Why US citizens can’t participate in airdrops: Top house republicans ask SEC Chair Gary Gensler

- A US Congressman and the Chair of House Committee on Financial Services ask SEC Chair Gary Gensler to provide clarity on airdrops.

- SEC Chair Gary Gensler faces the question of how the agency believes the Howey test applies to free crypto tokens sent to users.

- Decentralized Ethereum re-staking protocol Eigenlayer and meme coin projects like Simon’s Cat have airdropped tokens in 2024.

Crypto market participants in the United States are excluded from airdrops for legal reasons. Airdrops occur when crypto projects distribute their tokens to holders in a free or discounted manner, sending them directly to their wallet address or inviting eligible users to claim these crypto assets.

Top Republican Congressmen Tom Emmer and Chairman of House Committee on Financial Services Patrick McHenry penned a letter to the Chair of the US Securities & Exchange Commission (SEC) Gary Gensler about the status of airdrops in the US.

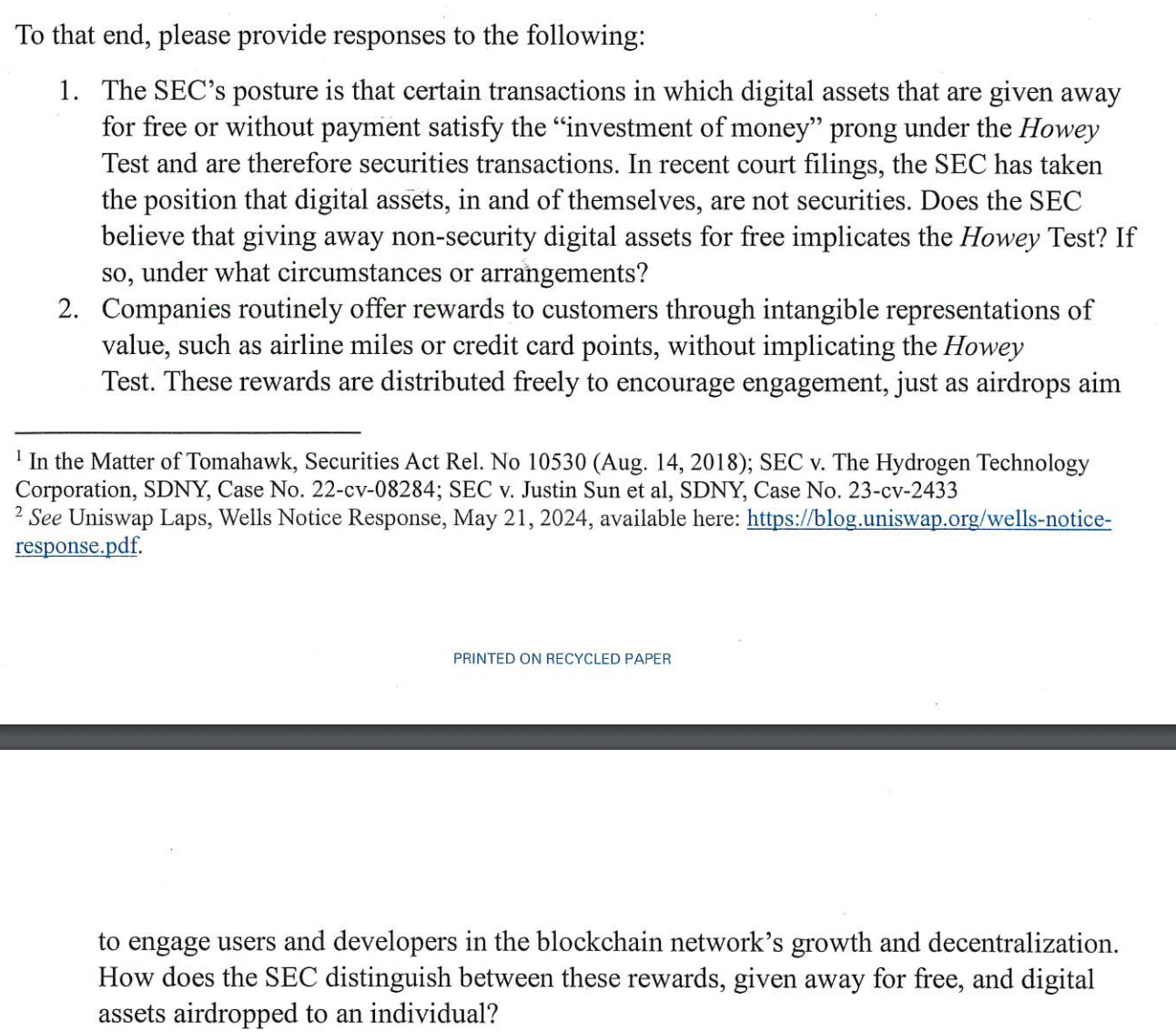

The two Congressmen demand answers to five questions, including why the SEC has blocked citizens of the US from participating in crypto airdrops and how the “Howey Test” (a test used to determine whether an asset is a security) applies to these kind of free digital assets sent to users.

The SEC’s answers to the questions could shape the future of crypto regulation, adoption and the participation of US-based traders in airdrops.

Congressmen demand answers: Are crypto airdrops securities?

Two top Republicans have given SEC Chair Gary Gensler until September 30 to answer their questions on crypto airdrops and why US citizens are blocked from claiming them. Typically, airdrops are part of the marketing effort for crypto projects that send digital assets to eligible users who interact with or drive adoption of the cryptocurrency in its early stages.

The launch of several Ethereum scaling projects or Layer 2 protocols in the last few months has included airdrop campaigns. US-based crypto traders were banned from participating in these.

The highlight of the letter is demand for an analysis of whether the SEC has quantified the market impact of crypto airdrops, and how airdrops in crypto marketing campaigns are different from, for example, free air miles.

Letter addressed to SEC Chair Gary Gensler

The SEC uses the Howey Test to determine whether an asset is a security.This has been applied to the regulator’s lawsuits against Ripple and Terra Labs in the past. The Republican leaders ask the regulator how this test applies to crypto token airdrops and whether they are considered as securities.

Crypto traders in the US await the SEC’s answers to the questions because these could directly impact their ability to participate in future airdrops of projects like EigenLayer, an Ethereum re-staking protocol or meme coin like Simon’s Cat.

Both Congressmen have slammed the US financial regulator for its “unwillingness to establish a regulatory framework in the United States.”