on Chainlink partnership

Mega-cap assets like XRP and exchange tokens BNB and BGB showcased resilience, defying broader market weakness spurred by an ongoing liquidation event that wiped over $150 billion from global crypto market capitalization in the past 24 hours.

Aggregate Crypto market capitalization

Aggregate Crypto market capitalization

BNB and BGB gained traction as exchange-linked assets benefited from a surge in user activity on Binance and Bitget platforms. Meanwhile, XRP found support at $2.3, fueled by optimism surrounding Ripple’s new collaboration with Chainlink, aimed at integrating oracles for improved DeFi adoption.

Key Altcoin Price Movements

- Ripple (XRP)

XRP managed to hold above the crucial $2.3 support, despite broader market sell-offs. This level emerged as a key psychological and technical barrier for bears. Ripple’s partnership with Chainlink sparked renewed interest in its utility for cross-border payments and DeFi expansion. However, upside momentum remains capped near $2.5, with bulls requiring a strong catalyst to regain dominance.

- Litecoin (LTC)

Litecoin experienced heightened bearish pressure, falling 8% to $100 after briefly testing $115 resistance earlier in the week. The bearish trend aligns with weakening on-chain activity, though the halving narrative continues to lend medium-term optimism. Bulls must defend $100 support to avoid further downside risks toward $85.

- Avalanche (AVAX)

AVAX faced a sharp 7% drop to $37, as sellers capitalized on a broader market correction. The decline follows a failed breakout attempt above $40 resistance, leaving the token vulnerable to further downside.

