Shiba Inu Price Prediction: SHIB whale demand surges 300% as Ethereum ecosystem regains momentum

- Shiba Inu price rose as much as 11% in the last 24 hours, reclaiming territory above $0.000014 despite broader market turbulence.

- On-chain data reveals SHIB whale transactions have increased more than 300% since the start of the week.

- Large investors are capitalizing on the dip, suggesting bears may struggle to regain dominance in the near term.

Shiba Inu price surged more than 11% in the last 24 hours, defying turmoil in the broader crypto market to reclaim territories above $0.000014. With whale investors spotted buying the dip, SHIB price could be on course for an extended rebound phase.

Shiba Inu price extends rebound as Ethereum ecosystem recovers from Bybit hack

Shiba Inu (SHIB) is showing early signs of a sustained recovery as Ethereum ecosystem tokens begin to bounce back from the recent Bybit hack, which saw over 400,000 ETH stolen by hackers linked to North Korea’s Lazarus Group.

Bybit has since assured customers that all losses will be covered using the company’s reserve capital. The exchange has also reimbursed over 100,000 ETH to key partners, including Bitget, who provided emergency liquidity to stabilize withdrawals. These efforts have helped restore confidence in Ethereum-based assets with SHIB leading the rebound.

Shiba Inu price analysis

The daily trading chart shows SHIB surging 11% during the day, breaking above the $0.000014 level.

This marks a sharp turnaround from its local bottom of $0.000013 recorded on Monday, following US President Donald Trump’s confirmation of tariffs on Mexico and Canada.

Despite initial concerns about the impact of protectionist policies on global markets, SHIB has demonstrated strong resilience. The bullish momentum suggests that its recent price action is largely driven by internal market forces rather than broader macroeconomic trends.

SHIB large transactions surge 300% as whales defy Trump tariff fears

While Trump’s tariff announcement dampened investor sentiment across global markets, Shiba Inu’s rapid price rebound indicates strong internal demand. The latest on-chain data reveals that institutional investors are taking advantage of the dip to accumulate SHIB.

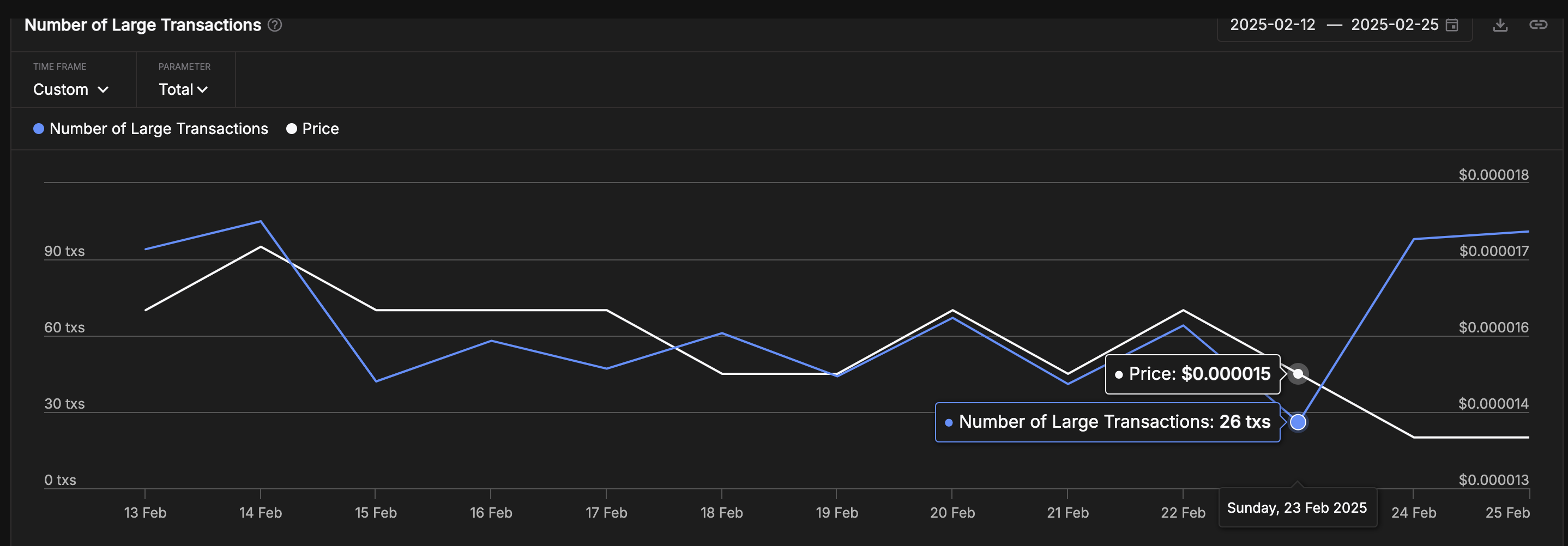

According to IntoTheBlock, large transactions — those exceeding $100,000 — have surged dramatically over the past few days. On February 23, the number of such transactions had dwindled to just 26 as investors adopted a risk-off stance. However, as SHIB’s price rebounded, whale activity spiked to 101 transactions by February 25, marking a 288% surge in just two days.

Shiba Inu Price vs. SHIB Large Transactions

Historically, when whale transactions rise in tandem with a double-digit price gain, it signals that institutional buyers are the primary drivers behind the rally.

This suggests that rather than a short-lived bounce, SHIB’s price action may be entering a more sustained bullish phase.

If whale accumulation continues at this pace, retail traders may gain confidence and re-enter the market, potentially pushing SHIB toward higher resistance levels in the coming days.

A decisive break above $0.000015 could pave the way for a move toward $0.000017. However, if whale demand slows, bears may attempt to drag the price back toward key support at $0.000012.

Shiba Inu price forecast: Bears could fold after $0.000020 breakout

Shiba Inu price is showing signs of a potential bullish reversal as SHIB rebounds 11.36% from its recent low of $0.000013.

The daily candlestick structure suggests that buyers are stepping in near the lower boundary of the Keltner Channel, signaling potential trend exhaustion for the bears.

A decisive close above $0.0000150 could validate this recovery with further upside potential toward the midline of the Keltner Channel at $0.000016.

Shiba Inu price forecast

Momentum indicators reinforce this cautiously bullish outlook. The MACD histogram is beginning to shift upward, suggesting that selling pressure is waning.

Additionally, the MACD signal line is attempting a bullish crossover, which, if confirmed, could indicate the start of a larger rally toward resistance at $0.000018.

However, failure to sustain the current bounce could result in another retest of support at $0.00001341, with a breakdown exposing $0.000010 as the next bearish target.

If buying pressure continues to build, SHIB could establish a strong foundation for a move beyond $0.000020, where short sellers might fold.

However, bulls must defend $0.000014 to maintain control and prevent a deeper correction.