Dogecoin Price Forecast: DOGE Open Interest stabilizes at $3.4B as Elon Musk Moves to purchase Liverpool FC

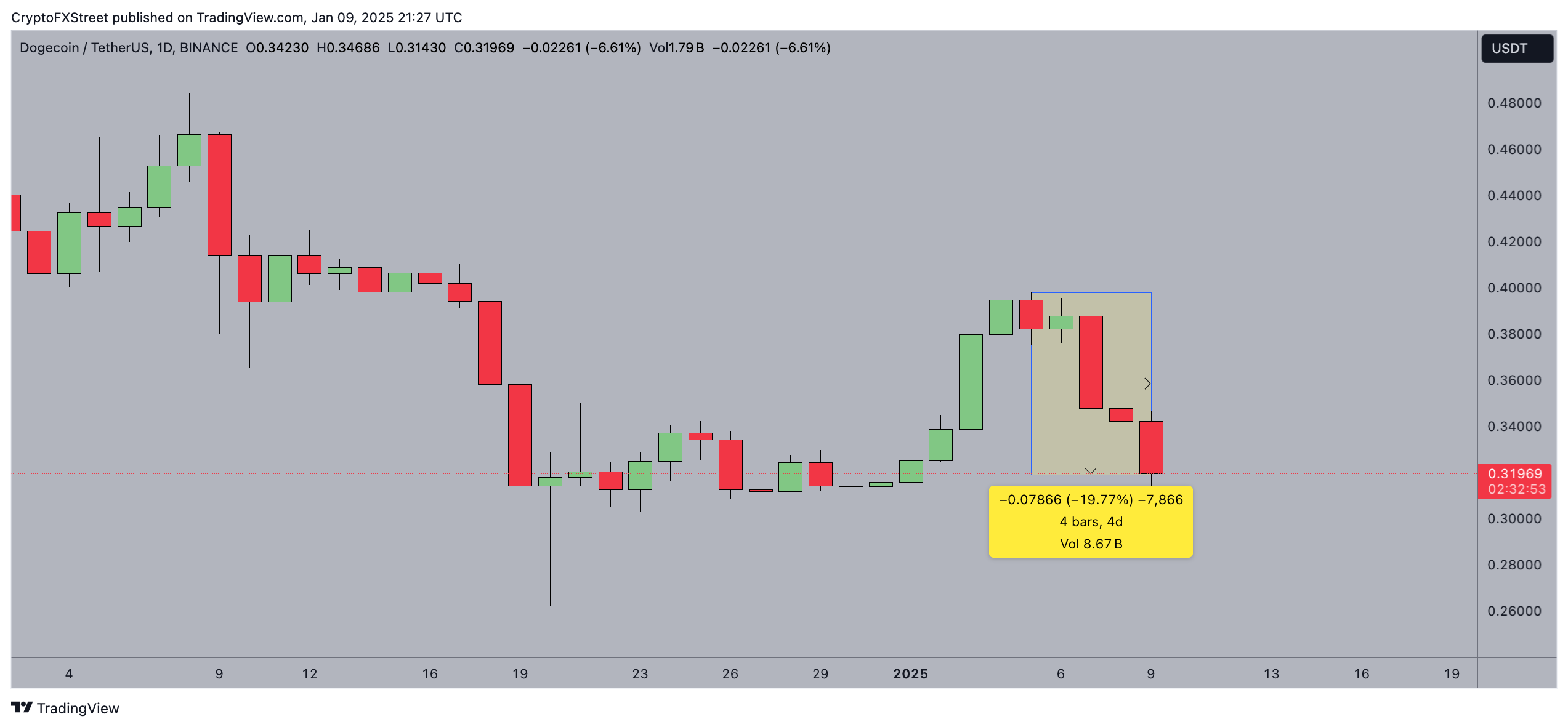

- Dogecoin price found support at $0.32 on Thursday, having declined 20% in the past four days.

- Derivative market data shows early rebound signals for DOGE as traders react to Elon Musk’s rumored interest in purchasing British soccer team, Liverpool FC.

