Bitcoin Price Forecast: BTC bullish momentum builds as premium exceeds 9% for first time in three months

- Bitcoin price extends its gains on Wednesday, following a two-day rally of 9.75% so far this week.

- US spot ETFs recorded an inflow of $936.43 million on Tuesday, the highest since January 17.

- CME futures exposure has climbed to 140,000 BTC, with premiums exceeding 9% for the first time since January 22.

Bitcoin price (BTC) is extending its gains, trading above $94,000 at the time of writing on Wednesday, following a two-day rally of 9.75% so far this week. BTC rally gathers momentum as trade war fears ease, following US President Donald Trump’s downplaying of tensions with China.

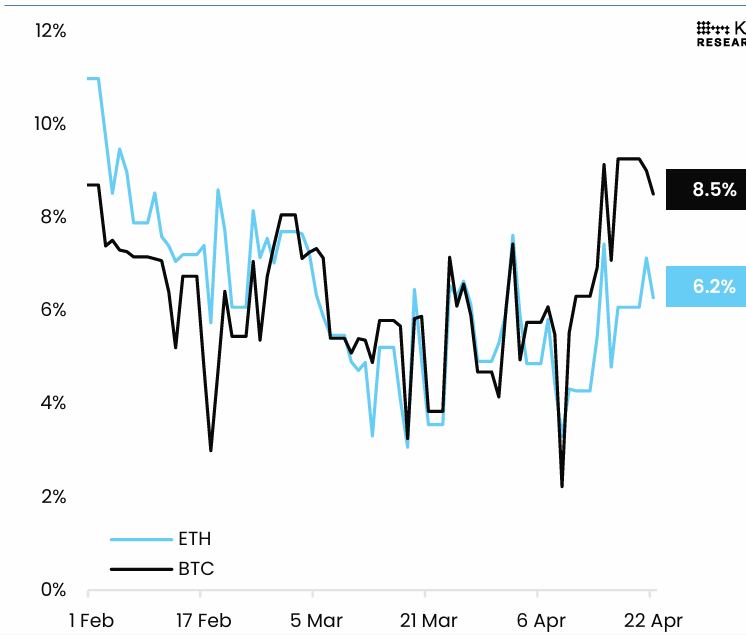

Moreover, institutional demand appears to support BTC’s recent price rally, with US spot Exchange Traded Funds (ETFs) recording an inflow of $936.43 million on Tuesday. Additionally, reports indicate that BTC CME futures exposure has increased to 140,000 BTC, with premiums exceeding 9% for the first time since January 22.

Bitcoin soars past $94,000 as Trump keeps Powell and trade war fears recede

According to a report by The Wall Street Journal on Tuesday, global markets have rallied after President Trump stated that he is not planning to fire Federal Reserve (Fed) Chair Jerome Powell. The president also said 145% tariffs on China are “very high.” “It won’t be that high,” Trump said. “It will come down substantially.”

The report further explained that the US Treasury Secretary Scott Bessent said at an investor summit that he expects the trade war with China to de-escalate and believes a deal can be reached, according to people familiar with the matter.

This announcement has eased trade war fears, supporting the risk-on sentiment, as risky assets like Bitcoin rallied 6.77% on Tuesday and closed above $93,400. At the time of writing on Wednesday, it continues to extend its gains, trading above $94,000.

Bitcoin’s CME futures surge while leveraged short positions wipe out

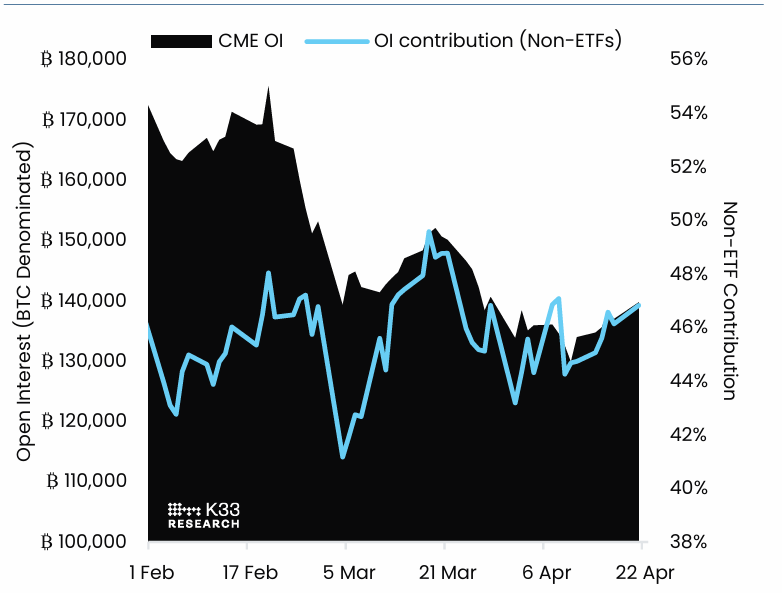

According to a K33 Research report released on Tuesday, the CME futures exposure has increased to 140,000 BTC, with premiums exceeding 9% for the first time since January 22, signaling improved sentiment and long-term demand.

The report further explained that the Open Interest (OI) increased by 5,000 BTC over the Easter period, primarily driven by an influx of activity from active market participants. This pushed open interest to three-week highs of 140,000 BTC. While this marks an uptrend in CME leverage, exposure remains relatively soft compared to late Q4 to early Q1 levels, when OI briefly surpassed 200,000 BTC.

CME BTC Futures Open Interest chart. Source: K33 Research

CME BTC and ETH Futures Annualized Rolling 1-month Basis chart. Source: K33 Research

As the risk-on sentiment prevails, due to rising open interest, CME futures, and easing trade war fears, a wave of liquidation was triggered for Bitcoin. According to the Coinglass Liquidation Map chart, in the last 24 hours, a total of $316.83 million positions were liquidated for BTC, out of which 94.8% were short positions. Huge short liquidations, like these, signal strong upward momentum and attract more buyers, thereby accelerating the Bitcoin price rally.

BTC Liquidation Map chart. Source: Coinglass

Bitcoin institutional demand shows strength

According to the SoSoValue data, the US spot Bitcoin ETF recorded a net inflow of $936.43 million on Tuesday, the highest daily inflow since January 17, after an inflow of $381.40 million the previous day. These inflows are a positive sign for Bitcoin, indicating a rise in institutional demand. If these inflows continue and intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

BTC bulls are aiming for $95,000 before potentially reaching $97,000

Bitcoin price faced multiple rejections around its 200-day Exponential Moving Average (EMA) at $85,000 since April 13. On Monday, BTC finally broke above this resistance level, rising 9.7% to close above $90,000. At the time of writing on Wednesday, it continues to extend its gains, trading above $94,000.

If BTC continues its upward momentum, it could extend the rally to test its March 2 high of $95,000 before potentially reaching $97,000, its next daily resistance.

The Relative Strength Index (RSI) on the daily chart reads 68, approaching its overbought territory of 70, but has not yet crossed it and still indicates bullish momentum. Traders should be cautious if the RSI gets rejected and moves lower, as it would indicate fading bullish momentum and could potentially lead to a correction.

BTC/USDT daily chart

On the other hand, if BTC declines, it could find support around its key level of $85,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.