Japanese Yen strengthens further as recession fears boost safe-haven demand

- The Japanese Yen continues to benefit from US tariffs-inspired global flight to safety.

- Hopes for a US-Japan trade deal further underpin the JPY amid sustained USD selling.

- The divergent BoJ-Fed expectations support prospects for deeper USD/JPY losses.

The Japanese Yen (JPY) buying remains unabated for the second straight day on Wednesday as investors continue to take refuge in the traditional safe-haven currency amid concerns about a tariffs-driven global recession. Moreover, reports that US President Donald Trump has agreed to meet Japanese officials to initiate trade discussions following a phone call with Japan's Prime Minister Shigeru Ishiba fuel optimism about a possible US-Japan trade deal. This, along with expectations that the Bank of Japan (BoJ) will continue raising interest rates on the back of broadening domestic inflation, also underpins the JPY.

Meanwhile, hawkish BoJ expectations mark a big divergence in comparison to rising bets for more aggressive interest rate cuts by the Federal Reserve (Fed). This, in turn, would result in the further narrowing of the rate differential between Japan and the US, which, in turn, is seen as another factor driving flows towards the lower-yielding JPY. Apart from this, the prevalent US Dollar (USD) selling bias drags the USD/JPY pair closer to the 145.00 psychological mark during the Asian session. Traders now look to FOMC meeting minutes for some impetus ahead of US consumer inflation figures on Thursday.

Japanese Yen bulls retain control amid rising global trade tensions, BoJ rate hike bets

- Mounting worries that US President Donald Trump’s sweeping tariffs would push the US, and possibly the global economy, into recession this year have led to an extended sell-off in equity markets worldwide. In fact, the S&P 500 registered its steepest four days of losses since the 1950s after Trump unveiled sweeping reciprocal tariffs late last Wednesday.

- Japan's Prime Minister Shigeru Ishiba and Trump agreed to keep dialogue open to address the pressing levy issues. Moreover, Trump told reporters that we have a great relationship with Japan and we're going to keep it that way. This fuels optimism about a possible US-Japan trade deal, which lends additional support to the safe-haven Japanese Yen.

- Investors have pared their bets that the Bank of Japan will hike interest rates at a faster pace amid concerns about the potential economic fallout from Trump's trade tariffs. However, BoJ Deputy Governor Shinichi Uchida said last Friday the central bank will keep raising interest rates if the chance of underlying inflation achieving its 2% target heightens.

- Meanwhile, investors now seem convinced that a tariffs-driven US economic slowdown would put pressure on the Federal Reserve to resume its rate-cutting cycle. According to the CME Group's FedWatch Tool, the markets are currently pricing in over a 60% chance that the US central bank will lower borrowing costs at the next policy meeting in May.

- Moreover, the Fed is expected to deliver five interest rate cuts by the end of this year despite expectations that Trump's tariffs will boost inflation. This, in turn, weighs on the US Dollar for the second straight day and keeps the USD/JPY pair within striking distance of its lowest level since October 2024 touched last Friday.

- Traders now look forward to the release of FOMC meeting minutes, due later during the US session this Wednesday. Apart from this, the US Consumer Price Index (CPI) and the Producer Price Index (PPI) on Thursday and Friday, respectively, might provide cues about the Fed’s rate-cut path. This, in turn, will drive the buck and USD/JPY.