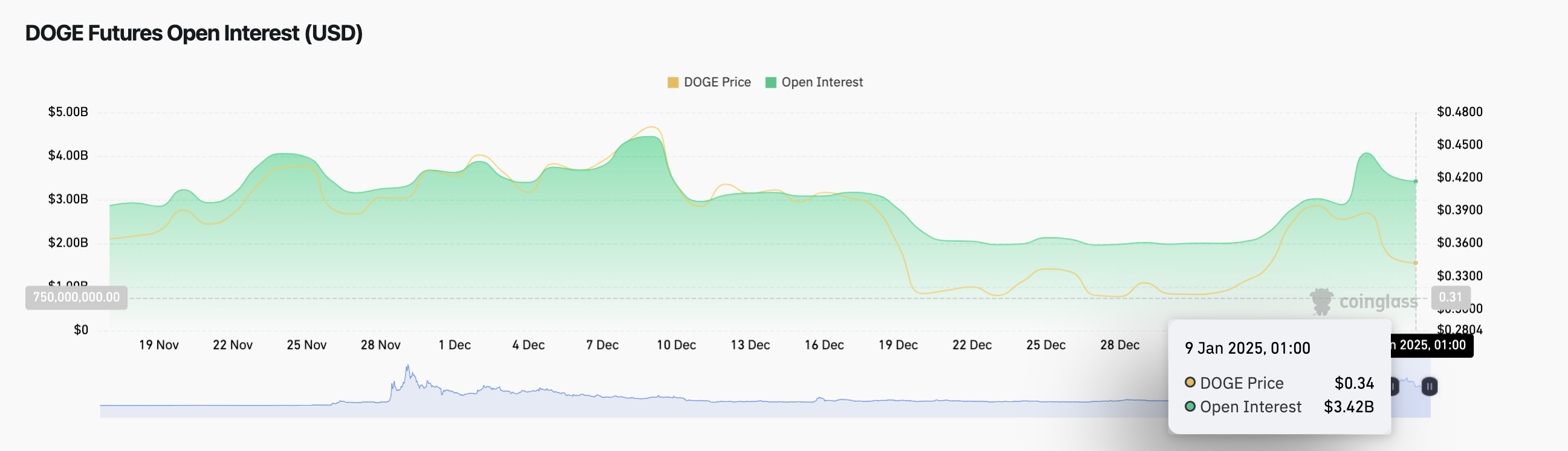

- DOGE Open Interest stabilized above the $3.4 billion market despite the $500 million liquidations tearing through the crypto market on Wednesday.

Dogecoin price stabilized around the $0.32 mark on Thursday, as the market sell-off subsided after 20% losses in 4 days. Market reports suggest Elon Musk’s rumored plan to purchase Liverpool FC could lift DOGE traders’ sentiment.

DOGE price finds support at $0.32 after 20% losses in less than week

Dogecoin price steadied around $0.32 on Thursday, halting a sharp 20% decline over the last four days.

This stabilization follows a broader market sell-off triggered by hawkish macroeconomic expectation that weighed heavily on the global memecoin market.

Notably, DOGE price managed to avoid a breakdown below $0.32, as bears extended the weekly time frame losses to 20% mark on Thursday.

DOGE’s rare show of resilience at the $0.32 support level suggests investors appear to be defending this crucial price zone.

Dogecoin price action | DOGEUSDT (Binance)

Dogecoin price action | DOGEUSDT (Binance)

One crucial factor bolstering Dogecoin market sentiment is the speculation surrounding Elon Musk's rumored plan to acquire Liverpool FC.

Musk’s historical influence on Dogecoin's price remains significant, as his business decisions and tweets have often driven retail interest in DOGE.

If confirmed, this development could reinvigorate bullish momentum, with traders anticipating Musk's involvement to bring DOGE back into the spotlight.

Dogecoin traders maintain $3.4B Open Interest despite market pullback

Dogecoin price resilience around $0.34 shows that the majority of DOGE traders remain reluctant to close out their existing positions.

An indication of this, the Coinglass Open Interest chart below shows the total value of unsettled derivative contracts with the Dogecoin futures market, offering insight into trader engagement and market liquidity.

Dogecoin Open Interest vs. DOGE price | Source: Coinglass

Dogecoin Open Interest vs. DOGE price | Source: Coinglass

The chart above shows that while Dogecoin price fell 20% between Jan 5 and January 9, open interest only declined by 16% during that period, moving from $4.07 billion to $3.4 billion at the time of publication.

When open interest declines at a slower rate than price during a market downturn, strategic traders may interpret it as an early rebound signal for two key reasons.

First, the slower decline in Open Interest suggests that a significant number of traders are holding onto their positions, anticipating a potential recovery.

Second, it highlights that leveraged traders remain active, possibly setting the stage for a short squeeze if bullish momentum returns.

While market caution persists amid macroeconomic uncertainty, DOGE’s elevated Open Interest signals that traders remain optimistic about its price recovery, amid tailwinds from Elon Musk’s proposed purchase of Liverpool FC.

Dogecoin Price Forecast: Short Squeeze could spark $0.40 breakout

Dogecoin price action continues to test the $0.318 support level, reflecting cautious sentiment among traders.

The chart reveals that Dogecoin has declined nearly 20% in four days, yet it holds above the 200-day moving average (DMA) at $0.284.

This suggests that long-term bullish traders may be attempting to establish a price floor, bolstered by its proximity to the VWAP at $0.326, which further aligns with buyer re-entry interest.

Additionally, the narrowing Volume Delta, showing -$271 million, indicates that selling pressure has waned considerably, hinting at a potential rebound.

Dogecoin price forecast | DOGEUSD

Dogecoin price forecast | DOGEUSD

In the bullish scenario, Dogecoin could break above the 50-day DMA at $0.378, signaling a recovery toward the $0.40 resistance level.

This rebound would likely be fueled by short-squeeze dynamics, given the sustained Open Interest and active leveraged positions.

However, a decisive close above the VWAP remains a prerequisite for confirming renewed bullish momentum.

Conversely, if Dogecoin fails to maintain support at the 200-day DMA, a further decline to $0.28 becomes plausible.

Increased selling pressure could amplify bearish momentum, invalidating the rebound narrative and signaling further downside risk.