Binance media traction drops 103% as Trump excluded BNB from crypto strategic reserve: How will price react?

- Binance Coin price stabilizes at $560, with a 5% decline representing the smallest loss among top five crypto assets on Tuesday.

- Since Trump’s crypto strategic reserve announcement, BNB Social Volume has plunged 103% from last month's peak.

- Binance trading volumes remain elevated, with BNB attracting demand from traders seeking discounts to mitigate losses in high-volume trades.

Binance Coin (BNB) price stabilized at $560 on Tuesday, with its 9% decline representing the lowest losses among the top five crypto assets. Rising trading volumes appear to be cushioning the impact of negative market sentiment following Trump’s decision to exclude BNB from the newly established Crypto strategic reserve.

BNB price shows resilience as sellers seek trading discounts nullify Trump’s snub

Binance Coin (BNB) price has been influenced by opposing market catalysts in the past week. On the bearish side, U.S. President Donald Trump excluded BNB from the list of five assets designated for the U.S. Crypto Strategic Reserve.

Trump Announces Crypto Strategic Reserve | March 2

This decision raised concerns among investors, as BNB was the only top-five-ranked crypto asset omitted.

The reserve includes Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA).

For context, at its current market capitalization of $84 billion, BNB’s market dominance is 150% higher than Cardano, which holds a $33 billion valuation.

Why did Trump exclude BNB from the Crypto strategic reserve?

Trump’s decision to exclude BNB from the Crypto Strategic Reserve signals an intent to prioritize projects with a strong corporate presence in the U.S. Binance’s early ties to China are notable, as the exchange was founded by Chinese-born Changpeng Zhao.

Two other key reasons for the exclusion could be Binance’s recent legal troubles under the Biden administration.

The firm paid over $4.6 billion in fines, and CZ was jailed.

Although CZ was released in December 2024, Binance’s U.S. subsidiary remains embroiled in litigation with the SEC.

The exchange only recently reinstated U.S. deposit and withdrawal functionality last month.

Hence, Trump’s decision to exclude BNB may be a strategic effort to avert political backlash and avoid interfering in ongoing legal proceedings involving U.S. regulators and Binance’s U.S. subsidiary.

How did the Crypto community react to Trump’s snub?

BNB has traded sideways over the past week, reflecting lukewarm market sentiment.

Following its exclusion from the crypto reserve announcement, BNB’s weekend gains were limited to single digits.

Changpeng Zhao (CZ) led the market reactions, expressing optimism that BNB could be listed in the reserve at a later stage.

Binance Co-Founder Changpeng Zhao Reacts to Trump’s Crypto Strategic Reserve Announcement | Feb 28, 2025

