Solana price in danger zone: FTX's $23M SOL liquidation offsets US CPI and PPI gains

- Solana price drops below the $125 support level on Thursday, down 4% in the last 24 hours

- On Wednesday, wallets linked to FTX and Alameda Research unstaked $23 million worth of SOL ahead of impending creditor repayments.

- Early reactions in the derivatives market suggest Solana’s rebound momentum may weaken.

Solana’s price is dipping 5% on Thursday as bears forced another breakdown below the critical $125 support. The timing of the decline coincided with large amounts of SOL being unstaked in preparation for FTX creditor payouts, reinforcing bearish sentiment.

Solana (SOL) price plunges under $125 support as bears tighten grip

Solana’s price action over the past 24 hours has been underwhelming. Despite a 0.26% increase in the aggregate crypto market cap on Thursday, Solana, Bitcoin (BTC) and Ethereum (ETH) were among the top-ranked assets with mild losses.

Solana Price Analysis | March 12

The chart above illustrates how SOL initially rallied 17.3% on Wednesday, reclaiming ground above $131 before sentiment suddenly turned bearish, triggering a sharp pullback. The reversal came amid growing concerns over renewed sell pressure from FTX-linked wallets, creating an overhang that continues to weigh on price action.

$23 Million Alameda Research transaction unsettles markets

With BTC and ETH also underperforming, market behavior suggests that traders are favoring high-risk, low-cap altcoins and memecoins, especially after the United States (US) Producer Price Index (PPI) confirmed the cooling inflation trend seen in Wednesday’s Consumer Price Index (CPI) data.

