Crypto Today: XRP and Cardano among top losers, BTC plunges below $80K for first time in four months

- The global crypto market fell another 7% on Friday amid growing inflation concerns.

- Bitcoin (BTC) price declined below $80,000 for the first time since November 2024.

- Ripple (XRP), Cardano (ADA) and Chainlink (LINK) were among the hardest-hit assets.

- Mantra (OM) defied bearish headwinds, gaining 3% on the day.

Bitcoin market updates:

- Bitcoin price fell as low as $78,335 on Friday, its lowest in four months dating back to last November.

- Bitcoin ETFs saw another $275 million in withdrawals, making it eight consecutive days of outflows.

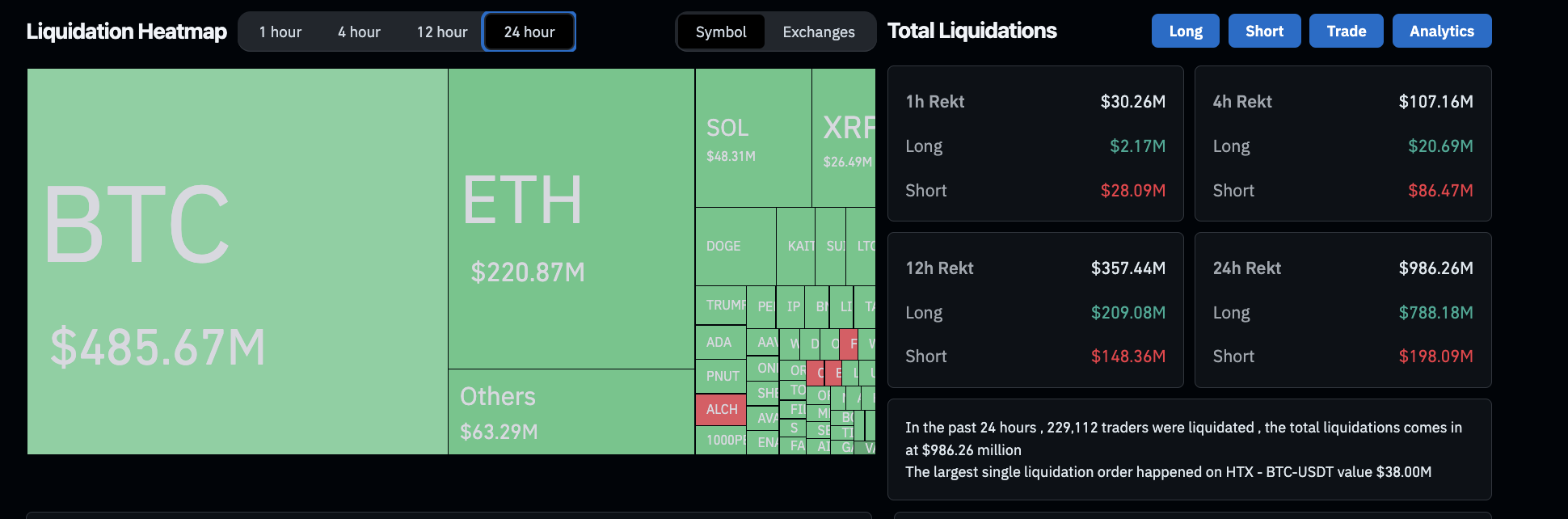

Crypto Market Liquidations | Source: Coinglass

Crypto Market Liquidations | Source: Coinglass

- In the last 24 hours, Bitcoin derivatives market liquidations reached $485 million, according to Coinglass data.

Altcoin market update:

Compared to BTC, altcoins suffered steeper losses with the majority of the top 50 ranked assets posting losses exceeding of 5%.

Altcoin Market Performance, Feb 28 | Source: TradingView

As seen above the global altcoin market excluding BTC and ETH saw declines by up to 7% on Friday, exceeding Bitcoin’s 4% plunge.

This suggests disinterest in BTC and ETH now triggers higher outflows from altcoins, aligning with the Crypto Fear and Greed Index, which plunged to record lows this week.

- Ripple (XRP) price declined 3% on Friday, but bulls made frantic efforts to defend the $2.00 support.

