Bitcoin Price Forecast: BTC could fall toward the $73,000 mark as tariffs hit the global market

- Bitcoin’s price stabilizes at around $76,000 on Wednesday after falling 3.59% the previous day.

- BTC could face volatility as Trump’s tariffs take effect on Wednesday, with China’s retaliatory duties on Thursday.

- A K33 Research report highlights that despite markets panicking, Bitcoin has shown relative resilience compared to the global equity market.

Bitcoin (BTC) price stabilizes around $76,000 at the time of writing on Wednesday after falling 3.59% the previous day. BTC could face volatility as United States (US) President Donald Trump announced tariffs go live on Wednesday, with China’s retaliatory duties on Thursday. A K33 Research report highlights that despite markets panicking, Bitcoin has shown relative resilience compared to the global equity market.

Bitcoin shows relative resilience compared to the global equity market

Bitcoin’s price saw high volatility and closed in positive territory on Monday as an immediate reaction to some fake news regarding a likely 90-day pause in the imposition of tariffs by the Trump administration after hitting a new year-to-date low of $74,508. However, BTC continued its decline by 3.59% the next day. At the time of writing on Wednesday, BTC stabilizes at around $76,000.

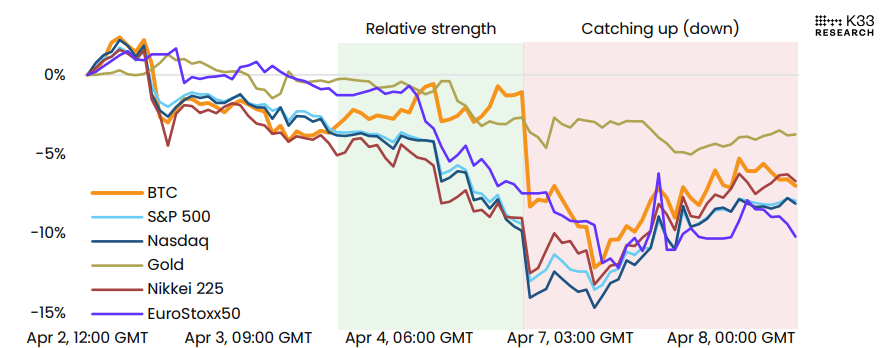

A K33 Research report on Tuesday highlights that despite markets panicking, Bitcoin has shown relative resilience while the S&P 500 saw its largest daily losses since the COVID-19 crash.

The report explains that the tariffs impact on the global economy and US equities are far from alone in facing an abnormally steep sell-off. Since the announcement, the Hang Seng index has fallen 14%, Nikkei 6%, and Eurostoxx 11%. BTC initially held strong during the first wave of selling but nosedived on Sunday and Monday, ultimately tracking equities while seeing a slight outperformance. Even gold has slipped post-announcement, underscoring the intense global dash for liquidity.

Performance since April 2 (Foreign indices USD Adjusted) chart. Source: K33 Research

The report further explains that the conditions remain rocky and uncertain. The announced tariffs are scheduled to go live on Wednesday, and China’s retaliatory duties will come into effect on Thursday.

“In their current form, they are destined to reap havoc on global consumption, justifying the market’s steep decline and raising recession risks,” says a K33 analyst.

The analyst continued: “Given the hostile tariff entry points, we expect prompt negotiations leading to lowered tariffs. Further, if equity indices continue their meltdowns, financial instabilities may erupt, forcing central banks and governments into crisis mode, leading to fiscal and monetary policy stimulus to keep the wheels running. In such environments, BTC’s scarcity offers a compelling narrative for any investor.”

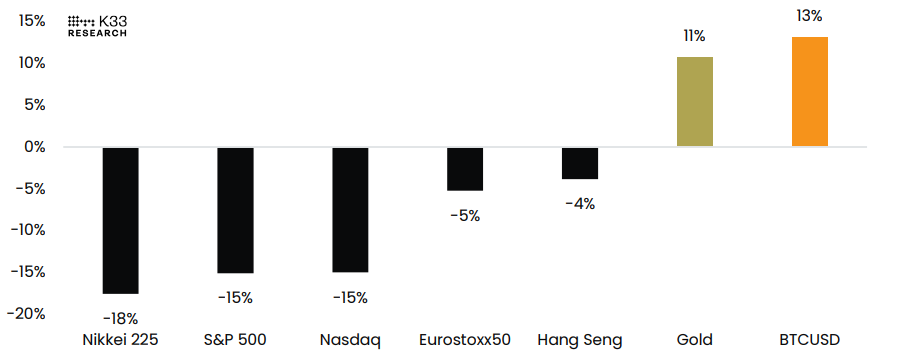

Despite Bitcoin’s 32% correction since Trump’s inauguration, which resembles the drawdown faced from March to August 2024, BTC still trades higher than it did on election day in November 5, which is in sharp contrast to equities.

The graph below shows that BTC has outperformed Gold since the election, but only with a narrow lead and a very different directional momentum over the past few months. BTC’s strength since the election may be justified by other US policy moves.

“Executive Orders covering a Strategic Bitcoin Reserve and Regulatory Clarity create a robust foundation for BTC in the medium to long term and, in our opinion, make current price levels an attractive area to buy,” says the report.

Performance since November 4 (USD Adjusted) – April 7, 13:00 CET chart. Source: K33 Research

Moreover, QCP Capital’s report on Wednesday says that the markets are now poised between two hopes, either a Trump put or a Federal Reserve (Fed) put, to provide a floor; neither looks immediately forthcoming.

The report explains that with steady unemployment and inflation showing signs of resurgence, the Fed will likely maintain current rates for the foreseeable future. This contrasts market pricing, which reflects expectations of four cuts in 2025, including speculation about a potential inter-meeting cut.

“BTC is consolidating around the $75k level, though this could unravel if equities face another sharp leg lower,” says the QCP report.

Bitcoin Price Forecast: BTC bears gain momentum, targeting the $73,000 mark

Bitcoin price was rejected from its resistance of $85,000 on April 2 and declined 10.55% until Tuesday. It reached a year-to-date low of $74,508 on Monday. At the time of writing on Wednesday, it hovers around $76,000.

If BTC continues its downward trend, it could extend the decline to test its next daily support level at $73,072.

The daily chart’s Relative Strength Index (RSI) momentum indicator is around 36, indicating strong bearish momentum and backing the negative outlook.

BTC/USDT daily chart

However, if BTC recovers and closes above its daily resistance at $85,000, it could extend the recovery rally to the key psychological level of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.