Bitcoin reclaims $100K as Calamos announces upcoming launch of first ever downside protection BTC ETF

- Asset management firm Calamos announced the upcoming launch of a 100% downside protection Bitcoin ETF.

- The ETF will provide full protection on BTC downsides but offers a limit on its upside if held through.

- Bitcoin is back above $100K after invalidating an Head-and-Shoulders pattern.

Bitcoin rallied above $100,000 on Monday following asset manager Calamos' announcement of a 100% downside protection Bitcoin exchange-traded fund (ETF) to help investors manage their risk.

Bitcoin rises above $100K, Calamos prepares to launch downside protection BTC ETF

Asset manager Calamos stated in a press release that it will launch a first of its kind 100% downside protection Bitcoin ETF (CBOJ) on January 22.

"I am excited to announce the launch of the world's first 100% downside protected Bitcoin ETF- CBOJ," said President and CEO of Calamos John Koudounis.

CBOJ aims to help investors hedge volatility risks by providing 100% protection against negative BTC returns acquired during market downturns. However, it will trade with an upside cap — a limit on the potential gains that investors can obtain from their BTC exposure — that resets every 12 months.

"CBOJ will use a combination of Treasuries and options on the CBOE Bitcoin US ETF Index [to] provide a regulated way to access Bitcoin within a risk-controlled framework," wrote Calamos.

Furthermore, CBOJ shares can be held indefinitely, signifying that investors can retain ownership of their shares for as long as they want.

Calamos plans to state the ETF's first cap rate on January 22 after the market closes. The cap rate will run until January 31, 2026.

Bitcoin invalidates H&S pattern with recent gains

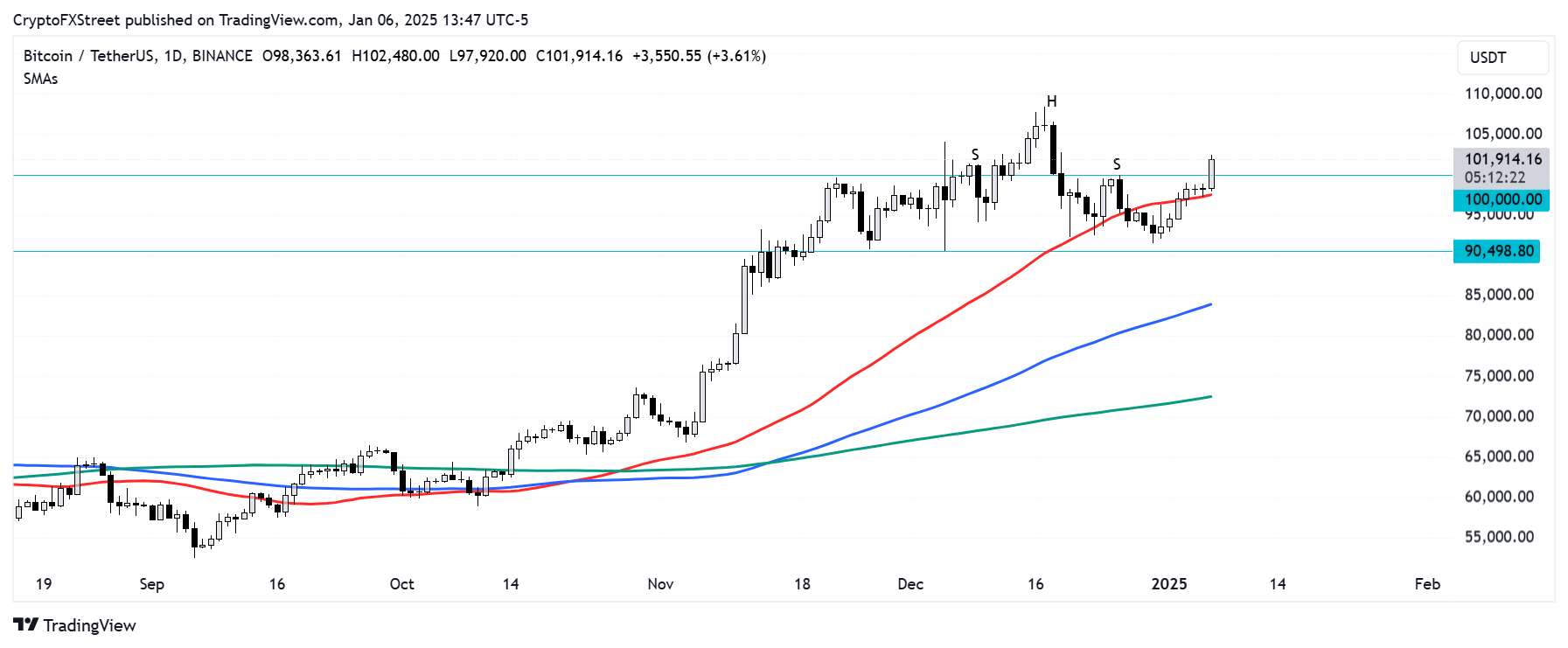

Following the announcement, Bitcoin witnessed a 4% gain, sending its price over $100K for the first time since December 19. The rise has seen BTC invalidate a Head-and-Shoulders (H&S) pattern that had been forming since December 26.

BTC/USDT daily chart

Meanwhile, CryptoQuant data revealed that the Bitcoin Coinbase Premium Index turned positive for the first time in 2025. This indicates an increased buying pressure from US-based investors, pointing to a bullish sentiment for the asset.

In addition, Bitwise Chief Investment Officer Matt Hougan predicts that Bitcoin's highest demand in 2025 will stem from companies, ETFs and governments.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.