- Ethereum (ETH) price also dropped by another 5% on Friday, plunging below the $2,200 mark for the first time in 2025.

- On a rare positive note, Mantra (OM) recorded 2% gains.

Mantra (OM) Price Performance | Coinmarketcap

Mantra (OM) Price Performance | Coinmarketcap

Mantra is a real-world asset tokenization protocol. The OM price rally aligns with the narrative that some strategic investors are opting to shift capital into Real Word Assets and tokenized fixed-income instruments amid the market crash.

Chart of the day: Bitcoin ETF enters eight-day losing streak as bearish momentum intensifies

Bitcoin has faced significant downward pressure this week, with the market reacting negatively to the expectation of inflation driven by United States (US) tariffs under Donald Trump's administration.

This bearish sentiment has accelerated Bitcoin's decline, pushing BTC below $80,000 on Friday for the first time since Trump's re-election.

One of the key factors weighing Bitcoin's price action has been the persistent outflows from Bitcoin spot ETFs, as illustrated by the latest data from SosoValue.

Bitcoin ETF Outflows Surge Over 8 Consecutive Days | Source: SosoValue

According to the data, Bitcoin ETFs have recorded eight consecutive days of outflows, reflecting declining institutional confidence in the market.

The largest outflows occurred on Wednesday, with $754.53 million exiting Bitcoin ETFs, marking the most significant single-day withdrawal in the period. Other notable outflow days included:

- February 24: -$538.98 million

- February 20: -$364.93 million

- February 12: -$251.03 million

In total, the eight-day losing streak resulted in more than $2.3 billion in outflows, putting significant pressure on Bitcoin’s price trajectory.

The sustained outflows from Bitcoin ETFs suggest that institutional investors are retreating from the crypto market.

In a high-interest-rate and inflation-sensitive environment, smart money appears to be reducing exposure to cryptocurrencies.

At press time, the Bitcoin ETFs still hold over $36 billion worth of BTC in their aggregate balances.

With the potential for heavier outflows, Bitcoin could face deeper corrections if ETF outflows keep flooding the short-term market supply.

Crypto News:

-

Germany’s DekaBank partners with Boerse Stuttgart Digital for institutional crypto trading

DekaBank, one of Germany’s largest asset managers with $395 billion under management, has announced a partnership with Boerse Stuttgart Digital to expand its crypto trading services.

The collaboration will allow institutional clients to buy, sell and store digital assets through Boerse Stuttgart Digital’s fully regulated infrastructure.

The move is expected to strengthen the institutional adoption of cryptocurrencies in Europe.

"As part of the strategic collaboration, DekaBank is leveraging Boerse Stuttgart Digital’s modular and fully regulated infrastructure for digital assets," the companies stated.

DekaBank’s expansion into crypto follows its approval for a cryptocurrency custody license from German and European regulators last year. The bank has spent the past two years preparing its infrastructure and securing the necessary approvals to support its crypto trading and custody offerings.

-

Ethereum Foundation forms advisory group to strengthen core network values

The Ethereum Foundation has introduced the EF Silviculture Society, a newly established advisory group composed of external experts.

The initiative aims to provide informal guidance on maintaining Ethereum’s foundational principles, including open-source development, privacy, security and censorship resistance.

These values play a key role in attracting developers and ensuring the long-term stability of the network.

By creating an external advisory body, the foundation seeks to reinforce Ethereum’s decentralized ethos and sustain its commitment to user sovereignty.

The EF Silviculture Society will operate as an independent entity offering insights on policy decisions and strategic directions while preserving the network’s core mission.

-

SEC declares memecoins are not securities, compares them to collectibles

The US Securities and Exchange Commission (SEC) has clarified that memecoins do not fall under the classification of securities, likening them instead to collectibles.

In a statement from the Division of Corporation Finance, the agency confirmed that memecoin transactions are not subject to the registration requirements outlined in the Securities Act of 1933.

This distinction means that memecoin traders and investors will not receive the same regulatory protections as those dealing with traditional securities.

The guidance marks a significant step in defining the regulatory treatment of digital assets, as market participants continue to navigate compliance and classification challenges in the crypto sector.