XRP investors enlarge realized profits to $2 billion despite potential inclusion in US crypto reserve

- XRP investors increased their total realized profits since the beginning of the week to $2 billion.

- Bullish sentiment surrounding its potential inclusion in the US strategic crypto reserve helped XRP record gains despite heavy profit-taking.

- XRP could tackle the $2.95 resistance if it holds the upper boundary of a descending channel as support.

Ripple's XRP managed to record gains on Thursday despite investors expanding their total realized profits to about $2 billion since the beginning of the week.

XRP investors continue to take profit amid potential inclusion in US crypto reserve

Several XRP investors resumed distributing their holdings following its recent rise. Investors booked over $700 million in profits on Wednesday, stretching the total realized profits since the beginning of the week to nearly $2 billion.

[22.51.52, 06 Mar, 2025]-638768969885150838.png)

XRP network realized profit/loss. Source: Santiment

Most of the distribution came from coins that investors last moved between 90 days to 180 days. Coins last moved within the 1 to 2-year cohort accounted for only a small percentage of the selling activity.

The selling is also visible across whales holding between 10M-100M XRP, who have depleted their supply by over 260 million XRP in the past 24 hours.

[22.51.58, 06 Mar, 2025]-638768970453721828.png)

XRP supply distribution. Source: Santiment

Despite the huge profit-taking, XRP has managed to hold up well, noting a 4% gain on Thursday, as most investors remained buoyed by bullish sentiments from its potential inclusion in the US crypto strategic reserve.

An inclusion in the reserve will signal an end to the long-standing headwind of its five-year legal battle with the Securities and Exchange Commission (SEC). It could also boost the chances of the agency approving XRP ETF applications. Six asset managers have filed for an XRP ETF, including Bitwise, Grayscale, Canary Capital, CoinShares, WisdomTree and 21Shares.

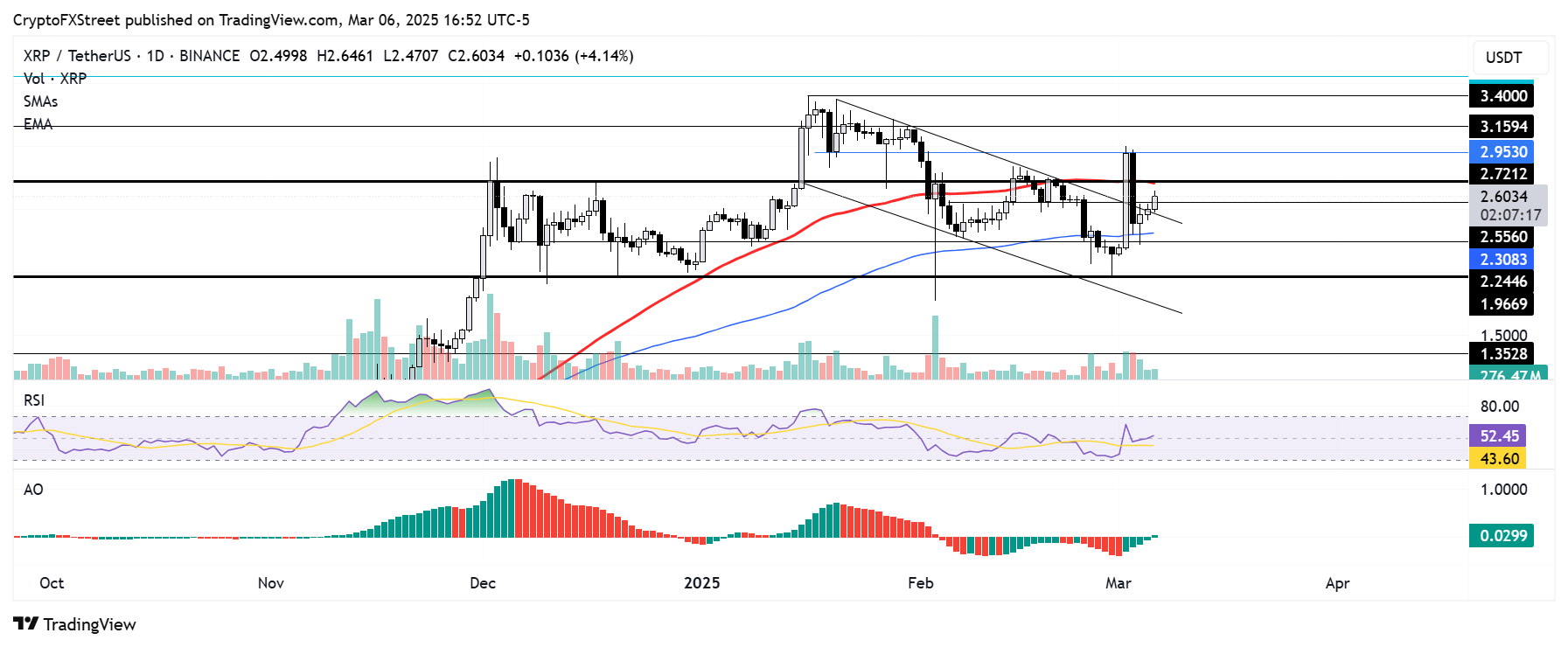

XRP could tackle $2.95 resistance if it holds descending channel’s upper boundary

XRP sustained $13.33 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $7.50 million and $5.83 million, respectively.

XRP moved above the upper boundary of a descending channel and aims to tackle the resistance near $2.72. This resistance is strengthened by the 50-day Simple Moving Average (SMA).

XRP/USDT daily chart

If XRP reclaims the $2.72 level, it will face a critical resistance near $2.95 — a level where bears mounted heavy selling pressure following XRP's rally on Sunday.

However, a rejection near $2.72 could send XRP toward $2.24 if the upper boundary of the descending channel fails to hold as support.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) are slightly above their neutral levels, indicating a mild dominant bullish momentum.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.