SEC appeal unlikely in Ripple lawsuit, says pro-crypto attorney, XRP back above $0.57

- SEC isn’t likely to appeal ruling in Ripple lawsuit, says attorney Bill Morgan.

- Attorney Bill Morgan says the ruling is positive for the US regulator and shares footnotes from the final ruling for insights.

- XRP gains nearly 2% on Wednesday, trading back above $0.57.

Ripple’s (XRP) lawsuit outcome was favorable for the Securities & Exchange Commission (SEC), according to pro-crypto attorney Bill Morgan. The final ruling in the SEC vs. Ripple lawsuit was well-received by both parties on August 7, 2024.

XRP traders have their eyes peeled for the SEC’s next move, and an appeal could make or break the trade for XRP holders.

Daily digest market movers: Ripple lawsuit may not see SEC appeal

- Pro-crypto attorney Bill Morgan said in an official tweet on X that the SEC is less likely to appeal the final ruling in the Ripple lawsuit.

- Attorney Morgan explains that if one takes legal considerations into account, Judge Analisa Torres’ final decision in the lawsuit can be interpreted as a win for the regulator.

- The pro-crypto attorney explained in a recent post that the judge presiding over the SEC vs. Kraken case preferred the approach of Judge Amy Berman Jackson in the SEC vs. Binance lawsuit and Judge Torres in the SEC vs. Ripple lawsuit. The highlight is that in these cases, the judge distinguishes between the primary and secondary market sales of the asset.

Very interesting case. I agree with you in part about the decision being positive for the SEC. The Judge is very clear in his reasoning. As a lawyer it is the sort of judgment you like to read.

— bill morgan (@Belisarius2020) August 27, 2024

As seems to be a habit with these decisions some of the juiciest parts are in the… https://t.co/PW4c3jDQwB pic.twitter.com/UkNnOqsPSY

- An appeal could make or break the legal clarity of XRP as a non-security, therefore, traders have their eyes peeled for the regulator’s next move.

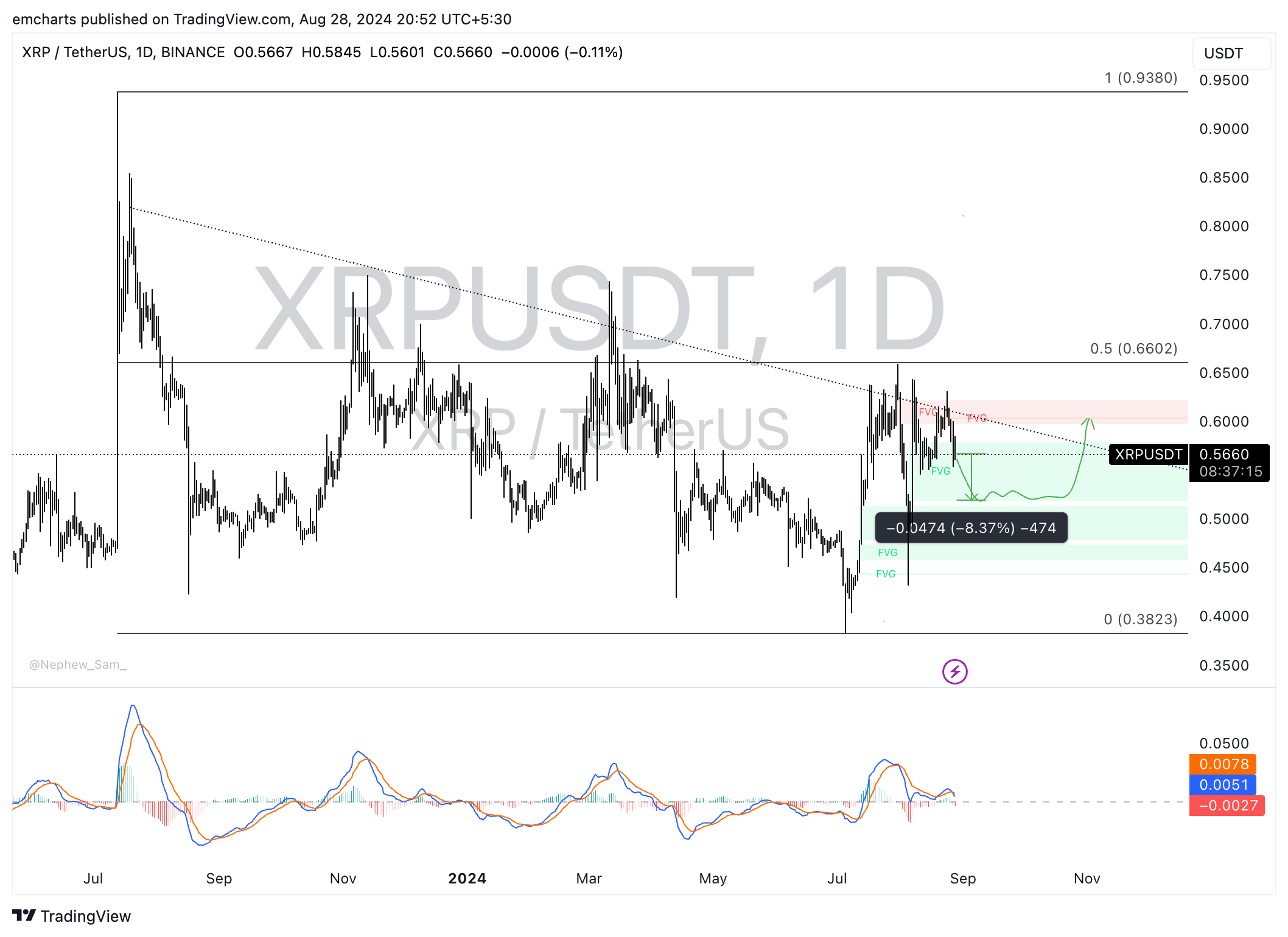

Technical analysis: XRP could dip nearly 9%

While XRP recovered from the recent correction earlier this week, the altcoin looks primed for a nearly 8.37% decline. XRP could dip to the lower boundary of the Fair Value Gap (FVG) at $0.5188, a key support level for the asset.

The Moving Average Convergence Divergence (MACD) indicator shows red histogram bars under the neutral line, meaning there is an underlying negative momentum in XRP price trend.

XRP/USDT daily chart

If a daily candlestick closes above $0.5785, it could invalidate the bearish thesis. XRP could rally toward the psychologically important $0.6000 level seen in the XRP/USDT daily chart.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies