Bitcoin drops to $79K: Three reasons to brace for a BTC price crash

- Bitcoin bull market has cooled off as BTC drops under the 200-day EMA on Monday.

- Crypto expert and YouHodler executive comment on Bitcoin’s consolidation phase, warning that it can last several months.

- BTC slips to a low of $78,372, technical indicators suggest further decline is likely.

Bitcoin wipes all gains since November 10, dropping to a low of $78,372 on Monday. The top three market movers for BTC are macroeconomic developments, Donald Trump’s announcements on tariffs and the United States (US) equities performance and declining demand among institutional investors.

Bitcoin slipped under key support at the 200-day Exponential Moving Average (EMA) at $85,722. Two key momentum indicators, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), signal a further decline in Bitcoin price is likely.

RSI is sloping downwards on the daily price chart and MACD flashes red histogram bars under the neutral line, meaning that the underlying momentum in the Bitcoin price trend is negative.

BTC/USDT daily price chart

Three reasons why Bitcoin is crashing

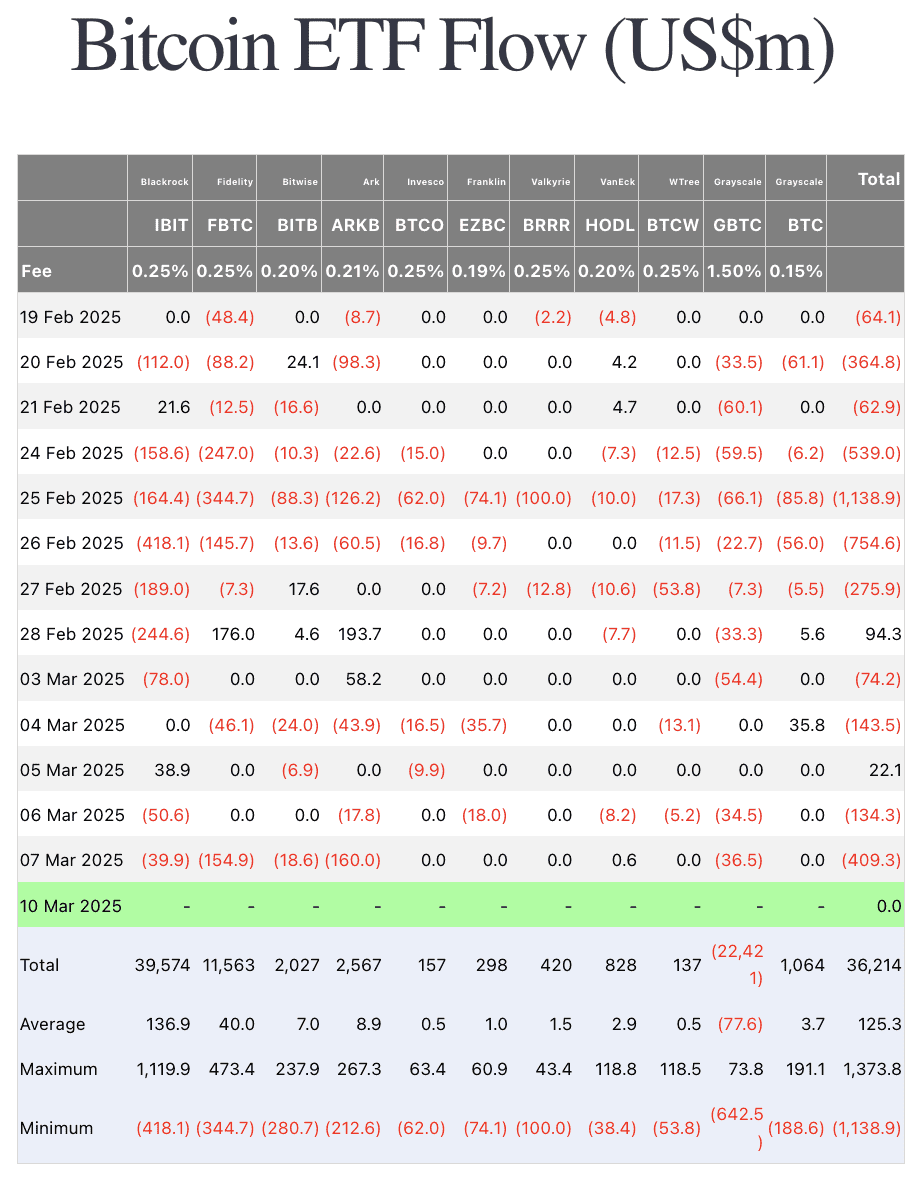

Bitcoin’s 2024 bull run was kicked off by the approval of US-based spot Bitcoin Exchange Traded Funds (ETFs). The catalyst drove the token to a new all-time high and supported the addition of BTC to the treasury and balance sheet of several institutions. However, in the recent past institutional investors have pulled capital from BTC, acting on risk-off sentiment amidst heightened volatility and Bitcoin price swings.

Data from Farside Investors shows the netflow of Bitcoin ETFs was negative for several consecutive days in the past two weeks. The statistics point to waning interest from institutions and a net outflow supports the bearish thesis for BTC.