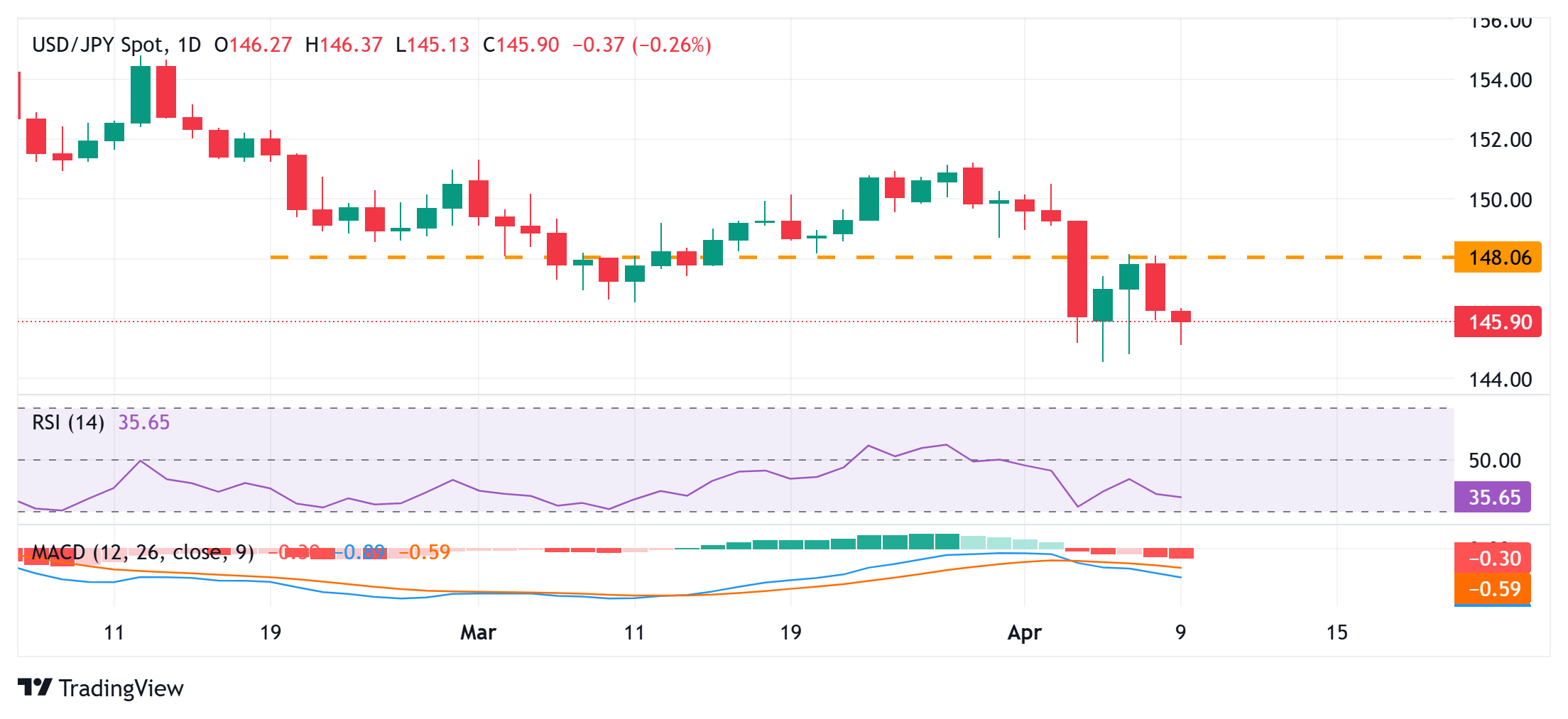

USD/JPY seems vulnerable to retesting a multi-month low, around the 144.55 region

From a technical perspective, this week's failure to find acceptance above the 148.00 mark and the subsequent fall favors bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone, suggesting that the path of least resistance for the USD/JPY pair is to the downside. Some follow-through selling below the 145.00 psychological mark will reaffirm the negative outlook and expose the year-to-date low, around the 144.55 region touched on Monday, before spot prices eventually drop to the 144.00 round figure.

On the flip side, the 146.00 mark now seems to keep a lid on any attempted recovery. This is followed by the Asian session high, around the 146.35 region, above which a bout of a short-covering could lift the USD/JPY pair to the 147.00 round figure en route to the 147.40-147.45 area. The subsequent move-up should allow bulls to reclaim the 148.00 mark and test the weekly top, around the 148.15 zone. A sustained strength beyond the latter might shift the near-term bias in favor of bullish traders and pave the way for some meaningful appreciating move.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.