BoE set to shelve interest rate cuts as US tariff narrative leads to uncertainty

- The Bank of England is expected to hold its policy rate at 4.50%.

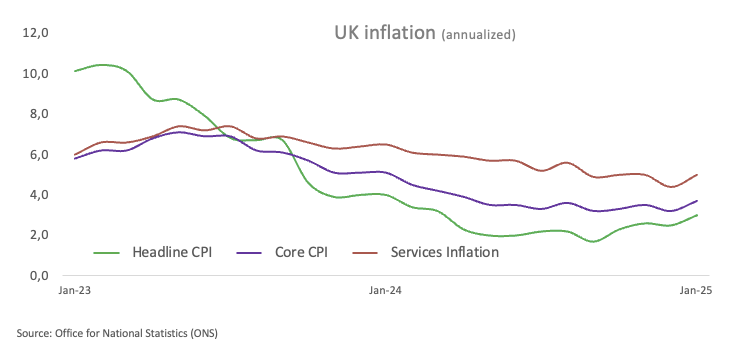

- UK inflation figures remain well above the BoE’s target.

- GBP/USD extends its rally past the psychological 1.3000 barrier.

The Bank of England (BoE) is set to reveal its monetary policy decision on Thursday, marking the second meeting of 2025.

Expectations are high among market watchers that the central bank will keep its benchmark rate at 4.50%, following a 25 basis point reduction in the previous month.

Alongside the decision, the BoE will publish the meeting Minutes, and Governor Andrew Bailey will hold a press conference to shed light on the reasoning behind the move.

Barring any surprises in the interest rate decision, all eyes will then shift to the bank’s forward guidance and economic outlook.

UK economic outlook: Stubborn inflation, fading growth

The Bank of England (BoE) lived up to expectations in February, delivering a hawkish rate cut backed unanimously by the nine-member Monetary Policy Committee (MPC).

Meanwhile, fresh data from the Office for National Statistics (ONS) revealed an unexpected uptick in the UK’s annual headline inflation, which climbed to 3.0% in January from 2.5% in December. Core inflation, which excludes food and energy costs, also rose, hitting 3.7% over the last 12 months.

In addition, growth figures painted a less optimistic picture. The UK’s Gross Domestic Product (GDP) unexpectedly shrank by 0.1% in January. Furthermore, downbeat Industrial and Manufacturing Production data also added to the gloomy picture, while the S&P Global Manufacturing PMI remained stuck in contraction territory during the same month.

Following these disheartening prints, the swaps market now sees around 56 basis points of easing by the BoE through year-end.

At the BoE’s latest monetary policy gathering, Governor Andrew Bailey explained that global economic uncertainty played a key role in the decision to add the word "careful" to the bank's future interest rate guidance.

At a news conference, he remarked that this uncertainty was "two-sided" — suggesting it could either hinder the disinflation process or, conversely, accelerate it.

"It could lead to conditions which actually make the path of disinflation less assured," Bailey noted, before adding that it "frankly could also... lead to conditions which have the opposite effect and lead to it being a faster path for disinflation."

How will the BoE interest rate decision impact GBP/USD?

As previously mentioned, investors widely anticipate the BoE keeping its interest rate unchanged on Thursday at 12:00 GMT.

With that in mind, the British Pound (GBP) will likely stand pat to the decision, but it could show some reaction to how rate-setters vote. Investors will also pay close attention to Governor Andrew Bailey’s remarks.

Ahead of the event, GBP/USD managed to trespass, albeit briefly, the psychological 1.3000 barrier, with the pair closely following USD dynamics as well as developments in the US tariff narrative.

Pablo Piovano, Senior Analyst at FXStreet, noted that GBP/USD managed to break above the critical 1.3000 hurdle earlier in the week, coming under some renewed downside pressure since then.

“Once Cable clears its 2025 high of 1.3009 (set on March 18), it could embark on a potential visit to the November 2024 top at 1.3047”, Piovano added.

“On the downside, the 200-day SMA at 1.2795 serves as the initial safety net, supported by the transitory 100-day SMA at 1.2621 and the weekly low of 1.2558 (February 28). If selling pressure accelerates, the pair could dip toward the 55-day SMA at 1.2552, followed by deeper support at the February trough of 1.2248 (February 3) and the 2025 bottom at 1.2099 (January 13)”, Piovano concluded.

Economic Indicator

BoE Minutes

The minutes of the Bank of England (BoE) Monetary Policy Committee (MPC) meetings are published alongside the committee decision. The minutes give a full account of the policy discussion, including differences of view among members. They also record the votes of each member of the MPC. Generally speaking, if the BoE is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the GBP.

Read more.Next release: Thu Mar 20, 2025 12:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Bank of England

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.