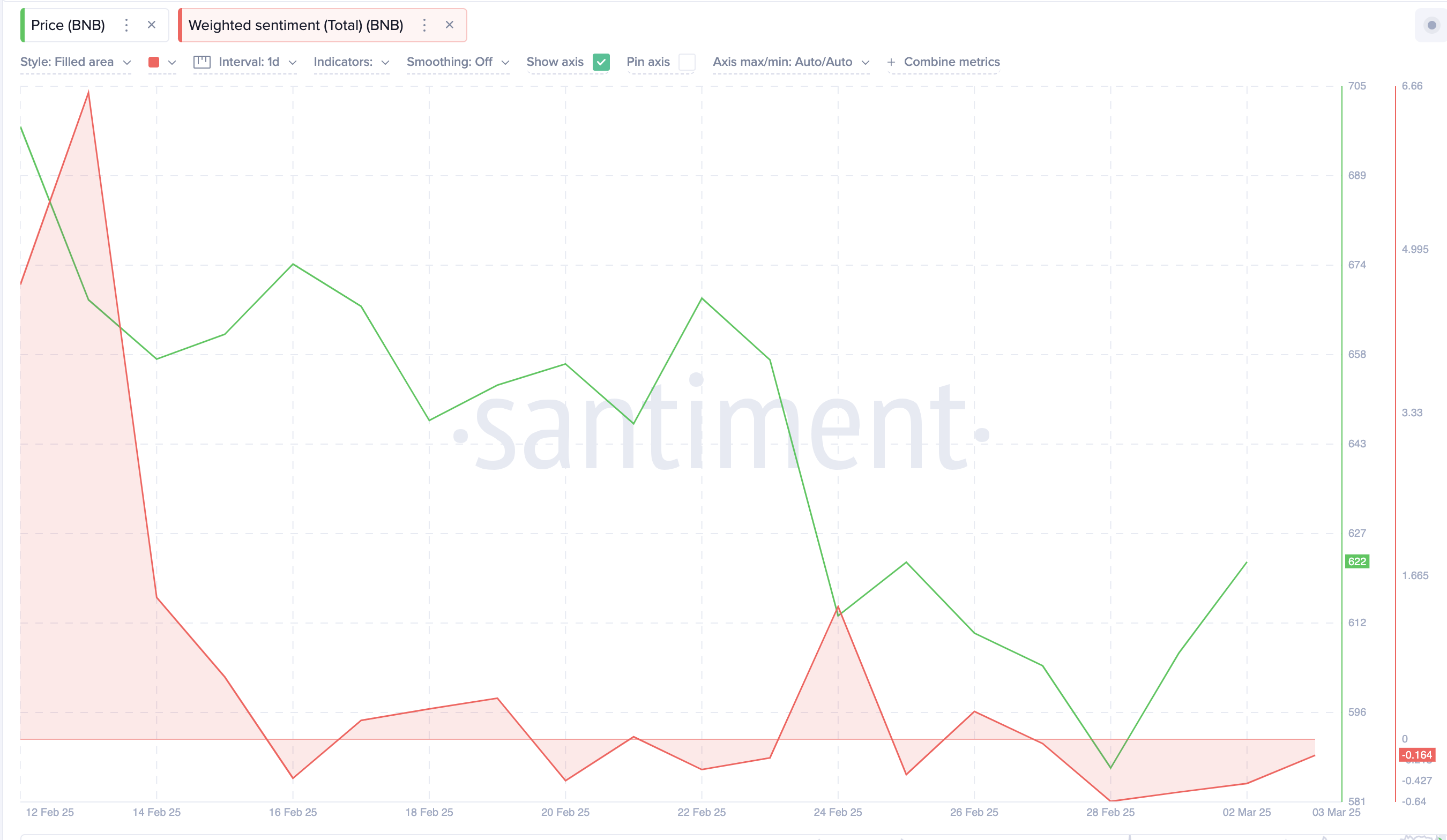

However, CZ’s optimism did not resonate across the broader market. Santiment’s Weighted Sentiment chart below tracks the balance between negative and positive comments a project receives on any given day, providing direct insights into shifts in community sentiment.

BNB Weighted Sentiment | Source: Santiment

As seen below, BNB’s weighted sentiment peaked at 6.59 on Feb. 13.

However, after Trump excluded the Binance native coin from the strategic reserve, market sentiment plunged 103%, entering negative territory at -0.16 as of March 4. This indicates that negative comments about BNB now outnumber positive discussions across various crypto media channels.

How did exclusion from the Crypto strategic reserve impact BNB price?

BNB’s exclusion from the strategic reserve has triggered a wave of negative comments, as reflected in the weighted sentiment chart.

However, another market catalyst has helped counteract the impact on BNB’s price action.

On Monday, Trump confirmed the commencement of 25% tariffs on imports from Canada and Mexico, sparking instant sell-offs across global cryptocurrency markets.

BNB Price Action – March 4

BNB Price Action – March 4

Among the top five cryptocurrencies, Binance Coin (BNB) is the only asset to post losses of less than 10% since Trump’s tariff announcement.

The rapid market sell-offs may have boosted demand for BNB as investors seek trading discounts to mitigate losses on high-volume sell orders.

BNB’s role as an exchange utility token makes it an attractive hedge during volatile periods.

Traders who hold and stake BNB receive discounts on Binance trading fees.

During periods of heightened trading activity, investors often purchase larger amounts of BNB to cover fees more efficiently while unlocking additional discounts.

This inadvertently drives up demand for exchange-native tokens like BNB during intense market sell-offs.

Supporting this stance, BNB market volumes have remained elevated in the two days following Trump’s tariff confirmation, signaling increased demand from traders leveraging Binance’s fee discount mechanisms to navigate turbulent market conditions.

BNB price forecast: Bull to maintain dominance if $550 support holds

BNB price is trading at $584.19, recovering from a recent low near $550, a critical support level that aligns with the lower boundary of the Keltner Channel.

This level has historically acted as a demand zone, preventing further downside.

If bulls defend this region, BNB could push toward the midline resistance at $618.49, with a potential extension to $685.79, where previous selling pressure emerged.

BNB price action on Tuesday shows a bullish rejection wick, signaling possible accumulation at current levels.

BNB Price Forecast

BNB Price Forecast

On the bearish side, a sustained break below $550 could open the door to further declines, with the next key support lying near $500.

The MACD indicator remains in negative territory, with the signal line below the zero mark, suggesting ongoing bearish momentum.

However, the histogram shows a reduction in selling pressure, which could hint at a reversal if bullish volume increases.

A decisive close above $618.49 would confirm strength, while failure to hold $550 may invite aggressive selling.