Crypto Today: Hawkish Fed triggers $400B sell-off as meme coins mirror ETH, SOL price dip

- The cryptocurrency sector valuation fell below the $3.5 trillion mark on Thursday, with a 10.7% decline reflecting $390 billion worth of outflows.

- The crypto market dip has been linked to the US Federal Reserve hinting at a hawkish stance for 2025.

- Etherum and Solana suffered double-digit losses as investors' skittish reaction triggered a market-wide meme coin sell-off.

Altcoin market updates: Ethereum and Solana among top losers after Fed triggers meme coin sell-off

The Federal Reserve's (Fed) 25-basis-point rate cut on Wednesday aligned with market expectations.

However, it was overshadowed by hawkish comments from Chair Jerome Powell signaling fewer rate cuts in 2025. This triggered an immediate negative response from crypto traders.

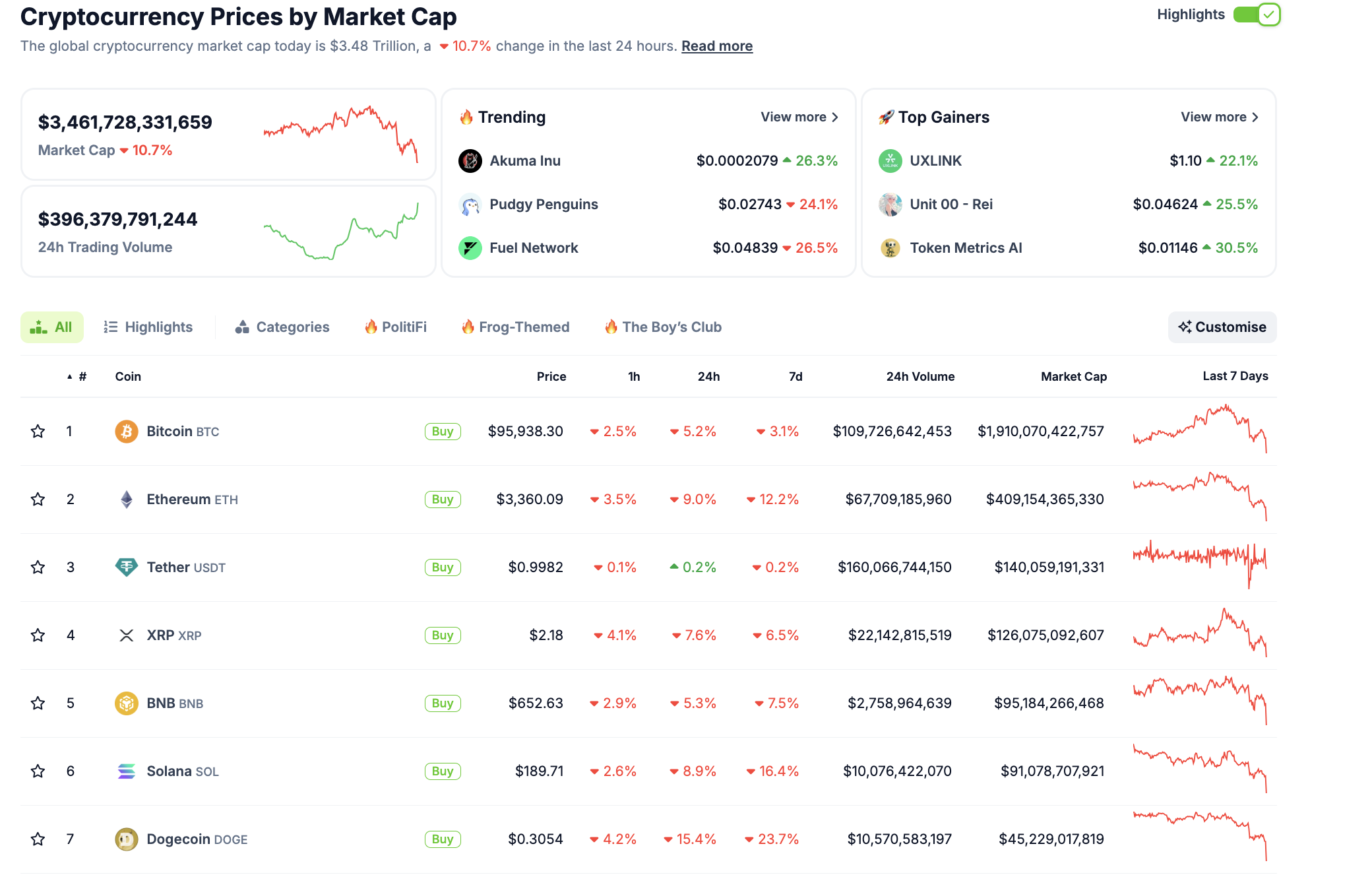

Crypto Market Performance | December 18, 2024 | Source: Coingecko

Within 24 hours of the FOMC meeting, the global crypto market lost 10.7%, erasing over $390 billion in market value, as per Coingecko data.

Risk sentiment further deteriorated, with meme coins — known for their high volatility and low liquidity — experiencing the sharpest declines.

Major meme coins like DOGE, SHIB, and WIF posted steep losses, while Ethereum and Solana, two leading blockchains for hosting meme coins, also suffered significant price drops. This highlights how the Fed's hawkish stance dampened risk appetite across the crypto market.

Chart of the day: Crypto AI Sector Market Cap plunges below $35B amid Bearish headwinds from Google and US Fed

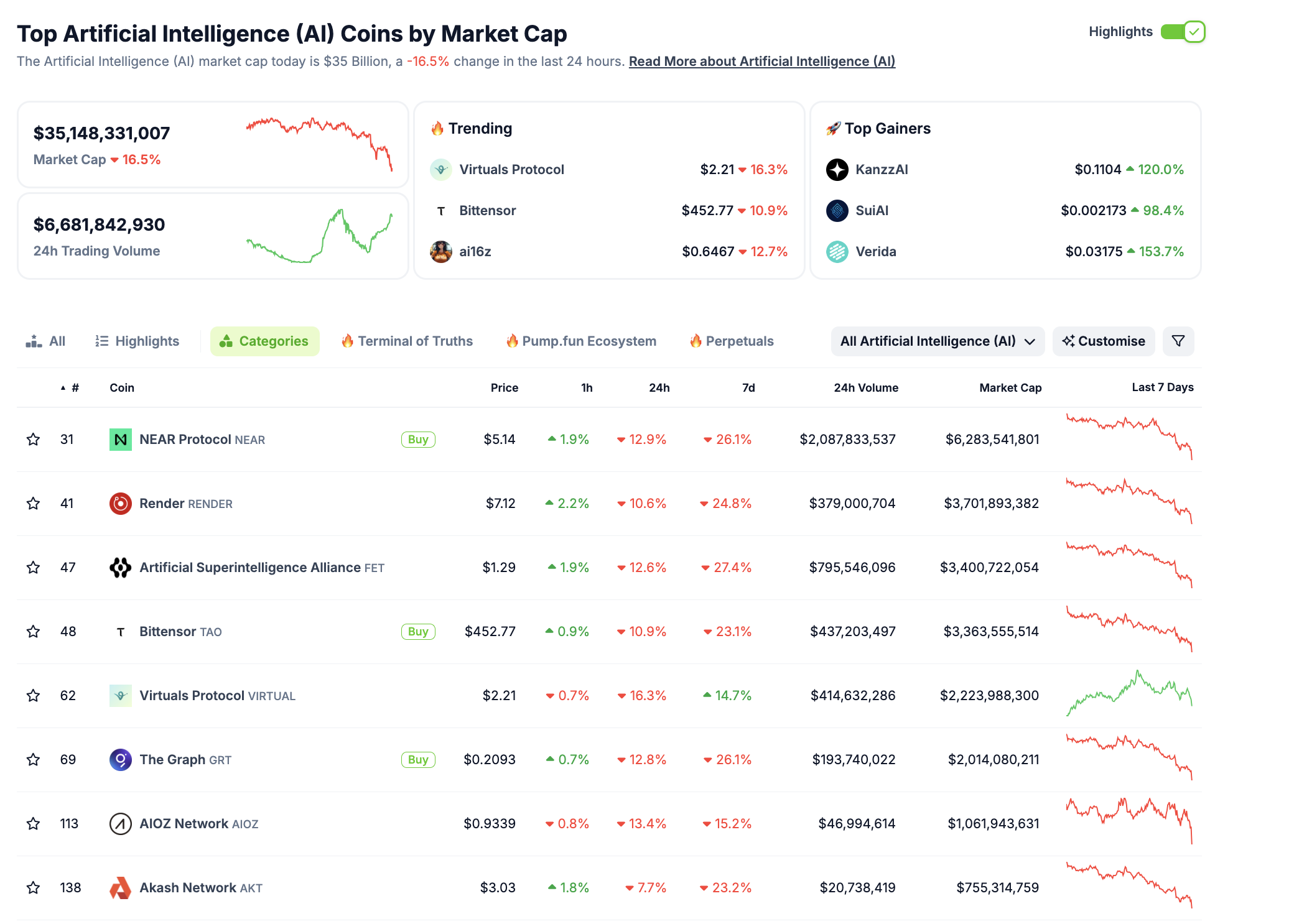

The Crypto AI sector has posted a volatile performance in December 2024 so far, amid major shifts in the global technological and macroeconomic landscapes. According to Coingecko data, a hawkish stance from the US Fed saw the crypto AI sector valuation plunge below the $35 billion mark on Thursday, reflecting 16.5% losses and outpacing the market average.

On December 10, Google announced the Willow quantum computing chip sparking concerns that it could impact cryptographic encryption that underpin the cryptocurrency sector. Experts predict that quantum computers will threaten Bitcoin encryption within five to 10 years.

This appears to have sparked some degree of fear, uncertainty and doubt within the crypto AI sector, and itwhich was further exacerbated by the 16% downswing that outpaced the market average losses of 10.7% on Thursday, in the aftermath of the FOMC meeting.

While speculations swirl, Maggie Wu, Research Lead at Foresight Ventures, has hinted that Google’s Willow quantum computing chip is unlikely to impact the crypto AI sector negatively, as widely feared.

Crypto AI Sector performance | December 19 2024 | Source: Coingecko

Crypto AI Sector performance | December 19 2024 | Source: Coingecko

As shown in the chart above, the crypto AI sector booked 16.2% losses with top assets like Render (RNDR), The Graph (GRT) and Near Protocol (NEAR) all booking double-digit losses.

In August 2024, Foresight Ventures issued an optimistic Crypto AI forecast report stating that “the social impact of AI x Crypto could be significant over the next 50 years”.

In an exclusive interview with FXStreet, when asked how Crypto AI projects can help to mitigate the risks that Quantum computing chips pose to Bitcoin’s security architecture, Wu doubled-down on an optimistic stance.

