Crypto Today: Trump tariffs trigger $1.1B sell-off 24-hours after crypto strategic reserve proposal

- Cryptocurrencies market cap declined $410 billion on Tuesday shedding excess of all 10% gains booked after Trump’s strategic reserve announcement.

- The market dip is linked to Donald Trump’s confirmation of 25% import tariffs on Canada and Mexico.

- Bitcoin price hit $82,400 after the tariff confirmation, down 11% from the $95,000 peak recorded on Sunday.

Bitcoin (BTC) market updates:

- Bitcoin’s 13% decline in early Asian trading on Tuesday triggered a $125 billion market cap decline, wiping out gains recorded on Sunday.

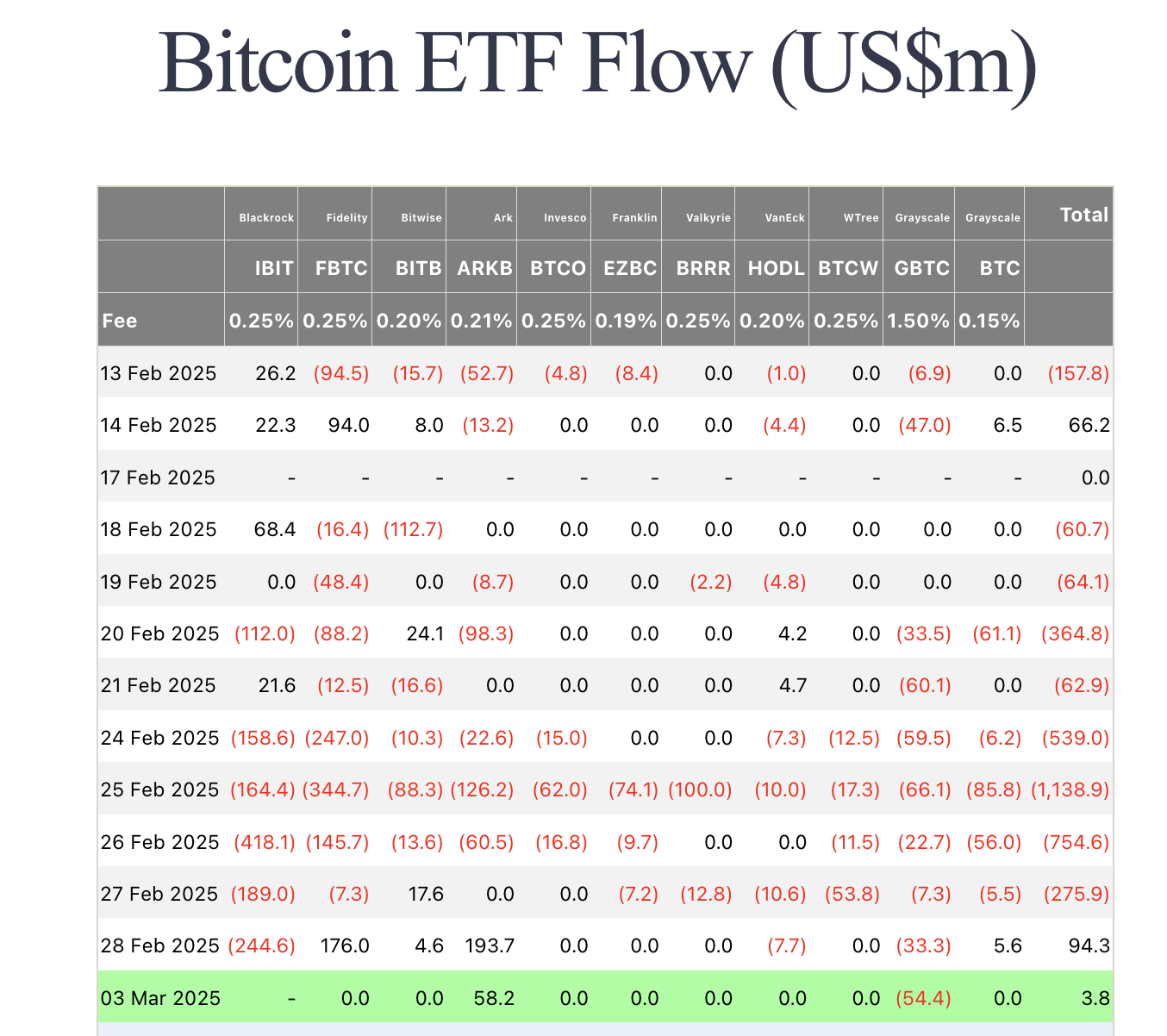

- Bitcoin ETFs recorded only $3.8 million inflows on Monday according to Fairside.co.uk data.

