Ethereum trumps Bitcoin in BlackRock ETF inflow, eyes double-digit gains

- BlackRock’s Ethereum ETF inflow surpassed Bitcoin by nearly $40 million on Tuesday.

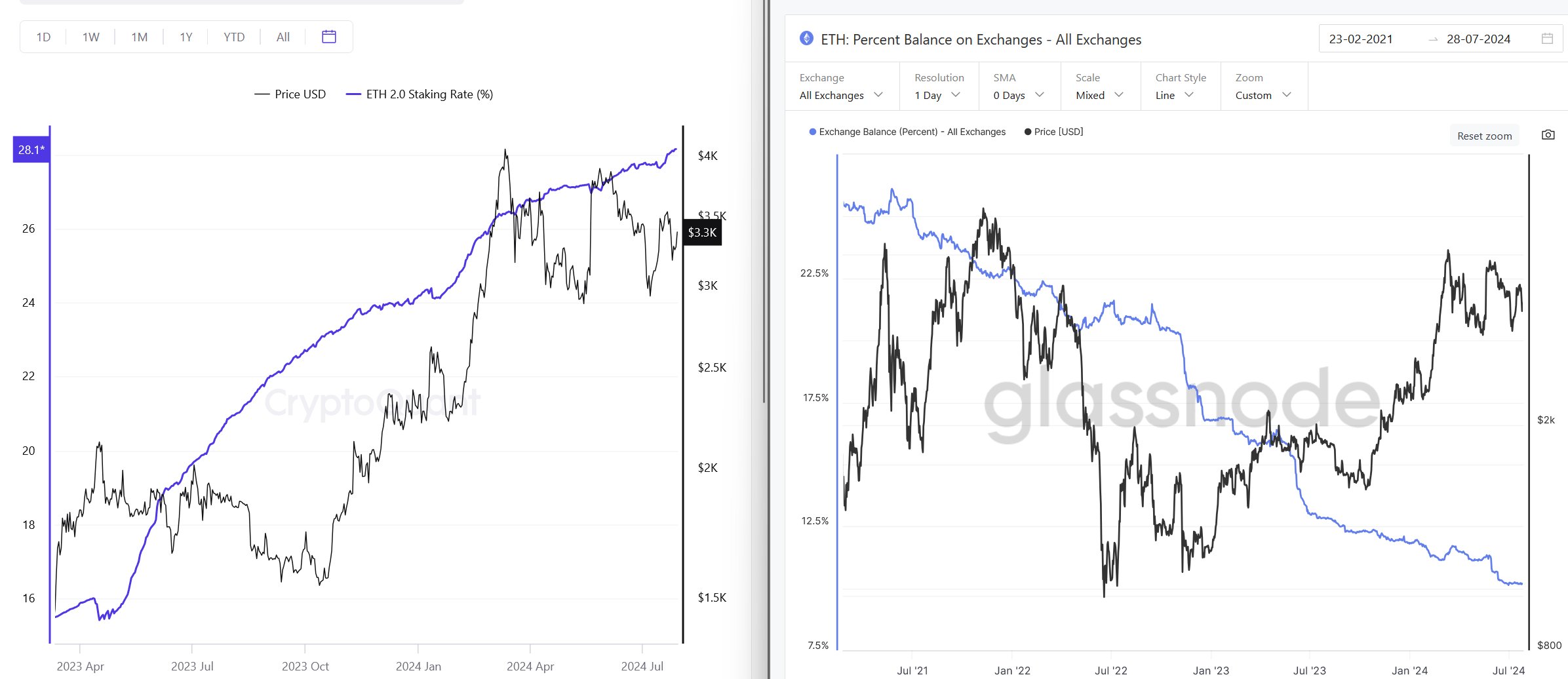

- Ethereum staked supply hits 28%, with only 10% of the supply on exchanges, hinting at reduced selling pressure.

- Ethereum sustains above support at $3,300, eyes double-digit gains.

Ethereum (ETH) hit its 2024 peak of $4,093 on March 12, and since then the altcoin has consolidated under this level. After weeks of struggling to make a comeback above key resistance at $3,500, Ether is primed for a recovery, per on-chain data.

On-chain metrics and data on BlackRock’s ETF inflows are two key market movers that support Ethereum’s bullish thesis.

