Bitcoin Price Forecast: BTC recovers above $92,000 ahead of first-ever White House Crypto summit

- Bitcoin price recovers above $92,000 on Thursday after rallying 5% in the last two days.

- Glassnode report highlights that Bitcoin’s market reaction hinges on the $92,000, a key level for momentum, while $71,000 serves as critical support if BTC declines.

- Traders should be cautious as the defunct cryptocurrency exchange Mt. Gox moved 12,000 BTC worth over $1 billion.

Bitcoin (BTC) extends recovery and trades above $92,000 on Thursday after rallying 5% in the last two days. A Glassnode report highlights that Bitcoin’s market reaction hinges on the $92,000, a key level for momentum, while $71,000 serves as critical support if BTC declines. Meanwhile, K33 Research highlighted that headlines surrounding US President Donald Trump continue to cause sharp market moves. Moreover, traders should be cautious as the defunct cryptocurrency exchange Mt. Gox moved 12,000 BTC worth over $1 billion.

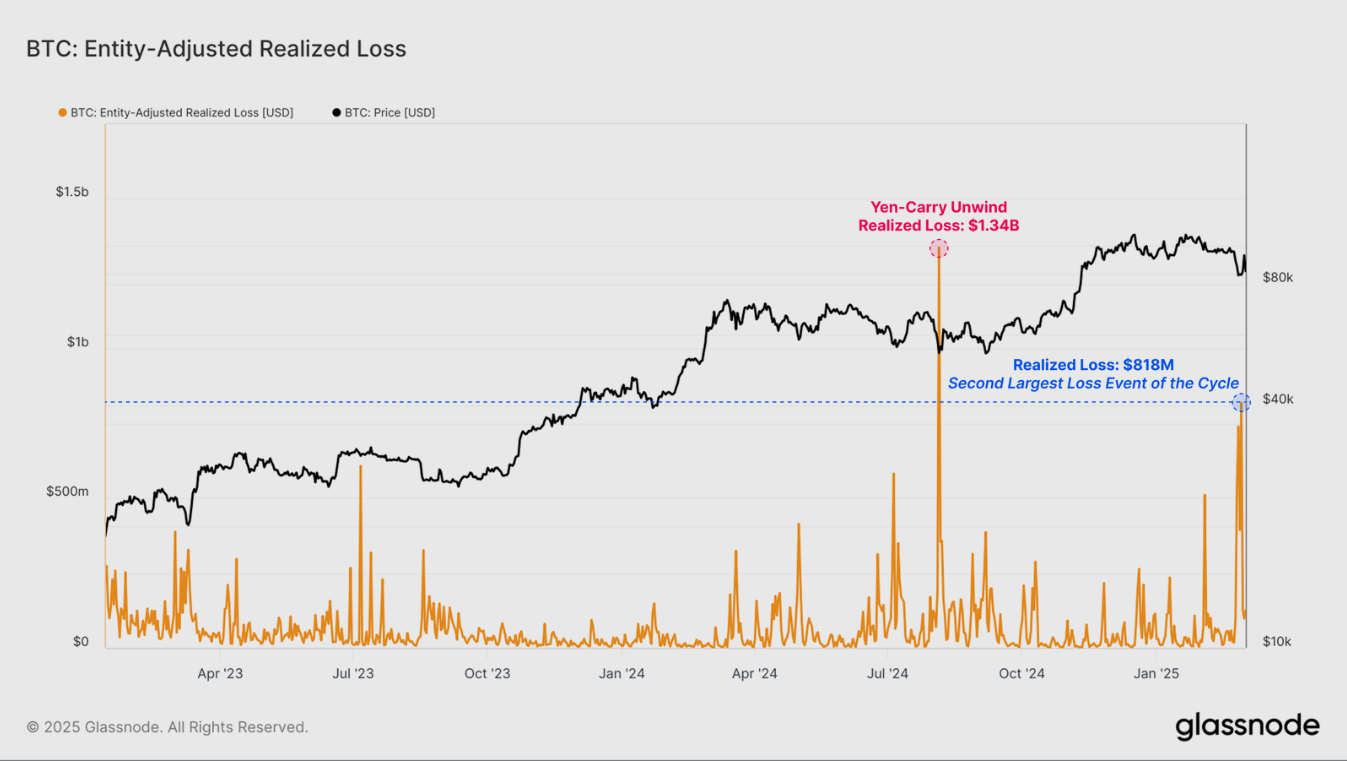

Bitcoin marks the second-largest capitulation – Glassnode Report

The Glassnode report on Wednesday highlighted that the coiling of volatility over recent months has led to a widespread price contraction across all digital assets. This has precipitated significant loss-taking events and marks the second-largest capitulation event of our current cycle, as shown in the graph below.

Bitcoin Entity-Adjusted realized loss chart. Source: Glassnode

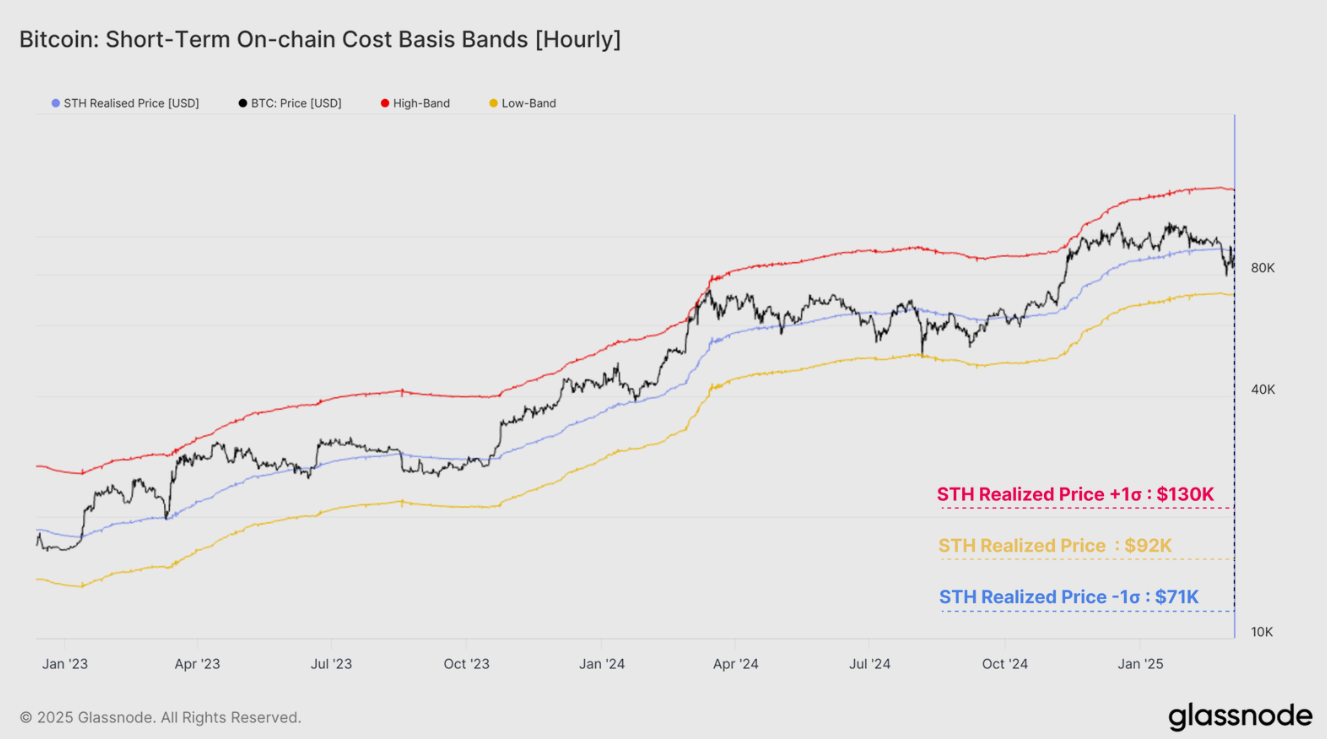

The report further explains that for the Bitcoin market, a decisive reaction is around the Short-Term Holder Cost-Basis at $92,000, which is a key level to monitor for local momentum. If BTC declines, the $71,000 would be the key support level.

