Ripple's XRP crosses $100 billion market cap following high expectations for its stablecoin and ETF approvals

- Ripple’s XRP rose to $1.7 after rumors of RLUSD approval by New York regulators made the headlines.

- Bitwise's André Dragosch stated that an XRP approval is even more likely in 2025 as retail investors show higher demands.

- XRP could extend its rally by 30% if it surges above the $1.96 level.

Ripple's XRP rallied near the $2 mark on Friday after rumors of New York regulators approving the company's RLUSD stablecoin surfaced. The growing demand for an XRP exchange-traded fund (ETF) could also accelerate its launch in 2025.

Ripple's XRP sees high bullish momentum ahead of potential stablecoin approval and ETF launch

XRP is seeing increased positive sentiment after posting double-digit gains on Friday following recent updates concerning its stablecoin release and ETF approval.

The remittance-based token surged over 17%, flipping BNB as the fifth largest cryptocurrency and reaching the $100 billion milestone.

The rise can be traced to rumors stating that the New York Department of Financial Services (NYDFS) may be considering approving Ripple's new stablecoin, RLUSD, with a potential launch in December, according to Fox Business.

By introducing a regulated stablecoin, Ripple aims to provide a reliable alternative to XRP for customers seeking to use digital currencies without the risks associated with volatility and regulatory ambiguity.

This would position Ripple as a competitor to popular issuers like Tether and Circle in New York's regulated digital finance market.

Meanwhile, Bitwise analysts suggested in a Friday report that an XRP ETF is more likely to receive the green light from the Securities & Exchange Commission (SEC) in 2025.

According to the report, XRP is among the top most searched tokens by retail investors, ranking 4th in allocation. This suggests that investors are actively seeking means to gain XRP exposure.

The report also highlighted that a wide array of XRP use cases solidifies its value as an asset, especially in powering cross-border payments in the traditional financial system.

XRP on the way to complete rounded bottom pattern

XRP rallied over 17%, sparking $24.75 million in liquidations in the past 24 hours, per Coinglass data. Liquidated long and short positions accounted for $7.58 million and $17.17 million respectively.

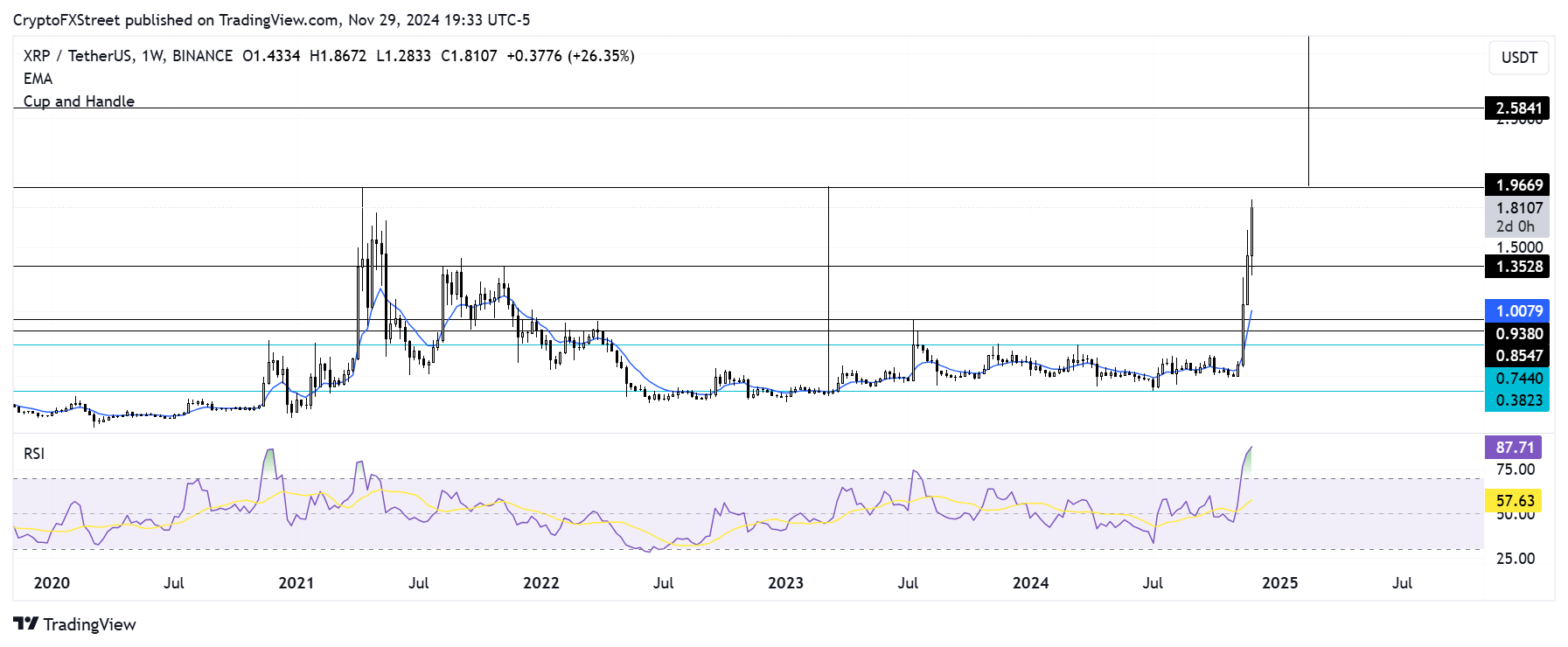

XRP is approaching the $1.96 high of 2021 as it looks to complete a rounded bottom pattern. If XRP fails to see a rejection near the $1.96 resistance, it could extend its rally by over 30% to $2.58.

XRP/USDT weekly chart

The Relative Strength Index (RSI) is deep in the oversold region, indicating prices are getting overheated and may see a correction.

A weekly candlestick close below $1.35 will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.