Three reasons why Ethereum could rally 15%

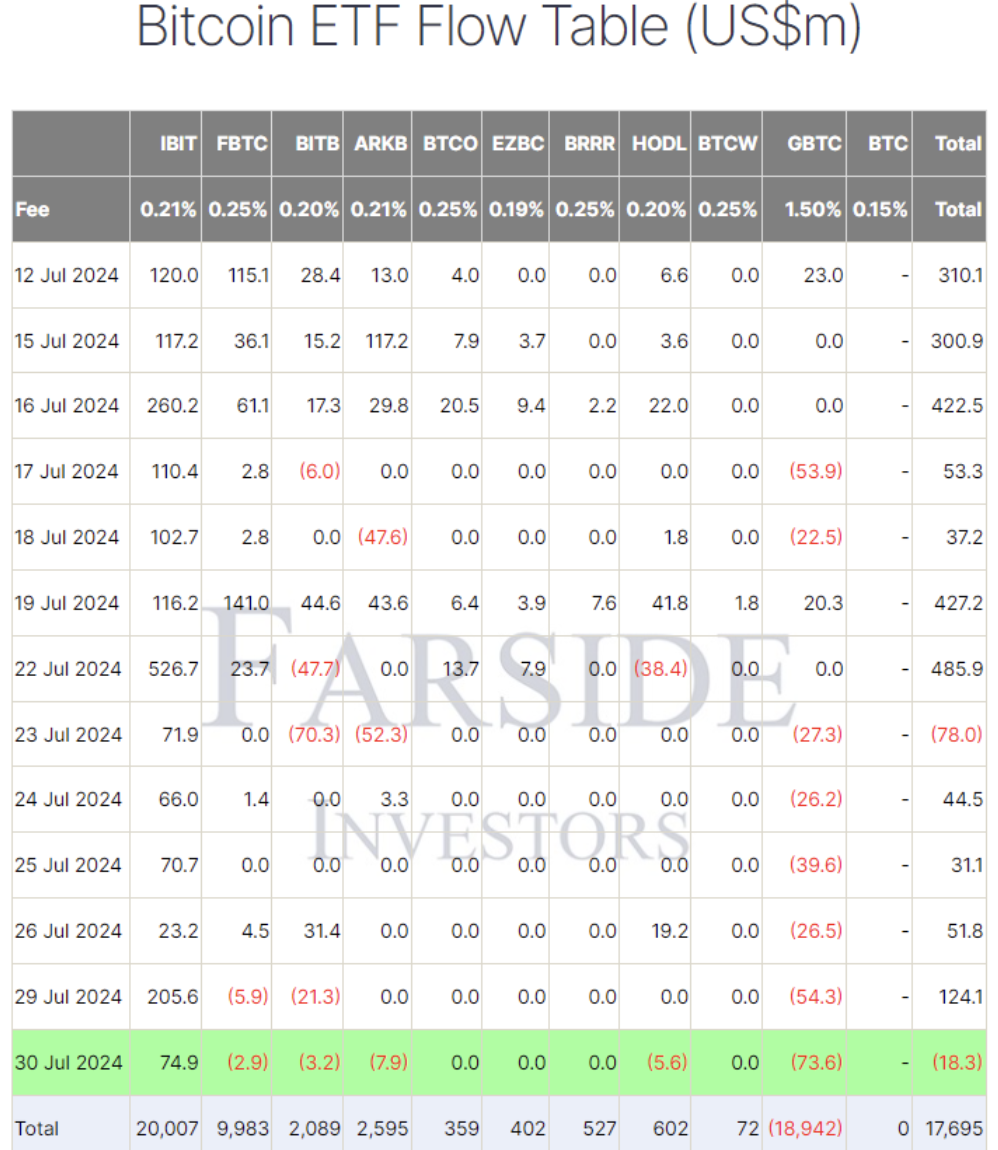

Asset management giant BlackRock’s Ethereum ETF (ETHA) observed $118 million in inflows on Tuesday, July 30. The issuer’s Bitcoin ETF (IBIT) attracted $74.9 million in inflows, nearly $40 million less than Ethereum.

Bitcoin and Ethereum ETF inflows data by Farside

Ethereum captured the lion’s share of institutional demand, per FarSide data. Additionally, there are other on-chain metrics that point to the altcoin’s recovery.

After struggling under sticky resistance at $3,500 for weeks, on-chain metrics show Ether is primed for a rally.