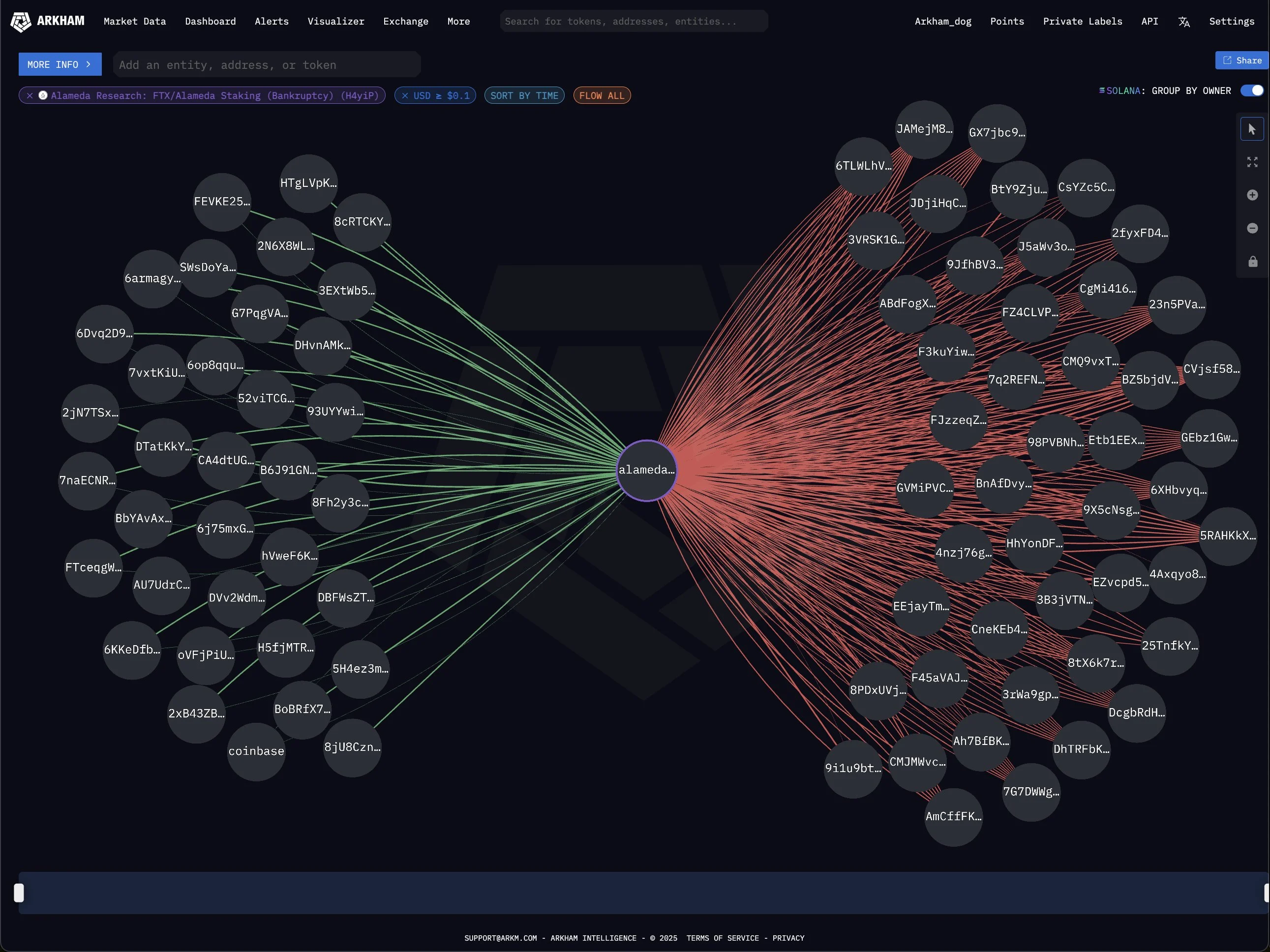

However, in Solana’s case, a more immediate catalyst appears to be at play. Blockchain analytics platform Arkham Intelligence identified a major transaction from Alameda Research, the parent company of the defunct FTX exchange, just before SOL’s downswing.

Alameda Research transfers Solana (SOL) worth $23 million into 38 address, March 12 | Source: Arkham

On-chain data reveals that Alameda unstaked over $23 million worth of SOL, a move likely tied to the FTX estate's looming creditor repayment deadlines.

"An FTX/Alameda staking address received $22.9M in SOL from a staking address unlock and has just distributed these funds to 37 addresses that have previously received SOL from this address. These addresses currently hold $178.82M in SOL."

- Arkham Intelligence, March 12, 2025

Given the scale of these transfers, market participants took a cautious stance, wary of additional SOL supply-hitting exchanges.

This internal bearish catalyst explains why SOL prices dipped 5% on the day while XRP and BNB scored considerable gains.

Why FTX liquidations could impact Solana price despite positive US CPI and PPI signals