Bitcoin ETF flows | Source: Farside Investors

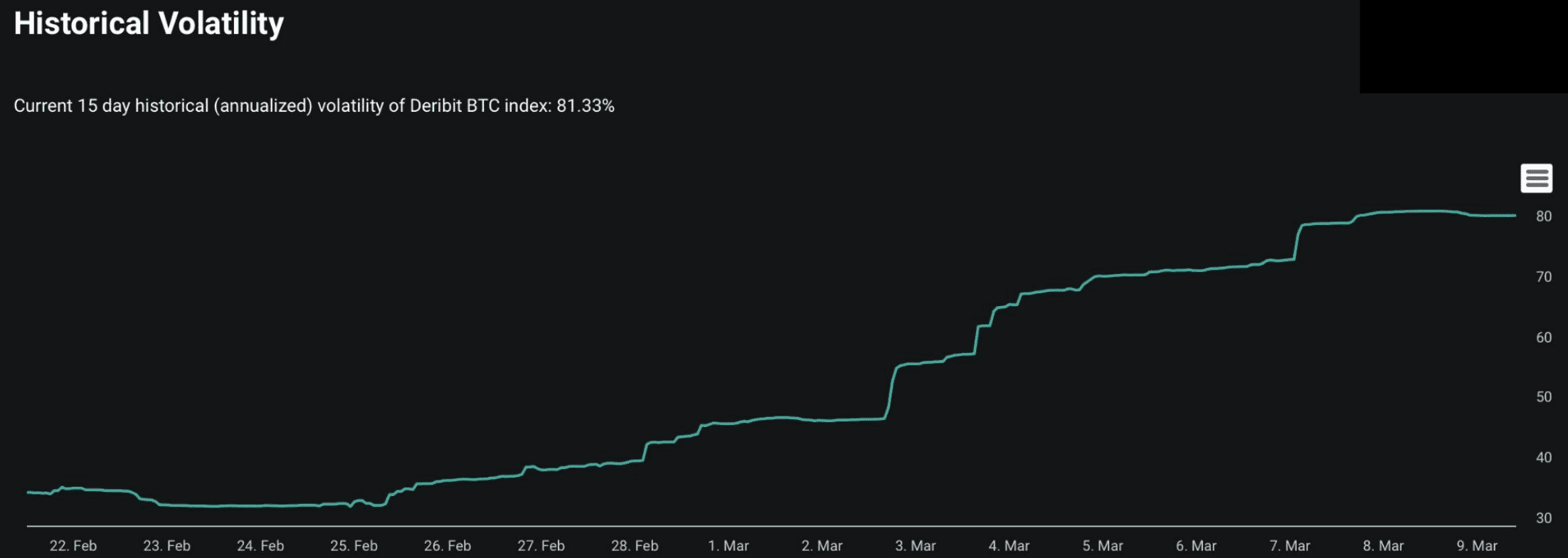

Bitfinex Alpha report published on Monday highlights the options market’s role in heightened volatility in BTC price. Analysts explain that Bitcoin has now entered a new more volatile price range between $85,000 and $92,000.

Traders in the options market contributed to the volatility with $3 billion in Bitcoin and Ethereum contracts expiring last week on Friday, driving price swings. In the report, analysts say:

“Options realised volatility surged above 80 percent, signaling heightened instability as traders reacted to shifting macroeconomic conditions. Implied volatility jumped 35.7 percent just ahead of the summit, as traders hedged positions.

Despite this, on-chain data revealed that many traders saw significant losses last week, with realised losses across market participants hitting $818 million per day, with February 28 and March 4 ranking among the largest single-day loss events in this cycle. Such widespread capitulation often precedes market stabilisation, though geopolitical and macroeconomic concerns remain a significant overhang.”

Historical volatility in Bitcoin | Source: Bitfinex Alpha Report

Bitcoin’s correlation with traditional markets is the third catalyst influencing BTC price. Ruslan Lienkha, Chief of Markets at YouHodler, commented on this market mover and explained that when viewed from the medium to long-term perspective, price trends in Bitcoin and US equities are closely aligned.

Lienkha told FXStreet:

“The crypto market is unlikely to thrive if the equity market undergoes a significant correction or downturn. While Bitcoin has the potential to evolve into a hedging asset in the future, it is currently perceived by investors as a high-risk asset, often reacting to broader market sentiment even more strongly than traditional financial markets.

The demand for short-dated put options on BTC, ETH, and SOL suggests a defensive market posture. How does this align with broader risk appetite across traditional and digital assets?

The US bond market is signaling a risk-off environment, leading to elevated selling pressure in the equity market and other asset classes, including crypto. Investor uncertainty has risen significantly over the past week. Typically, interest in options trading increases during such periods, as traders primarily use this instrument to hedge risks associated with their spot market positions.”

What catalysts can fuel a sustained recovery in Bitcoin

Lienkha says that positive economic data and inflation may fuel expectations of gradual monetary easing.

“Positive inflation and economic data can raise expectations of a gradual and controlled monetary easing policy, which may encourage capital inflows into financial markets and support crypto prices.

News about strategic reserves can certainly provide some short-term support for prices. However, sustained crypto purchases would be necessary for a meaningful long-term impact. The key issue is that the US government has not outlined concrete plans for acquiring Bitcoin. Overall, this remains a strong internal pro-growth factor for the crypto market. However, macroeconomic conditions continue to play a dominant role across all financial markets,” he added.