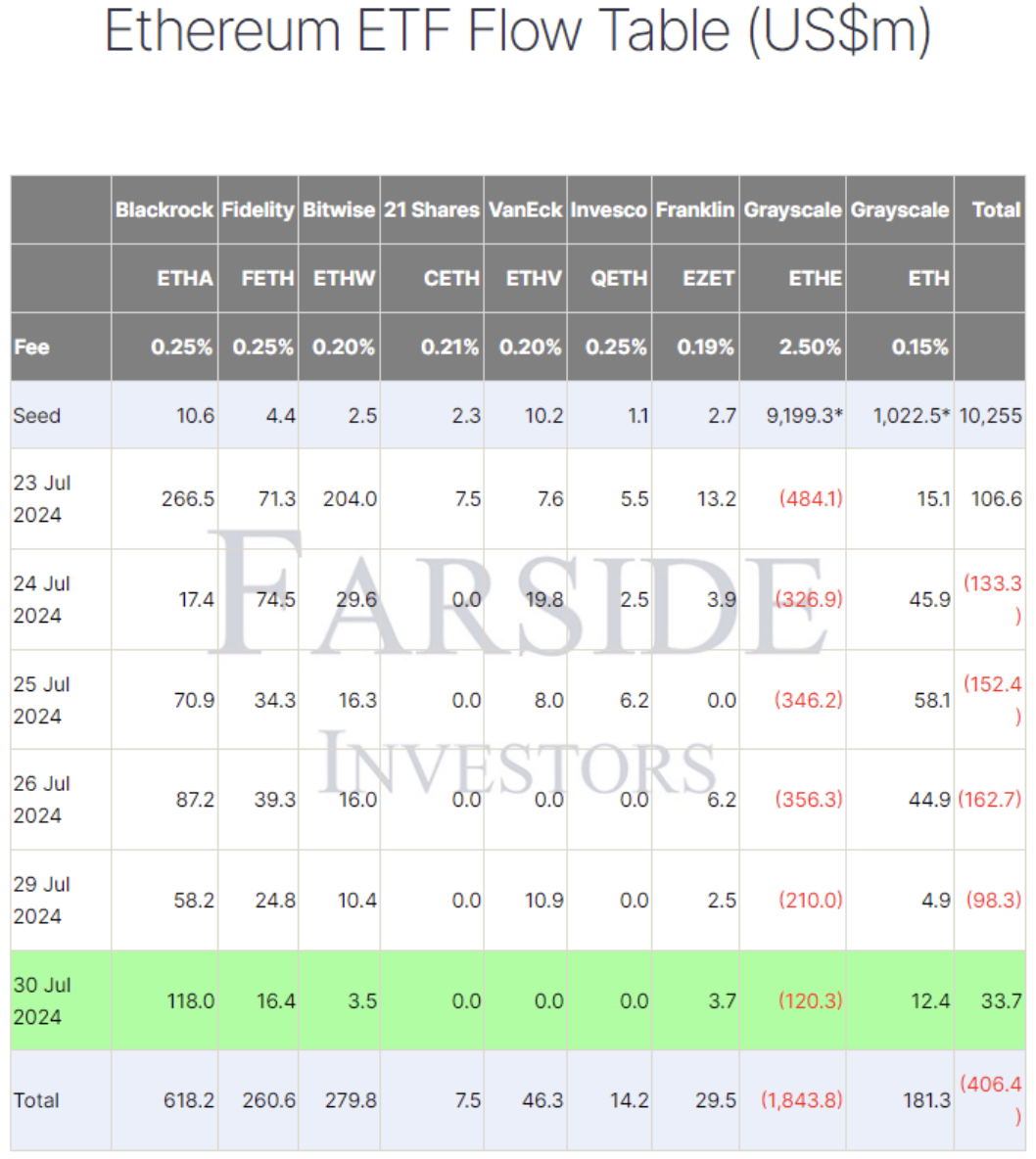

Ethereum supply on exchanges has declined swiftly. Data from crypto intelligence tracker Glassnode shows that 28% of Ether supply is staked and a mere 10% is on exchanges. The relatively low share of Ether held in exchange wallets implies lower selling pressure and room for a rally in the altcoin.

Ethereum balance on exchanges and supply staked

Ethereum’s supply distribution chart on Santiment shows that Ether whales holding between 100,000 and 100 million ETH have increased their holdings in the past week, starting July 23. In the same timeframe, smaller whale cohorts holding between 1,000 and 100,000 Ether have distributed.

This implies larger whale cohorts are accumulating, likely anticipating gains.

[15.49.00, 31 Jul, 2024]-638580209477716669.png)

Ether price and different whale cohorts

Ethereum could rally 15%

Ethereum trades at $3,318 on Binance, as seen in the ETH/USDT daily chart. Ether broke out of its downward trend on July 15, and the altcoin is rallying towards resistance at $3,500.

Ether could extend gains by 15.16% and hit the $3,819 target – the 78.6% Fibonacci retracement of the decline from the March 12 peak of $4,093 to the July 5 low of $2,810. The altcoin faces resistance at $3,451 (the 50% Fibonacci placeholder) and the Fair Value Gap (FVG) between $3,389 and $3,342.

ETH/USDT daily chart

If Ethereum closes under $3,300, the 38.2% Fibonacci retracement level, it could invalidate the bullish thesis. Ether could find support at $3,113 and the psychological support level of $3,000.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.