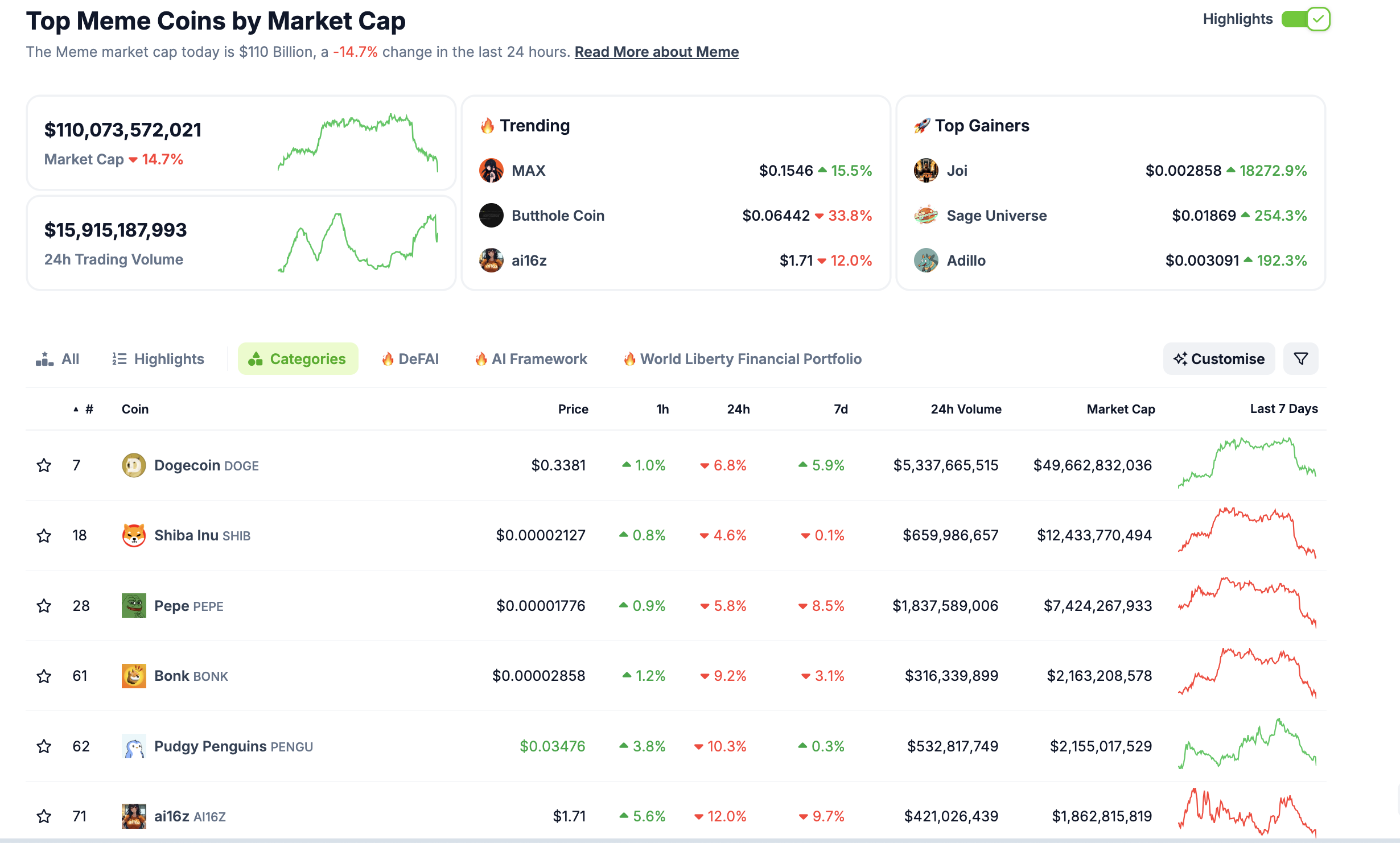

Chart of the day: Memecoins book $16B losses crypto traders move to avoid downside risks

The US JOLTs job openings data released today revealed higher-than-expected figures, intensifying market fears of a hawkish Federal Reserve.

With rising expectations of tighter monetary policy, risk-averse crypto traders are rapidly exiting highly volatile memecoins to mitigate downside risks.

Memecoins, known for their low liquidity and extreme sensitivity to market sentiment, bore the brunt of today’s market turmoil.

Memecoin sector performance

Memecoin sector performance

The aggregate market capitalization of memecoin projects plunged 14.7%, shedding $16 billion to settle at $110 billion as of Wednesday.

Among individual performances, ai16z led the losses with a steep 12% drop in the last 24 hours, while Bonk (BONK) shed 9.2%. Pepe (PEPE) and Shiba Inu (SHIB) also experienced declines of 5.8% and 4.6%, respectively, reflecting the broader risk-off sentiment.

Meanwhile, Pudgy Penguins (PENGU) slid 10.3%, despite its relative stability over the past week.

Crypto news updates:

- Bitfinex relocates derivatives operations to El Salvador after securing a DASP license

Bitfinex Derivatives has announced its relocation to El Salvador following the acquisition of a Digital Asset Service Provider (DASP) license.

This strategic move positions the exchange to leverage El Salvador’s progressive crypto regulations, enabling the rollout of innovative trading solutions.

The license allows Bitfinex to expand its crypto offerings in a region recognized for its adoption of digital assets and Bitcoin as legal tender.

As part of the transition, users accessing derivatives services will need to agree to updated terms of service managed under Bitfinex Derivatives El Salvador S.A. de C.V.

- South Korea to lift ban on institutional crypto trading, says FSC

South Korea's Financial Services Commission (FSC) has revealed plans to lift the ban on institutional cryptocurrency trading.

The proposed changes will allow local institutions to access crypto exchanges, marking a significant shift in the country's approach to digital assets.

The FSC is working alongside the Digital Asset Committee to implement this policy, starting with non-profit organizations, in a phased effort to broaden institutional participation in the crypto market.

This development aligns with President Yoon Suk-yeol's broader initiative to foster the growth of the local cryptocurrency sector.

The proposed regulatory adjustments also aim to establish clear guidelines for stablecoins, token listings and crypto exchanges.

- Fidelity predicts nation-state Bitcoin reserves to drive crypto growth in 2025

Fidelity Digital Assets anticipates that Bitcoin adoption will accelerate in 2025, fueled by nation-states, central banks and sovereign wealth funds increasingly building Bitcoin reserves.

In its “2025 Look Ahead” report, Fidelity pointed to the successful examples of Bhutan and El Salvador, emphasizing the competitive risks nations face if they fail to allocate Bitcoin within their reserves.

Fidelity also suggested that some countries may already be secretly accumulating Bitcoin, preparing to capitalize on its long-term potential.

In addition to nation-state adoption, Fidelity’s report forecasts substantial growth in structured digital asset products and tokenization.