Bitcoin ETF Flows, March 3, 2025 | Source: Fairside

The muted inflow suggests that the majority of US-based institutional investors holding BTC ETF assets, opted to take on a cautious approach to avoid a sell-the-news bull-trap as markets showed overheated signals after Trump’s crypto strategic reserve announcement during the weekend.

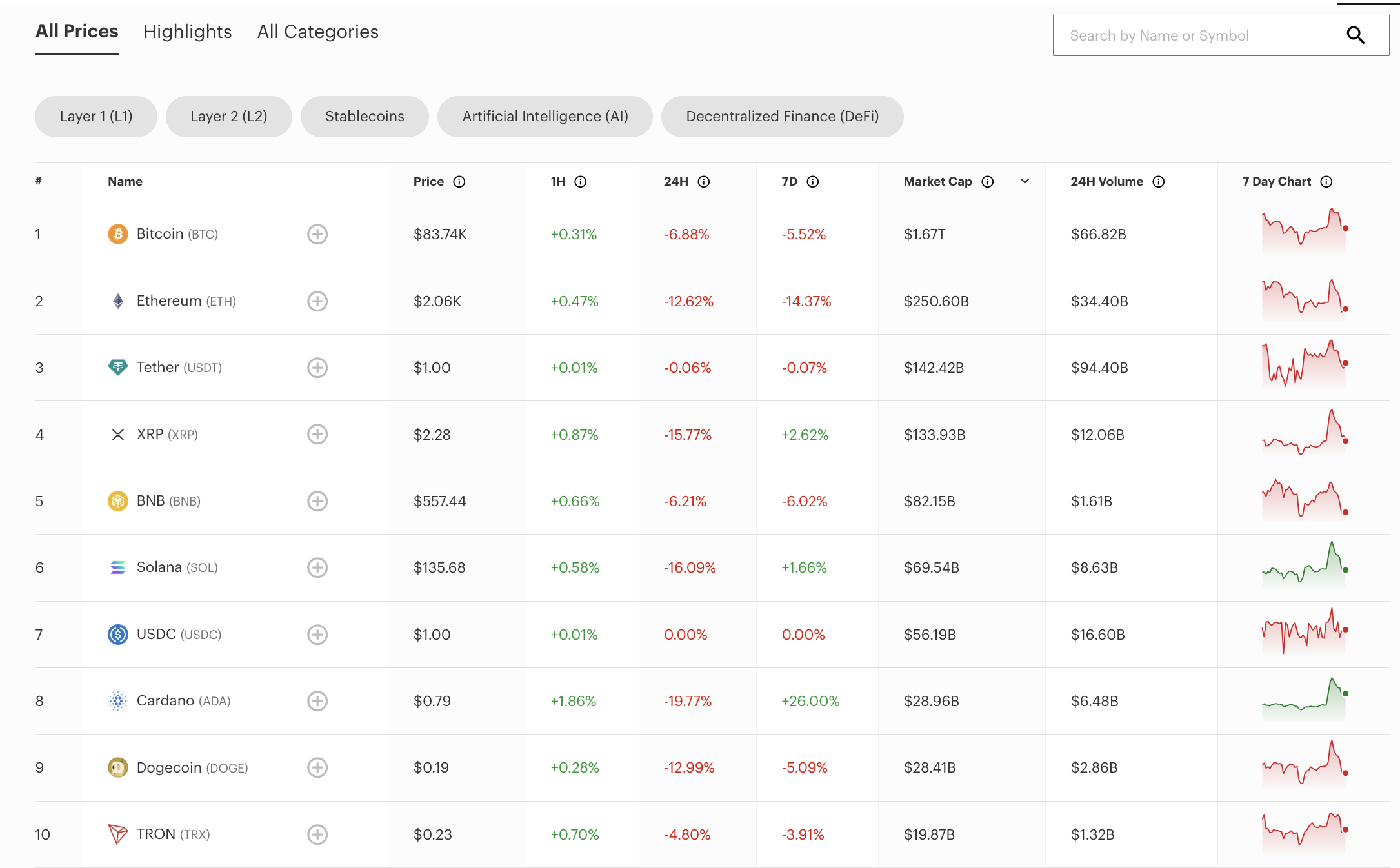

Altcoin market updates: Binance Coin (BNB) and TRON (TRX) stand out amid double-digit bloodbaths

- Ethereum price declined below the $2,100 mark for the first time in 14 months dating back to November 2023.

- Ripple (XRP) bulls continued to hold the $2.10 support level, at press time, still sustaining more than 5% of the weekend price gains.

Altcoin market performance, March 4 | Source: Forbes

- Of the top 10 altcoins, Binance Coin (BNB) and Tron (TRX) were the only assets to post less than 10% 24-hour losses, at the time of writing.

BNB price posted 8.3% losses, holding firmly above the $560 support level.

Binance Coin (BNB) Price Action | March 4

The rapid market sell-offs may have boosted demand for BNB as investors seek trading discounts to mitigate losses on high-volume sell-orders.