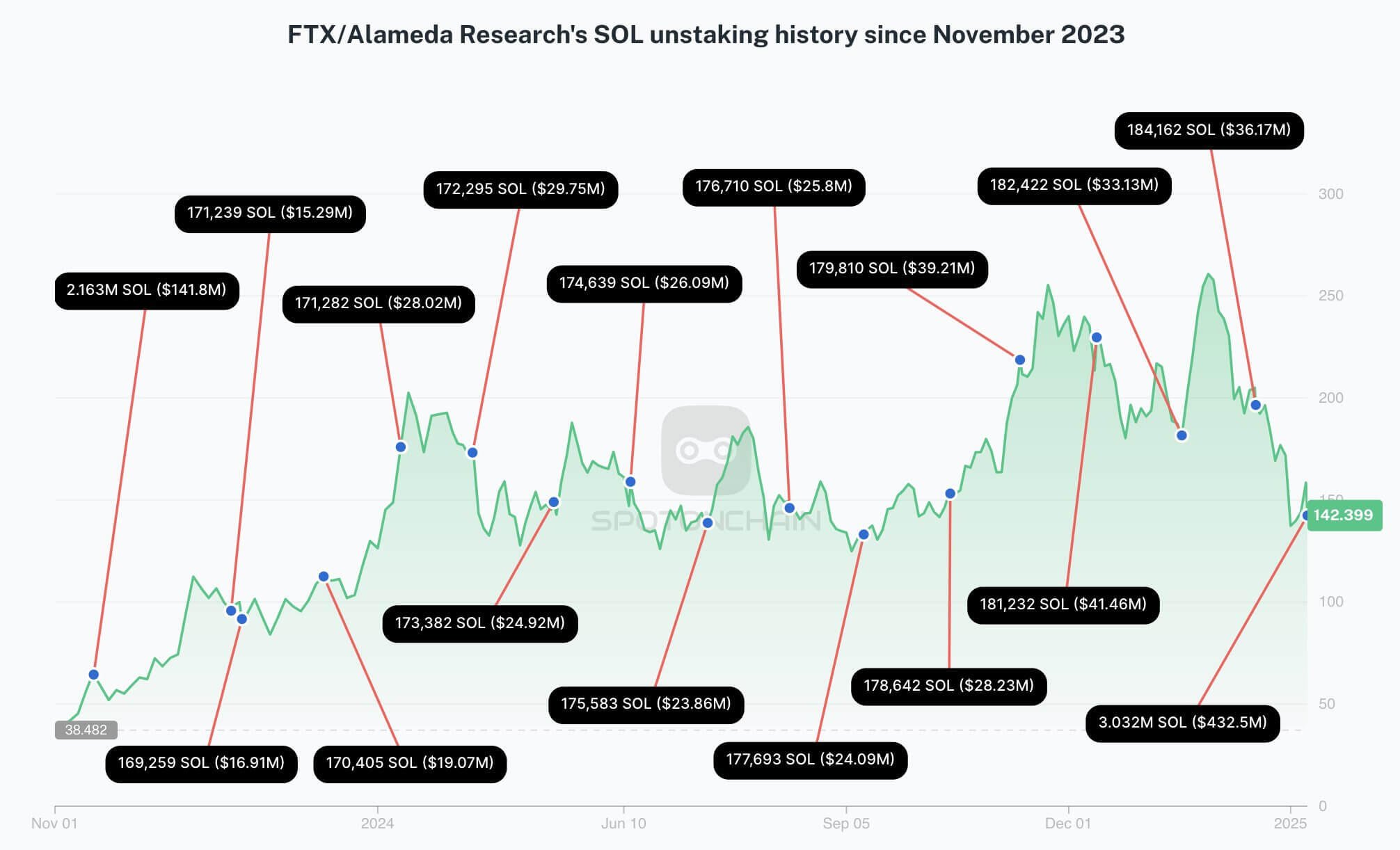

Historically, major outflows from Alameda Research and FTX-linked wallets have been followed by periods of price weakness for Solana.

SpotOnChain data shows that this latest unstaking follows an even larger event in early March when FTX unlocked 3.03 million SOL—worth approximately $432.5 million—and distributed the tokens across multiple wallets.

FTX’s Solana Unstaking History Since November 2023 | Source: SpotOnChain

Since November 2023, FTX and its trading arm have unstaked approximately 8.019 million SOL, valued at nearly $1 billion.

A substantial portion of these assets has already been liquidated through Coinbase and Binance over the past several weeks, contributing to Solana’s relative underperformance.

This impact was particularly evident in early March, when Solana gained just 14% in a two-day rally—significantly lagging ADA and XRP, which surged 100% and 40%, respectively, after Donald Trump announced their inclusion in his proposed Crypto Strategic Reserve alongside BTC and ETH on March 2.

Solana price outlook

Despite improving macroeconomic conditions, Solana’s upside potential remains constrained by the persistent threat of further liquidations.

With at least 5.5 million SOL—valued at roughly $693.8 million—still under FTX and Alameda control, new entrants may be reluctant to accumulate SOL, fearing additional sell pressure.

Until this overhang is cleared, Solana’s price may struggle to gain meaningful traction, even as broader market sentiment turns increasingly bullish.

Solana technical analysis: Elliott Wave pattern hints at $112 reversal

Solana price hovers near $123 as traders digest bearish momentum triggered by FTX liquidations.

The daily chart reveals a corrective Elliott Wave pattern, reinforcing downside risks despite broader market stability.

The ongoing ABC correction suggests SOL could extend its descent toward key Fibonacci retracement levels before a potential recovery.

Solana Technical Analysis (SOLUSD)

The Elliott Wave count highlights a completed wave (b) peak, followed by a protracted wave (c) decline.

The wave structure aligns with Fibonacci retracement levels, with the 0.398 Fib level at $112 acting as the first major support.

If selling pressure intensifies, the next bearish target sits at the 0.618 retracement near $74.62, a scenario that could materialize if liquidation pressure persists.

Momentum indicators confirm the bearish trend. The MACD line remains below the signal line, extending its downward trajectory into negative territory.

The histogram prints deepening red bars, signaling increasing downside momentum, and the moving averages reflect continued weakness, suggesting bulls lack the strength to reclaim lost ground.

Despite these bearish signals, a bullish invalidation emerges if SOL rebounds above the wave (b) high near $131.

A break above this level could shift momentum, attracting buyers and invalidating the current bearish Elliott Wave structure.

However, with more FTX payouts looming, bears could remain active to capitalize on downside risks.