“It aligns with several technical and on-chain metrics, making it an important level for the bulls to defend should it be reached,” says Glassnode’s analyst.

Bitcoin Short-Term on-chain cost basis bands (hourly) chart. Source: Glassnode

According to data from the crypto intelligence tracker Arkham, defunct cryptocurrency exchange Mt. Gox moved 12,000 BTC worth over $1 billion to a new wallet on Thursday.

Traders should be cautious as transferring such a large amount of Bitcoin to a new wallet often signals an intent to sell or distribute and can create bearish sentiment as market participants anticipate increased supply.

Trump’s headlines continue to cause sharp market moves

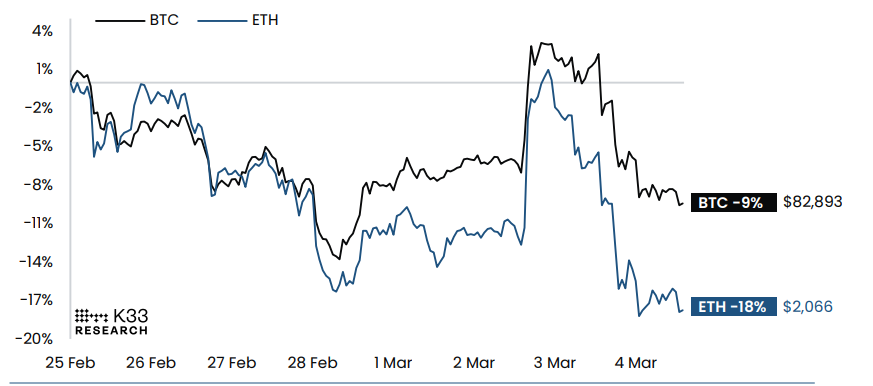

A K33 Research report on Tuesday highlighted that headlines surrounding President Trump continue to cause sharp market moves as the President pursues his tariff regime while uncertainty grows surrounding his geopolitical strategy.

The report explains that Trump’s confirmed tariffs on Canada, China, and Mexico on Tuesday, retaliatory tariffs expected on April 2, and potential European tariffs have led to a broad market de-risking, with both Nasdaq and the S&P 500 seeing their worst 2-week performances since August 2024. Moreover, Ethereum (ETH) continues its relative weakness as Lazarus Group has converted 83% of the stolen Bybit ETH to BTC via THORchain.

BTC and ETH performance chart in the last two weeks. Source: K33 Research

“We strongly believe BTC is the sole cryptocurrency that makes sense as a potential nation-state reserve asset,” says Vetle Lunde, Head of K33 Research.

Lunde continued, “Our rationale behind this belief is based on correlations, liquidity and decentralization. Correlations within the crypto market are generally high -where BTC moves, altcoins tend to follow on a higher beta. BTC suffices to diversify reserves from foreign currency reserves, gold, and SDRs at the IMF. Further, liquidity in alts is generally far weaker than in BTC, leading to significantly higher price impacts on either purchases or sales.”

The upcoming White House Crypto Summit on Friday conducted by Per AI and Crypto Czar David Sacks will share more information on the reserve.

Bitcoin Price Forecast: BTC heads towards $95,000 mark

Bitcoin price faced rejection around the $95,000 level on Sunday and declined 8.54% the next day. On Tuesday, BTC dipped below the daily support level of $85,000 but bounced and closed above it. This daily level roughly coincides with the 200-day Exponential Moving Average (EMA) at $85,760, making it a key support zone. BTC continued its recovery by 3.81% on Wednesday. At the time of writing on Thursday, it continues to recover, trading above $92,000.

If the $85,000 level holds as support, BTC could extend the recovery to retest its Sunday high of $95,000.

The Relative Strength Index (RSI) reads 49 and points upwards, indicating fading bearish momentum. The RSI must move above its neutral level of 50 to initiate a bullish momentum. Such a development would add a tailwind to the recovery rally.

BTC/USDT daily chart

However, if BTC breaks and closes below $85,000, it could extend the decline to retest its next support level at $73,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.