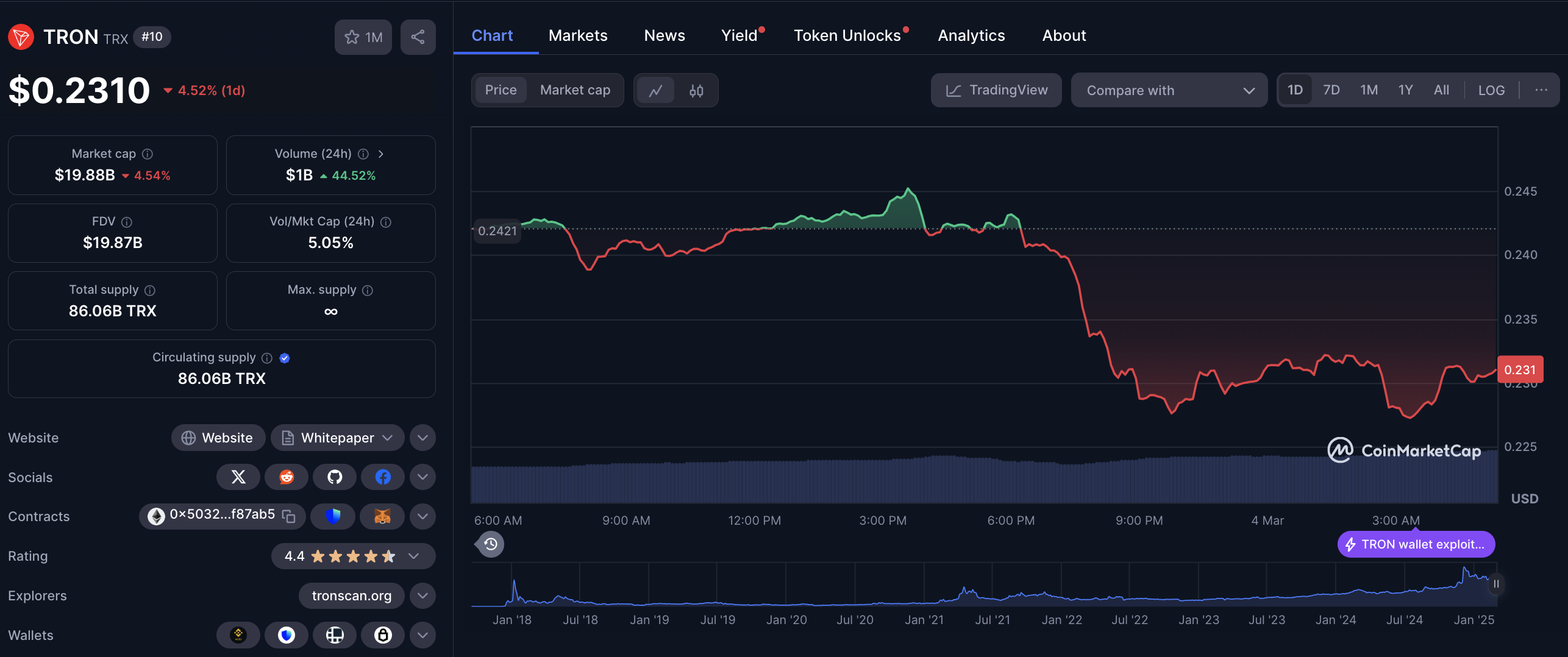

- Tron (TRX) only shed 4.6% as it consolidated support at the $0.23 mark.

Tron (TRX) price action | March 4

Tron (TRX) price action | March 4

TRX’s relatively resilient price action can be linked to increased demand for the Tron network’s efficient stablecoins and increased demand from traders looking to exit spot altcoin positions into stablecoins to avoid losses triggered by Trump’s tariffs.

Meanwhile Cardano (ADA), the biggest loser among the top 20 ranked altcoins, posted 20.1% losses.

