Binance market share hit lowest level since 2020 as general exchange trading volume declined

- Binance combined trading volumes for spot and derivatives markets declined in September, marking its lowest level since 2020.

- General trading volumes among centralized exchanges fell in September as Q3 ended.

- Open interest on retail derivatives exchanges increased by 32.1% in September following Fed rate cut.

CCData's report on Thursday revealed that Binance's market share for spot and derivatives trading volumes declined in the last month of Q3, dropping to lows not seen since 2020.

Crypto trading volumes drop in September amid Fed rate cuts

Binance experienced a notable drop in trading activity in September, per CCData report on Thursday. The report indicated that derivatives trading volume decreased by 21%, reaching $1.25 trillion, the lowest since October 2023. Consequently, Binance's derivatives market share fell to 40.7%, marking the lowest level since September 2020.

Likewise, Binance's spot trading volume also declined by 22.9% to $344 billion, reducing its market share to 27%, the lowest since January 2021.

Binance combined marketshare

Overall, Binance's combined market share dropped to 36.6%, the lowest since September 2020, although it remains the leader in global spot trading volume among centralized exchanges.

Spot trading volumes on centralized exchanges decreased by 17.2% to $1.27 trillion, the lowest level since June. Likewise, derivatives trading volumes on these exchanges dropped by 16.9% to $3.07 trillion, also reaching their lowest point since June.

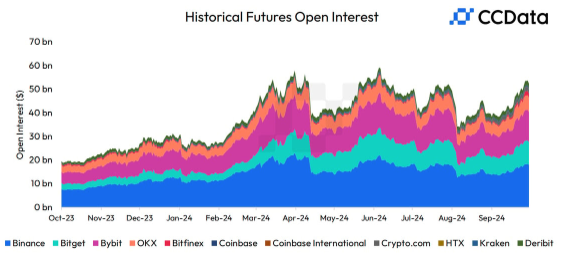

Additionally, open interest in retail derivatives exchanges surged by 32.1% to $53.8 billion, fueled by traders' anticipation of increased market activity. The rise follows the Federal Reserve's decision to cut interest rates by 50 basis points.

Historical Futures Open Interest

Binance open interest rose by 27.5% to $18.0 billion. Bitget, OKX, and Bybit also reported increases in open interest, rising by 28.2%, 32.0%, and 28.5% to reach $9.65 billion, $12.8 billion and $5.97 billion, respectively.

This uptick reflects growing speculation among traders in response to the Federal Reserve's (Fed) monetary policy shift.