“AI will likely have advanced to unimaginable levels of capability. To successfully attack a blockchain's signature scheme, quantum computers would need a significant leap in qubit count and coherence time, with several orders of magnitude still to overcome. This suggests that such threats are unlikely to become a major concern for at least the next several decades.”

Maggie Wu Research Lead, Foresight Ventures

Crypto news updates:

- Ark Invest offloads $3.9M in Coinbase shares as Fed’s hawkish stance sparks market turmoil

Ark Invest sold $3.9 million worth of Coinbase shares from its ARKF ETF after the stock plunged 10% amid market turbulence triggered by hawkish remarks from Powell.

The move reflects Ark’s disciplined strategy of maintaining diversification by capping any single holding at 10% of the ETF’s portfolio.

Despite the sell-off, Coinbase remains a core holding and the second-largest component of the ARKF ETF.

- Fed Chair Powell says Fed legally prohibited from owning Bitcoin

Powell reaffirmed that the Fed is barred from owning Bitcoin under the Federal Reserve Act.

Addressing questions about President-elect Donald Trump's proposed Bitcoin reserve, Powell emphasized the central bank’s adherence to its legal framework and its lack of authority to invest in digital assets.

Powell also clarified that there are no plans to lobby Congress for legislative changes that would allow Bitcoin ownership.

He underscored that any revision of the Fed’s asset policy would remain solely under congressional jurisdiction.

- El Salvador Strikes $1.4 Billion IMF Deal, Scaling Back Bitcoin's Role

El Salvador has reached a $1.4 billion agreement with the International Monetary Fund (IMF), signaling a significant policy shift by making Bitcoin acceptance voluntary in the private sector.

The deal also limits public sector involvement with Bitcoin, ending mandatory use of the cryptocurrency for payments and transactions.

Taxes will remain exclusively payable in US Dollars, and state-backed Chivo wallet operations will be gradually phased out.

The agreement, pending IMF Executive Board approval, aims to strengthen El Salvador’s fiscal position with measures targeting a 3.5% improvement in the primary balance over three years.

The country’s public debt, which peaked at 85% of GDP in 2024, is expected to decline under this program.

Additional financing of $3.5 billion from the World Bank and regional development banks will support broader economic reforms, further curbing Bitcoin's official role in El Salvador’s economy.