Ethereum Price Forecast: ETH could see a decline as on-chain and derivatives data paint bearish picture

Ethereum price today: $3,080

- Ethereum options data show that most investors expect a further downside after purchasing more put contracts.

- Ethereum's rising transaction volume and staking outflows point to a potential increase in selling pressure on the top altcoin.

- ETH struggles near the 14-day EMA support amid confirmation of an inverted head and shoulders pattern.

Ethereum (ETH) declined below $3,100 on Tuesday as market sentiment surrounding the top altcoin is turning bearish. On-chain data reveals that investors are potentially withdrawing and putting sell pressure on exchanges.

Ethereum's on-chain and derivatives data indicate further price decline

According to crypto options exchange Derive CEO Nick Forster, market sentiment surrounding Ethereum has been gradually flipping bearish following its recent price consolidation.

"Ethereum is showing signs of a more negative sentiment brewing, with more calls being sold (27%) and puts bought (34.8%) in comparison to Bitcoin," he wrote in a report to investors.

Call and put contracts are derivatives instruments that options traders use to predict the price movement of an underlying asset. Calls signify a bet that ETH's price will rise and vice versa for puts.

Investors also expect ETH to see increased volatility in the coming days, with options traders anticipating a 68% chance of a move between -19.18% ($2,510) and 23.73% ($3,843), according to Derive data.

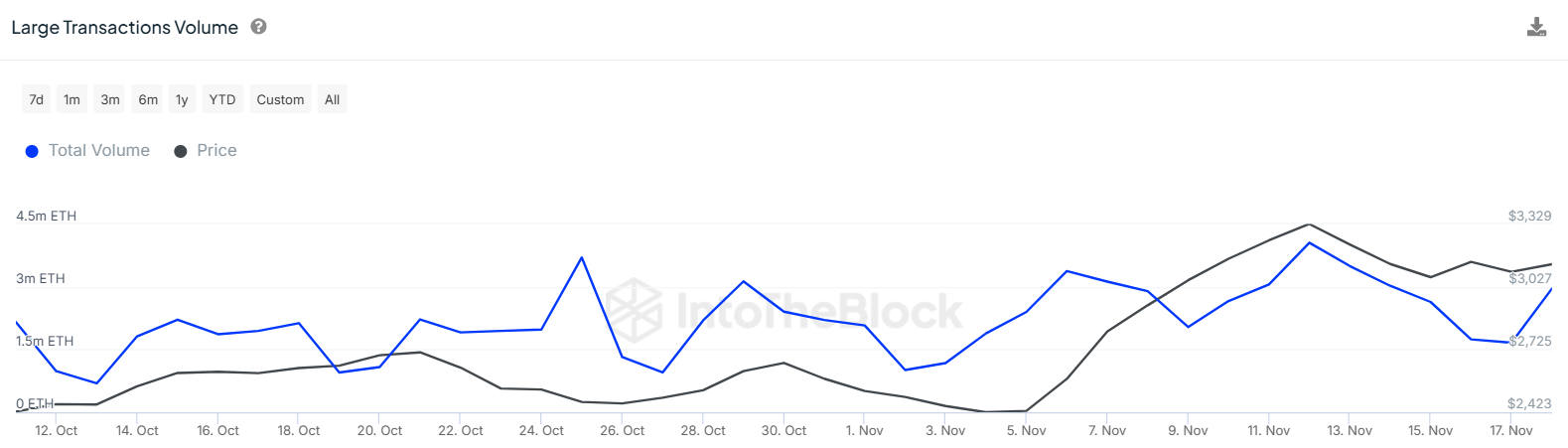

Ethereum's large transaction volume also paints a similar picture, increasing from 1.66 million ETH on Sunday to over 2.95 million ETH on Monday, per IntoTheBlock's data.

ETH Large Transaction Volume | IntoTheBlock

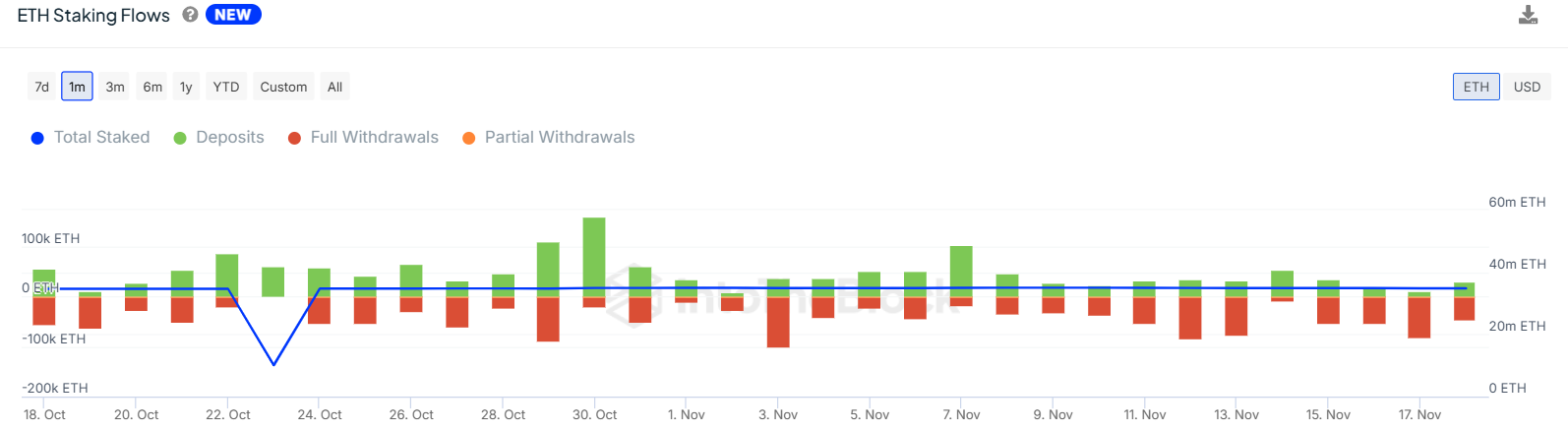

However, the rising transaction volume may be tilted toward the downside as ETH staking net flows in the past five days show net outflows of 188K ETH worth over $580 million. This indicates that most investors are withdrawing their staked tokens to sell them on exchanges potentially.

ETH Staking Flows | IntoTheBlock

Meanwhile, Ethereum exchange-traded funds (ETFs) recorded net outflows of $39.1 million on Monday, per Coinglass data.

Ethereum Price Forecast: ETH struggles near EMA support amid inverted head and shoulders pattern

Ethereum is down over 2% following $35.88 million in ETH futures liquidations in the past 24 hours. Liquidated long and short positions accounted for $25.32 million and $10.36 million, respectively.

The 14-day Exponential Moving Average (EMA) continues to defend ETH near the $3,000 psychological level following its consolidation in the past few days. This move has validated an inverted head and shoulders pattern on the daily chart for the top altcoin.

ETH/USDT daily chart

As a result, if ETH overcomes the resistance near $3,400, it could rally over 30% to $4,522. However, ETH has to overcome the $3,732 and $4,093 hurdles to complete such a move.

The Relative Strength Index (RSI) is above the neutral level and trending downwards after seeing a rejection near its yellow moving average line. This indicates that bullish momentum is steadily weakening.

A daily candlestick close below $2,817 will invalidate the thesis and send ETH toward the support level near $2,250.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.