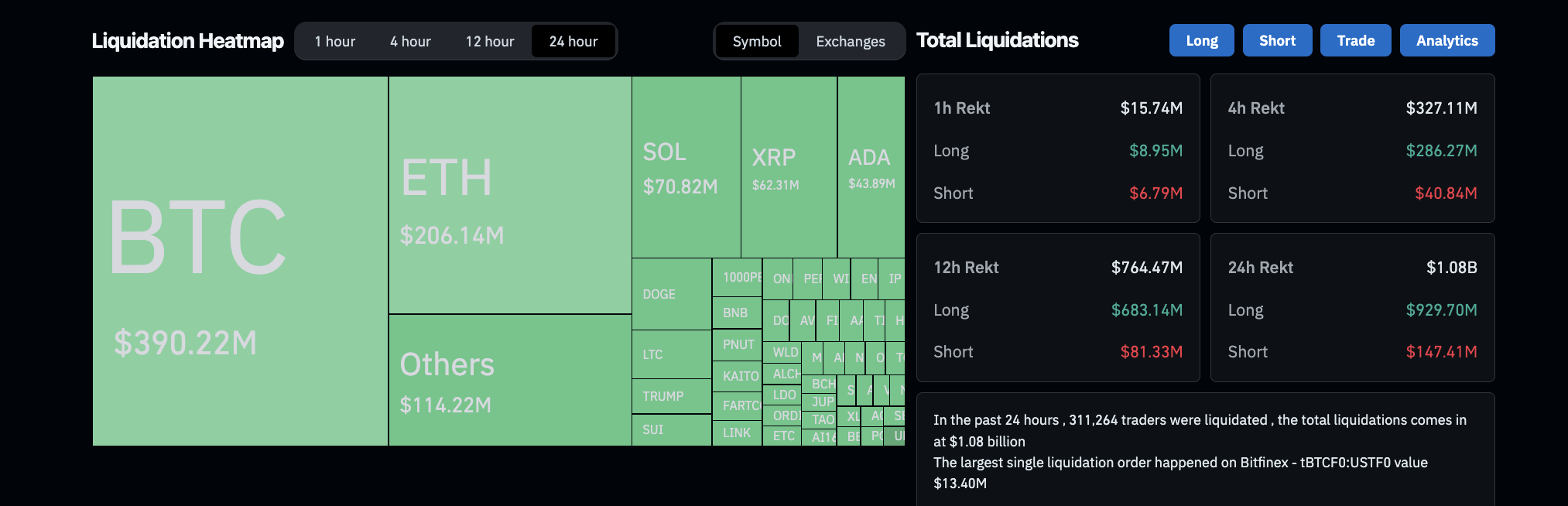

Chart of the day: XRP, ETH, ADA, and SOL buyers emerge biggest losers as Trump’s tariffs tanks markets by $1.1 Billion

U.S. President Donald Trump has officially confirmed the commencement of 25% tariffs on imports from Canada and Mexico, set to take effect on Wednesday.

This announcement sent shockwaves through global financial markets, triggering significant volatility among top altcoins and derivatives traders.

Crypto market sentiment had been riding high on Monday following Trump’s confirmation of Ethereum’s inclusion in the U.S. Crypto Strategic Reserve.

This optimism led speculative traders to pile on leverage positions in BTC, ETH, SOL, ADA, and XRP, amplifying downside risk.

Crypto market liquidations, March 4 | Source: Coinglass

According to Coinglass’ data, traders holding long positions on BTC, ETH, SOL, ADA, and XRP faced aggregate liquidations totaling $773 million.

This accounts for 77% of the $1.1 billion total losses recorded in the past 24 hours.

Evidently, as the bearish shock from the tariff confirmation swept through the market, long-position holders in these five assets bore the brunt of the downturn.

The skewed sell-off impact on Trump’s five handpicked assets, suggests that traders are expressing a vote of no confidence on the administration’s tariff policy.

Crypto news updates:

-

Tether (USDT) team appoints Simon McWilliams as CFO to oversee full audit process

Tether, issuer of world’s largest stablecoin, USDT has appointed Simon McWilliams as its new Chief Financial Officer, marking a significant step toward completing a full audit.

The announcement comes amid growing scrutiny over stablecoin reserves, reinforcing Tether’s efforts to enhance financial transparency and regulatory compliance.

McWilliams' appointment aligns with Tether’s ongoing initiatives to strengthen trust and financial integrity in the digital asset sector. The stablecoin issuer continues expanding its influence in global markets, positioning USDT as a critical component of the global financial ecosystem.

-

Binance to delist Non-MiCA compliant stablecoin trading pairs for European users by end of March

Binance will stop offering spot and margin trading pairs for non-MiCA compliant stablecoins to European Economic Area (EEA) users by March 31, 2025. Affected assets include USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG, aligning with new EU regulatory requirements.

The exchange advises EEA users to convert non-compliant stablecoins into MiCA-approved assets like USDC and EURI or to EUR before the deadline.

Binance will continue supporting custody services and conversions for impacted assets after delisting, ensuring compliance with evolving regulations.

-

Metaplanet expands Bitcoin holdings with 156 BTC purchase, total reaches 2,391 BTC

Metaplanet Inc. acquired 156 additional Bitcoin at an average price of 12,952,147 yen per BTC, raising its total holdings to 2,391 BTC.

The purchase aligns with the company's Bitcoin Treasury Operations, reinforcing its long-term investment strategy.

Metaplanet evaluates its Bitcoin acquisitions using Bitcoin Yield (BTC Yield) as a key performance indicator. This metric measures financial gains in yen, ensuring transparency for shareholders while assessing the effectiveness of its Bitcoin investment strategy.